NEW YORK--(BUSINESS WIRE)--Viacom Inc. (NASDAQ: VIAB, VIA) today reported financial results for the quarter ended June 30th, 2019.

Statement from Bob Bakish, President & CEO

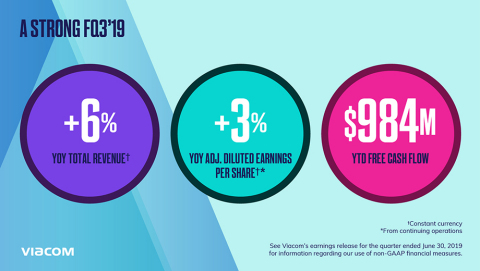

“Viacom delivered another strong quarter, as our core businesses and investments in strategic priorities fuel our growth and evolution. Importantly, we returned Domestic Advertising Revenue to growth, which is a direct result of the strategy we have been executing for the last two years and the significant progress we have made in scaling Advanced Marketing Solutions. Paramount’s momentum also continues, keeping us on track to deliver full year profitability. As this quarter shows, Viacom’s brands are strong, our strategy is delivering, and our investments continue to position us well for the future.”

Fiscal Year 2019 Results

Quarter Ended June 30 |

Nine Months Ended June 30 |

||||||||||||||||||||||||||||||||

2019 |

|

2018 |

|

B/(W) % |

|

FX

|

|

CONSTANT

|

|

|

2019 |

|

|

|

2018 |

|

B/(W)% |

|

FX

|

|

CONSTANT

|

||||||||||||

| GAAP | |||||||||||||||||||||||||||||||||

| Revenues | $ |

3,357 |

$ |

3,237 |

4 |

% |

(2 |

)% |

6 | % |

$ |

9,405 |

$ |

9,458 |

(1 |

)% |

(3 |

)% |

2 |

% |

|||||||||||||

| Operating income | 757 |

752 |

1 |

|

1,932 |

1,926 |

- |

|

|||||||||||||||||||||||||

| Net earnings from continuing operations attributable to Viacom | 538 |

511 |

5 |

|

1,219 |

1,302 |

(6 |

) |

|||||||||||||||||||||||||

| Diluted EPS from continuing operations | 1.33 |

1.27 |

5 |

|

3.02 |

3.23 |

(7 |

) |

|||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||

| Non-GAAP† |

|

|

|

|

|||||||||||||||||||||||||||||

| Adjusted operating income | $ |

757 |

$ |

767 |

(1 |

)% |

(1 |

)% |

- |

% |

$ |

2,144 |

$ |

2,126 |

1 |

% |

(1 |

)% |

2 |

% |

|||||||||||||

| Adjusted net earnings from continuing operations attributable to Viacom | 484 |

475 |

2 |

|

(1 |

) |

3 | 1,320 |

1,259 |

5 |

|

(2 |

) |

7 |

|

||||||||||||||||||

| Adjusted diluted EPS from continuing operations | 1.20 |

1.18 |

2 |

|

(1 |

) |

3 | 3.27 |

3.12 |

5 |

|

(1 |

) |

6 |

|

||||||||||||||||||

| † Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release. |

FILMED ENTERTAINMENT

Paramount delivered its tenth consecutive quarter of year-over-year adjusted operating income improvement. Revenue growth was driven by strong licensing and home entertainment results.

Quarterly Financial Results

| FQ3'19 | TOTAL |

B/(W)% |

DOMESTIC |

B/(W)% |

INT'L |

B/(W)% |

|||||||||||||||||||||

| Revenues | $ |

877 |

14 |

% |

$ |

446 |

(4 |

)% |

$ |

431 |

40 |

% |

|||||||||||||||

| Theatrical | 152 |

(27 |

) |

65 |

(51 |

) |

87 |

18 |

|

||||||||||||||||||

| Home Entertainment | 161 |

35 |

|

109 |

38 |

|

52 |

30 |

|

||||||||||||||||||

| Licensing | 521 |

29 |

|

240 |

10 |

|

281 |

51 |

|

||||||||||||||||||

| Ancillary | 43 |

5 |

|

32 |

(3 |

) |

11 |

38 |

|

||||||||||||||||||

| Expenses | 792 |

(9 |

) |

||||||||||||||||||||||||

| Adjusted OI | $ |

85 |

93 |

% |

|||||||||||||||||||||||

| $ millions | |||||||||||||||||||||||||||

| All figures are presented on a reported segment basis as impact from foreign exchange is not material. | |||||||||||||||||||||||||||

-

Adjusted OI increased by $41 million YOY – nearly doubling from the prior year quarter.

