CAMPBELL, Calif.--(BUSINESS WIRE)--Market research firm Infonetics Research released excerpts from its 4th quarter 2013 (4Q13) and year-end CMTS, CCAP, and Edge QAM Hardware and Subscribers report, which tracks cable broadband equipment and subscribers.

ANALYST NOTE

“The pent-up demand for new CCAP (converged cable access platform)-capable equipment is evident in the early volume deployments of CCAP gear, and we expect the upward trend in combined CMTS and CCAP channel shipments to continue as operators prepare their networks for DOCSIS 3.1 and potential remote PHY (physical layer) architectures,” notes Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Heynen adds: “Casa Systems had an outstanding fourth quarter shipping CCAP equipment globally, but it wasn’t enough to overtake perennial leaders Cisco and Arris. However, these vendors should now be on notice, as Casa’s made inroads and will continue to make this market more dynamic.”

CMTS, CCAP, AND EDGE QAM MARKET HIGHLIGHTS

- 4Q13 marks the highest number of combined CMTS and CCAP upstream and downstream DOCSIS channel shipments on record, owing largely to a 192% sequential jump in CCAP channel shipments

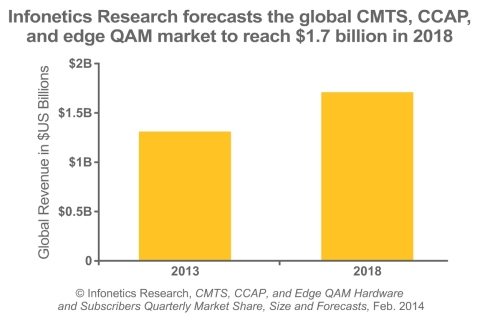

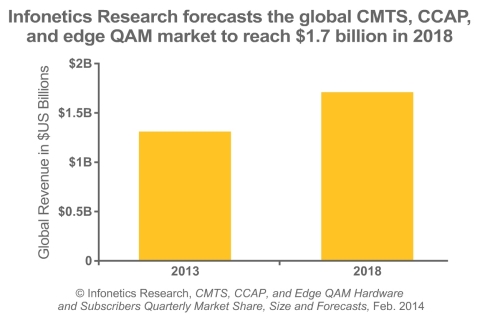

- Despite an 11% revenue bump in 4Q13, the combined worldwide CMTS, CCAP, and edge QAM market was down 8% in 2013 from the previous year, dropping to $1.3 billion

- CMTS channel price erosion in the early part of 2013 was the primary reason for the revenue decline, notwithstanding record levels of CMTS and CCAP channel shipments

- Harmonic is the edge QAM revenue leader in 4Q13 and for the full year 2013

- Infonetics Research forecasts the global CMTS, CCAP, and edge QAM market to reach $1.7 billion in 2018, a 5-year compound annual growth rate of 5% from 2013 to 2108

BROADBAND ACCESS WEBINAR

Join Jeff Heynen March 11 for Extending Copper Access Networks with Vectoring and G.Fast: Why Fiber Isn't a Must, a live event detailing the roadmap for DSL, FTTdp VDSL, vectoring, and G.Fast technologies, and explaining why fiber isn't necessarily a must for operators to compete: http://w.on24.com/r.htm?e=748757&s=1&k=3FA95A7E80E9811BBC75D27914898B02

ABOUT THE CABLE BROADBAND REPORT

Infonetics’ quarterly CMTS, CCAP, and edge QAM report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for CMTS, CCAP, and edge QAM (linear broadcast, VoD and unicast video, switched digital video, and DOCSIS/M-CMTS) equipment and cable broadband subscribers (standard and wideband). Vendors tracked: Arris, Casa Systems, Cisco, Ericsson, Harmonic, and others. To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp.

RELATED REPORT EXCERPTS

- Latest Infonetics Broadband Access research brief: http://bit.ly/1egksoF

- Record year for GPON in China; VDSL shipments outstrip ADSL for first time ever

- Tier 3 operators ramping VDSL2 in 2014, rate Calix, Adtran, ALU top broadband vendors

- Infonetics launches broadband subscriber database of 130+ global service providers

- Emerging markets driving growth in pay-TV market

- Pay-TV operators look to ‘second screen’ apps, enhanced DVR in tug-of-war for subscribers

- Focus of home networking industry squarely on multiscreen video

- Over-the-top home automation services gaining popularity with service providers

RECENT AND UPCOMING BROADBAND MARKET FORECASTS AND SURVEYS

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

- Research Note: License in Hand, China Mobile Is Fixed on Broadband Market (Feb.)

- Research Note: Broadband Scale Drives Comcast's Bid for Time Warner Cable (Feb.)

- PON, FTTH & DSL Aggregation Equipment & Subscribers (Mar.)

- Broadband CPE & Subscribers: PON, FTTH, Cable, DSL & LTE (Mar.)

- Home Networking Devices (Apr.)

- Residential Gateway Strategies & Vendor Leadership: Service Provider Survey (Apr.)

INFONETICS WEBINARS

Visit https://www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on demand, or learn about sponsoring a webinar.

- Extending Copper Access Networks with Vectoring and G.Fast (Mar. 11: Attend)

- Using Video Gateways to Improve the Multiscreen Experience (View on-demand)

- SDN and NFV: The Nitty Gritty (Mar. 18: Attend)

- Using Big Data Analytics to Amplify Security Intelligence (Mar. 20: Attend)

- The Great 802.11ac Migration: Upgrade Now, or Wait? (Mar. 27: Attend)

TO BUY REPORTS, CONTACT:

N. America (West), Asia Pacific: Larry Howard, larry@infonetics.com, +1 408-583-3335

N. America (East, Midwest), L. America: Scott Coyne, scott@infonetics.com, +1 408-583-3395

EMEA, India, Singapore: George Stojsavljevic, george@infonetics.com, +44 755-488-1623

Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

ABOUT INFONETICS

Infonetics Research (www.infonetics.com) is an international market research and consulting firm serving the communications industry since 1990. A leader in defining and tracking emerging and established technologies in all world regions, Infonetics helps clients plan, strategize, and compete effectively. View Infonetics’ About Us slides at http://bit.ly/QUrbrV.