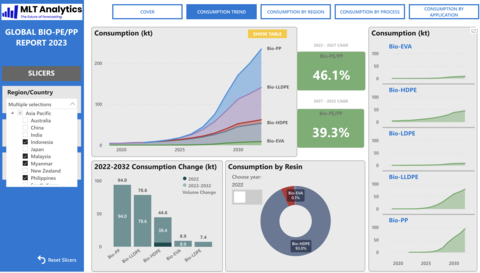

SINGAPORE--(BUSINESS WIRE)--The global market for bio-based polyolefins is forecast to multiply by a factor of more than 20 over the next decade, reaching an overall volume of more than 4.7 million tonnes in 2032 according to a ground-breaking report released by MLT Analytics entitled Global Bio-based Polyolefin Report—2023 Edition: Market penetration for a sustainable industry future. This impressive growth is set to be fueled by a variety of end-use applications, including existing mainstream bio-polyethylene applications such as LDPE extrusion coating, HDPE shopping bags, and HDPE blow-molded containers, as well as emerging bio-polypropylene applications such as hygiene, housewares, and rigid and flexible packaging, bio-EVA applications such as footwear, and bio-LLDPE products such as stretch film.

“2022 was a breakout year for bio-polyolefins in that we saw a notable diversification in the supplier base, with emerging suppliers developing and augmenting their commercial presence in the market, and adding to the dominant presence of incumbent producer Braskem,” said MLT Analytics CEO and co-founder Stephen Moore. “We also saw the bio-PP market more than triple in scale between 2021 and 2022 as mass balance-based polymer production kicked off in Europe and Japan,” he added.

Most global polyolefin suppliers have announced sustainable polyolefin targets, typically to be achieved by 2030, that involve a mixed slate of plastics derived from either biomass, mechanically-recycled or chemically-recycled feedstocks; while the mechanical and chemical recycling routes may be preferred by many polyolefin producers, brand owner and consumer preferences should ensure that bio-based polyolefins play a notable role in achieving sustainability targets.

The European Commission’s Packaging and Packaging Waste Directive (PPWD) in its current form is a potential complicating factor to market growth for bio-polyolefins according to MLT Analytics' Moore. “The Commission has essentially signaled its preference for C14 assay over mass balance as the preferred means of measuring bio content, and added that bio-based plastics should target durable applications such as pipe and automotive, thereby functioning as carbon sinks. I don’t believe this is a stance that will be acceptable to bio-polyolefin suppliers given their investment in the mass balance approach,” added Moore.

On the bio-polyolefin supply side, the main incumbent supplier—Braskem—is being joined by a stable of European, Japanese, and Korean suppliers, with Dow Chemical, also increasing its presence via production assets in Europe. “Bio-polyolefins are major components of Korean and Japanese suppliers’ sustainability strategies, and they will have ready access to export-oriented markets in Asia Pacific,” said Moore. “In fact, by 2032, we expect the Asia Pacific region to overtake Europe in consumption of bio-polyolefins.”

Bio-polyolefin suppliers also need to ensure they can secure sufficient bio-feedstocks to polymerize their products for the market according to Moore. “Most bio-refineries focus on production of bio-fuels, with bio-naphtha being a lower priority by-product,” noted Moore.

For further information, please visit our website: www.mltanalytics.com

About MLT Analytics

MLT Analytics was established in June 2021 in Singapore by plastics industry market research veteran Stephen Moore and partners with the likeminded intent of applying artificial intelligence (AI), notably machine learning (ML) technology, augmented by extensive hands-on industry knowledge, to develop rational and robust and reliable forecasts. The company believes that solid domain expertise is essentially in the successful application of AI and ML. Hence, its team includes industry experts with decades of combined expertise in industries such as commodity, specialty and engineering plastics and elastomers, petrochemical feedstocks and products, specialty chemicals and additives. Expertise extends to processing, conversion and production equipment and plants, as well as downstream and end user industries such as automotive, hygiene, food and beverage, and packaging.