-

Licensing revenue increased 29% driven by monetization of the library and growth in TV production.

-

Home entertainment revenue grew 35%, primarily benefiting from last quarter’s release of Bumblebee.

- Theatrical revenue reflected the strong performance of Rocketman and Pet Sematary, which was more than offset by the performance of A Quiet Place in the prior year quarter.

Operational Highlights

- Paramount benefited from the successful releases of Rocketman and Pet Sematary in the fiscal third quarter.

− Rocketman was a global success, generating over $185 million at the global box office.

− Pet Sematary drove over $110 million at the global box office.

- Current quarter releases include:

− Crawl, which received great reviews and is performing well in theaters.

− Dora and the Lost City of Gold, a live action film based on Nickelodeon’s Dora the Explorer franchise, premieres in August, rekindling this beloved Nickelodeon franchise.

-

Paramount’s fiscal 2020 film slate is now at 16 films, and includes Gemini Man, Terminator: Dark Fate, and the sequel to Top Gun.

- Paramount Television continues its momentum, with 26 shows ordered to or in production.

− Third season of 13 Reasons Why premiering on Netflix in the second half of 2019.

− New series ordered include Shantaram for Apple, Made for Love and Station Eleven for HBO Max, When the Street Lights Go On for Quibi and Sexy Beast for Paramount Network.

− Also producing The Angel of Darkness, the sequel series to the highly praised limited series The Alienist for TNT, as well as a second season of Boomerang for BET.

MEDIA NETWORKS

Viacom Media Networks benefited from strong advertising performance, as domestic ad sales returned to growth.

Quarterly Financial Results

| FQ3'19 | TOTAL |

B/(W)% |

FX Impact % |

Constant Currency Basis† |

DOMESTIC |

B/(W)% |

INT'L |

B/(W)% |

FX Impact % |

Constant Currency Basis† |

|||||||||||||||||||||||||||||||

| Revenues | $ |

2,504 |

|

|

|

- |

% |

|

|

(3 |

)% |

|

|

3 |

% |

|

|

$ |

2,021 |

|

|

1 |

% |

|

|

$ |

483 |

|

|

(5 |

)% |

|

|

(12 |

)% |

|

|

7 |

% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Advertising |

|

1,226 |

|

|

|

3 |

|

|

|

(4 |

) |

|

|

7 |

|

|

|

|

976 |

|

|

6 |

|

|

|

|

250 |

|

|

(7 |

) |

|

|

(16 |

) |

|

|

9 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Affiliate |

|

1,189 |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

- |

|

|

|

|

988 |

|

|

(1 |

) |

|

|

|

201 |

|

|

- |

|

|

|

(8 |

) |

|

|

8 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consumer Products, |

|

89 |

|

|

|

(18 |

) |

|

|

(2 |

) |

|

|

(16 |

) |

|

|

|

57 |

|

|

(17 |

) |

|

|

|

32 |

|

|

(18 |

) |

|

|

(5 |

) |

|

|

(13 |

) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Recreation & Live Events* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Expenses |

|

1,756 |

|

|

|

(3 |

) |

|

|

3 |

|

|

|

(6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted OI | $ |

748 |

|

|

|

(6 |

)% |

|

|

(1 |

)% |

|

|

(5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

| $ millions |

| * Beginning Q1 2019, Media Networks revenue components previously reported as Ancillary were renamed to Consumer Products, Recreation and Live Events. Furthermore, certain components previously reported as Ancillary were reclassified to Affiliate. Prior period amounts have been recast to conform to the current presentation. |

| † Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release. |

-

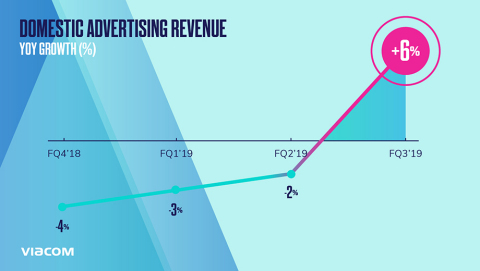

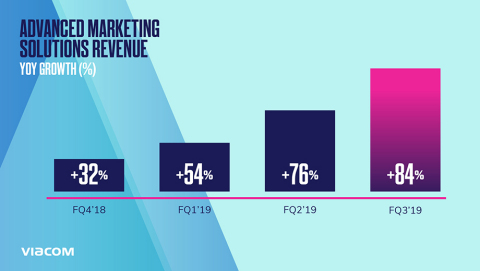

Domestic advertising revenue rose 6% in the fiscal third quarter, driven by accelerating growth in Advanced Marketing Solutions (AMS).

- Domestic affiliate revenue declined 1%.

− Performance driven by subscriber declines, partially offset by higher contractual rates and OTT and studio production revenues.

− From a timing perspective, certain revenue shifted from FQ3 to FQ4.

- Viacom International Media Networks delivered strong constant currency results † :

− International advertising revenue increased 9% driven by strong growth in Argentina and the U.K.

− Affiliate revenue increased 8% benefitting from growth in linear, as well as SVOD and other OTT deliveries.

- Adjusted OI declined 6% impacted by marketing for current and upcoming original programming launches, as well as investments in key growth initiatives.

Operational Highlights

- Domestic Media networks continued to grow audience share as total portfolio share increased by 1% YOY.

− Comedy Central delivered its ninth consecutive quarter of share growth – up 6% YOY.

− Paramount Network earned its third straight quarter of share growth – up 11% YOY – and its largest P18-49 share gain in 5 years.

− Viacom owned more top 20 original cable series in the quarter than any other cable family among key demos.

-

Internationally, Telefe remained #1 in ratings for 19 straight months, while Channel 5, Comedy Central and Paramount Network International all grew share YOY in the quarter.

-

Studio production continued to expand worldwide with premieres of The Perfect Date and Trinkets on Netflix, and season 2 of Light as a Feather on Hulu in July.

-

In June, Viacom announced a joint venture with Tyler Perry to launch BET+, a premier subscription video-on-demand service focused on the African American audience.

- Viacom Digital Studios extended its video consumption growth, placing 7th in Tubular’s Media & Entertainment ranking in June, up from 13th a year ago.

− Video views grew 17% YOY to 5.9B and watch time increased by 85% YOY with 9.6B minutes viewed.

- Viacom’s live events drew close to a million fans in the fiscal quarter, with attendance at BETX up, sold out shows at JoJo Siwa’s D.R.E.A.M Tour, Clusterfest, Slime City and several new Bellator events.

SPOTLIGHT ON DOMESTIC AD SALES, UPFRONT AND PLUTO TV

Viacom’s return to growth in domestic advertising was a milestone achievement in the company’s evolution.

DOMESTIC AD SALES

- The return to growth in domestic ad sales is the result of the strategy Viacom began executing two years ago to launch AMS and help offset secular industry declines.

− Organically, the company introduced Vantage, one of the most sophisticated ad targeting platforms in the industry, and built key advanced marketing partnerships with MVPDs.

− Viacom also made strategic acquisitions, including AwesomenessTV, WhoSay and Pluto TV.

-

As a result, AMS now engages customers across linear and digital video, influencer and shopper marketing, branded content and Pluto TV.

- AMS continued to scale in the quarter, with revenue increasing 84% YOY, more than offsetting linear headwinds and fueling domestic ad sales growth.

UPFRONT

-

Viacom delivered strong Upfront results, with high-single to double-digit price increases – the highest rate of change in over a decade – and doubled agency commitments across its digital, social and advanced advertising portfolio.

- The strength of Viacom’s brands and demand for its AMS portfolio, especially Pluto TV, drove significant shifts to Viacom’s premium digital video inventory.

PLUTO TV

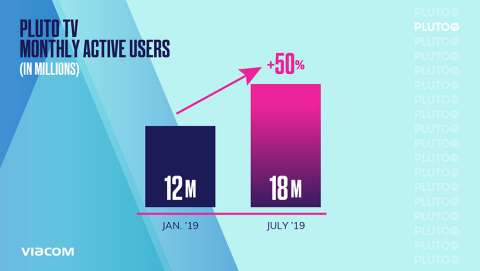

- Pluto TV’s leadership in free streaming TV continues to grow, with monthly active users (MAUs) up 50% this calendar year.

