BOSTON--(BUSINESS WIRE)--Fidelity Investments®, one of the industry’s most diversified financial services firms and a leader in creating dynamic employee benefits programs, today announced its 20th annual Retiree Health Care Cost Estimate. According to Fidelity, a 65-year old, opposite-gender couple retiring this year can expect to spend $300,0003 in health care and medical expenses throughout retirement. For single retirees, the 2021 estimate is $157,000 for women and $143,000 for men.

This year’s estimate marks a new milestone high, up 30% from 10 years ago when the amount was $230,000, but just 1.7% from 2020 ($295,000) as health care inflation has remained relatively flat over the last few years. Fidelity began measuring in 2002 to build greater awareness of estimated health care costs and the importance of starting to plan and save early to meet those anticipated expenses. Since then, the estimate has risen a total of 88% (from $160,000).

“While this past year has certainly made protecting our health today a priority, we need to do the same when planning for future health care needs,” said Hope Manion, senior vice president, Fidelity Workplace Consulting. “Covering health care costs is one of the most significant, yet unpredictable, aspects of retirement planning. By providing this estimate for retirees, we want to increase awareness among people of all ages to help them proactively get more engaged in saving and investing, so they can be better prepared in years to come.”

Broader awareness is much needed, as 58% of current employees say they have spent little or no time thinking about what they need to cover in retirement. Even among those who have, 50% believe they’ll need just $50,000 or less to meet health care expenses4.

Fidelity’s estimate assumes both members of the couple are enrolled in traditional Medicare, which between Medicare Part A and Part B covers expenses such as hospital stays, doctor visits and services, physical therapy, lab tests and more, and in Medicare Part D, which covers prescription drugs.

How to Save $300k, and Beyond

While Fidelity’s estimate is for an opposite-gender couple retiring this year, it also should be a call to action for younger Americans to start saving early and consistently, as health care costs will likely continue to rise. Diligent savings habits and utilization of accounts where savings can be invested are powerful tools in helping to build a health care nest egg, regardless of age.

The good news is saving for both retirement and health care is on the rise. Fidelity’s own customer data, representing millions of working Americans across the country, reported record high savings rates and balances across 401(k), 403(b) and IRA accounts at the end of 2020. As well, Fidelity has seen a significant increase in new Health Savings Account (HSA) openings (19%), with total assets growing 52% to surpass $10 billion this past year.

“While higher savings rates and growing balances are good news, the goal of saving toward a significant amount like $300,000 can be daunting. But it is achievable with some planning,” added Manion. “We continue to see many HSA owners not using these accounts to their full potential, in particular not using the power of investing to potentially grow their savings. And that’s the step that can make a big difference, especially for younger people with time on their side.”

The ability to invest contributions for potential growth, tax-free, is one of the most valuable aspects of an HSA, but it is also one of the most underutilized. At the start of the year, just 16.5% of Fidelity HSAs were invested. Though this figure is more than double the industry average5 and an increase from 11.2% at the beginning of 2020, this still represents a significant missed opportunity for those with cash balances intended to be used for future health expenses.

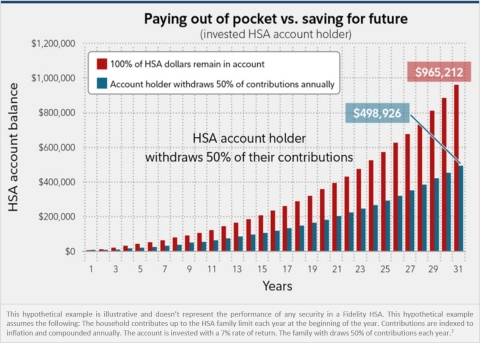

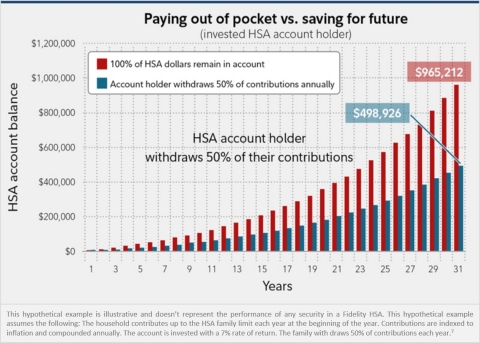

Consider a couple saving and investing their annual HSA contributions over a 30-year period, taking into account that a future health care savings goal will likely be greater than $300,000 over time. The accompanying chart shows two examples. First, by maxing out HSA savings opportunities and investing at an average hypothetical 7% annual rate of return, a couple could potentially accumulate $300,000 after approximately 18 years, and a balance of nearly $1 million after 30 years.6

Since not everyone is able to do that, the second example represents a couple who contributes the maximum, withdraws 50% each year to pay for current qualified medical expenses but leaves the remaining 50% invested, also earning an average 7% return. This balance still has the potential to grow to $300,000 after about 25 years, reaching nearly half a million dollars after the 30-year time frame illustrated7.

Learn more here about investing options within an HSA and other benefits of these tax-advantaged accounts to help grow savings for future expenses.

COVID-19 Impact on Retirement Plans, and How to Bridge a Health Care Gap

Sometimes even with a plan in place, as you get closer to retirement there can be a need to adjust, either by choice or necessity. According to a recent Fidelity study, 82% of Americans say the pandemic has impacted their retirement plans7. For those within 10-years of retirement, one-in-five (22%) say they are accelerating their timeline to leave the workforce8. Of this group, 80% are under the age of 65, meaning they will need to bridge their health care options before eligibility for Medicare kicks in.

These options may have additional financial implications that need to be considered and planned for. Fidelity’s “Your bridge to Medicare” provides an overview of health coverage options to consider for anyone who may be retiring before the age of 65 and resources to help make educated decisions and build a plan, including a 4-question widget to identify what options may align best with your situation.

For more guidance and decision support, those getting ready to retire are encouraged to take advantage of planning resources that may be available:

- Meet with your employer’s HR department: While still employed, look into what health care benefits, if any, their employer may offer in retirement. Even having access to group coverage or professional support in choosing bridge health care options or a Medicare plan when the time comes can be valuable benefits.

- Talk with a financial professional: In addition to over-all retirement and health care planning support, long-term care needs are difficult to predict and are not included in Fidelity’s retirement health care cost estimate, so it’s recommended that pre-retirees meet with a financial professional to discuss potential needs based on their current health, family history, and other personal factors. The earlier people start to explore options, the more affordable policies may be, if you decide long term care is right for you.

Additional Fidelity Resources for Managing Your Health Care Journey Today and Into Retirement

- Power of Confidence podcast series focuses on how confidence enables us to make informed decisions in relation to health and finance. Hear from expert behavioral health scientists as they share their insights and best practices.

- Fidelity’s Pulse on Health Care is a digital magazine sharing small steps everyone can take to tend to their health and wellness to keep themselves on a positive path for a better year.

- Online HSA hub answers the most frequently asked questions and prevalent misconceptions about HSAs and HSA-eligible health plans, as well as how to maximize their benefits.

- Viewpoints articles on planning for health care: 3 healthy habits for health care savings accounts; How to plan for rising health care costs; 5 ways HSAs can fortify your retirement, 6 key Medicare questions

About Fidelity Health Care Group

Fidelity’s Health Care Group brings a unique value to solve several critical health care benefits needs for employer and employees: managing health care expenses, planning for health care in retirement, and navigating health care events. These needs drive the group’s focus across the Health Savings Account (HSA), Health and Welfare (H&W) Administration, Digital Health Care Benefits and Fidelity Medicare Services® businesses.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $10.3 trillion, including discretionary assets of $3.9 trillion as of March 31, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 75 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit http://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax

Past performance is no guarantee of future results.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company, LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport Boulevard, Boston, MA 02110

978413.1.0

© 2021 FMR LLC. All rights reserved.

1 Data from Fidelity Health and Financial Decision-Making survey fielded Jan-Feb 2021 with Fidelity plan participants. Data reflects results from 13,299 survey respondents.

2 Fidelity Workplace Investing research, “Retirement Planning in COVID-19 times.” The survey was conducted in October 2020 and is based on responses from 731 participants.

3 Estimate based on a hypothetical opposite-gender couple retiring in 2021, 65-years-old, with life expectancies that align with Society of Actuaries' RP-2014 Healthy Annuitant rates projected with Mortality Improvements Scale MP-2020 as of 2021. Actual assets needed may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Cost Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

4 Data from Fidelity Health and Financial Decision-Making survey fielded Jan-Feb 2021 with Fidelity plan participants. Data reflects results from 13,299 survey respondents.

5 Devenir Research 2020 Year-End HSA Market & Statistics Trends, February 2021

6 All estimated dollar amounts for assets needed to pay for future medical costs assume an investment portfolio of 30% equity, 50% bonds, and 20% short-term investments.

7 The hypothetical is for illustrative purposes only and is not intended to predict the investment performance of any security. Past performance does not guarantee future results. Performance will vary and you may have a gain or loss when you sell your units.

8 Fidelity Investments State of Retirement Study, March 2021

9 Fidelity Workplace Investing research, “Retirement Planning in COVID-19 times.” The survey was conducted in October 2020 and is based on responses from 731 participants.