− Pluto TV is now integrated on Comcast’s Xfinity X1 and launching on Cox Communications’ Contour video and broadband platforms.

- Pluto TV launched 28 new channels and continued to extend its international presence:

− In July, it launched Pluto TV Latino, a suite of 11 channels with 2,000-plus hours of programming in Spanish and Portuguese.

− Pluto TV was also added to UK on-demand platform My5.

BALANCE SHEET AND LIQUIDITY

Viacom continues to strengthen its balance sheet and improve free cash flow.

-

At June 30, 2019, gross debt outstanding was $8.96 billion. Adjusted gross debt was $8.31 billion.

-

For the nine months ended June 30, 2019, net cash provided by operating activities increased 11% to $1.1 billion.

-

For the nine months ended June 30, 2019, free cash flow increased 10% to $984 million, driven by an improvement in working capital management, partially offset by higher cash taxes.

About Viacom

Viacom creates entertainment experiences that drive conversation and culture around the world. Through television, film, digital media, live events, merchandise and solutions, our brands connect with diverse, young and young at heart audiences in more than 180 countries.

For more information about Viacom and its businesses, visit www.viacom.com. Viacom may also use social media channels to communicate with its investors and the public about the company, its brands and other matters, and those communications could be deemed to be material information. Investors and others are encouraged to review posts on Viacom’s Twitter feed (twitter.com/viacom), Facebook page (facebook.com/viacom) and LinkedIn profile (linkedin.com/company/viacom).

Cautionary Statement Concerning Forward-Looking Statements

This news release contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: technological developments, alternative content offerings and their effects in our markets and on consumer behavior; competition for content, audiences, advertising and distribution in a swiftly consolidating industry; the public acceptance of our brands, programs, films and other entertainment content on the various platforms on which they are distributed; the impact on our advertising revenues of declines in linear television viewing, deficiencies in audience measurement and advertising market conditions; the potential for loss of carriage or other reduction in the distribution of our content; evolving cybersecurity and similar risks; the failure, destruction or breach of our critical satellites or facilities; content theft; increased costs for programming, films and other rights; the loss of key talent; domestic and global political, economic and/or regulatory factors affecting our businesses generally; volatility in capital markets or a decrease in our debt ratings; a potential inability to realize the anticipated goals underlying our ongoing investments in new businesses, products, services and technologies; fluctuations in our results due to the timing, mix, number and availability of our films and other programming; potential conflicts of interest arising from our ownership structure with a controlling stockholder; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our 2018 Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The forward-looking statements included in this document are made only as of the date of this document, and we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. If applicable, reconciliations for any non-GAAP financial information contained in this news release are included in this news release or available on our website at ir.viacom.com.

VIACOM INC. |

||||||||||||||||||||||

CONSOLIDATED STATEMENTS OF EARNINGS |

||||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||||

|

Quarter Ended

|

|

Nine Months Ended

|

|||||||||||||||||||

(in millions, except per share amounts) |

2019 |

|

2018 |

|

2019 |

|

2018 |

|||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

Revenues |

$ |

|

3,357 |

|

|

$ |

|

3,237 |

|

|

$ |

|

9,405 |

|

|

$ |

|

9,458 |

|

|||

Expenses: |

|

|

|

|

|

|

|

|||||||||||||||

Operating |

|

1,717 |

|

|

|

1,681 |

|

|

|

4,924 |

|

|

|

4,925 |

|

|||||||

Selling, general and administrative |

|

828 |

|

|

|

738 |

|

|

|

2,255 |

|

|

|

2,248 |

|

|||||||

Depreciation and amortization |

|

55 |

|

|

|

51 |

|

|

|

159 |

|

|

|

159 |

|

|||||||

Restructuring and related costs |

— |

|

|

|

15 |

|

|

|

95 |

|

|

|

200 |

|

||||||||

Legal settlement |

— |

|

|

— |

|

|

|

40 |

|

|

— |

|

||||||||||

Total expenses |

|

2,600 |

|

|

|

2,485 |

|

|

|

7,473 |

|

|

|

7,532 |

|

|||||||

Operating income |

|

757 |

|

|

|

752 |

|

|

|

1,932 |

|

|

|

1,926 |

|

|||||||

Interest expense, net |

|

(119 |

) |

|

|

(138 |

) |

|

|

(364 |

) |

|

|

(428 |

) |

|||||||

Equity in net earnings of investee companies |

— |

|

|

|

2 |

|

|

|

1 |

|

|

|

5 |

|

||||||||

Gain on marketable securities |

|

29 |

|

|

— |

|

|

|

21 |

|

|

— |

|

|||||||||

Gain on extinguishment of debt |

— |

|

|

— |

|

|

|

18 |

|

|

|

25 |

|

|||||||||

Other items, net |

|

(1 |

) |

|

|

(9 |

) |

|

|

(13 |

) |

|

|

(41 |

) |

|||||||

Earnings from continuing operations before provision for income taxes |

|

666 |

|

|

|

607 |

|

|

|

1,595 |

|

|

|

1,487 |

|

|||||||

Provision for income taxes |

|

(122 |

) |

|

|

(93 |

) |

|

|

(352 |

) |

|

|

(158 |

) |

|||||||

Net earnings from continuing operations |

|

544 |

|

|

|

514 |

|

|

|

1,243 |

|

|

|

1,329 |

|

|||||||

Discontinued operations, net of tax |

|

6 |

|

|

|

11 |

|

|

|

22 |

|

|

|

23 |

|

|||||||

Net earnings (Viacom and noncontrolling interests) |

|

550 |

|

|

|

525 |

|

|

|

1,265 |

|

|

|

1,352 |

|

|||||||

Net earnings attributable to noncontrolling interests |

|

(6 |

) |

|

|

(3 |

) |

|

|

(24 |

) |

|

|

(27 |

) |

|||||||

Net earnings attributable to Viacom |

$ |

|

544 |

|

|

$ |

|

522 |

|

|

$ |

|

1,241 |

|

|

$ |

|

1,325 |

|

|||

Amounts attributable to Viacom: |

|

|

|

|

|

|

|

|||||||||||||||

Net earnings from continuing operations |

$ |

|

538 |

|

|

$ |

|

511 |

|

|

$ |

|

1,219 |

|

|

$ |

|

1,302 |

|

|||

Discontinued operations, net of tax |

|

6 |

|

|

|

11 |

|

|

|

22 |

|

|

|

23 |

|

|||||||

Net earnings attributable to Viacom |

$ |

|

544 |

|

|

$ |

|

522 |

|

|

$ |

|

1,241 |

|

|

$ |

|

1,325 |

|

|||

Basic earnings per share attributable to Viacom: |

|

|

|

|

|

|

|

|||||||||||||||

Continuing operations |

$ |

|

1.33 |

|

|

$ |

|

1.27 |

|

|

$ |

|

3.02 |

|

|

$ |

|

3.23 |

|

|||

Discontinued operations |

|

0.02 |

|

|

|

0.03 |

|

|

|

0.06 |

|

|

|

0.06 |

|

|||||||

Net earnings |

$ |

|

1.35 |

|

|

$ |

|

1.30 |

|

|

$ |

|

3.08 |

|

|

$ |

|

3.29 |

|

|||

Diluted earnings per share attributable to Viacom: |

|

|

|

|

|

|

|

|||||||||||||||

Continuing operations |

$ |

|

1.33 |

|

|

$ |

|

1.27 |

|

|

$ |

|

3.02 |

|

|

$ |

|

3.23 |

|

|||

Discontinued operations |

|

0.02 |

|

|

|

0.02 |

|

|

|

0.05 |

|

|

|

0.06 |

|

|||||||

Net earnings |

$ |

|

1.35 |

|

|

$ |

|

1.29 |

|

|

$ |

|

3.07 |

|

|

$ |

|

3.29 |

|

|||

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|||||||||||||||

Basic |

|

403.5 |

|

|

|

402.8 |

|

|

|

403.3 |

|

|

|

402.6 |

|

|||||||

Diluted |

|

404.0 |

|

|

|

403.3 |

|

|

|

403.7 |

|

|

|

402.9 |

|

|||||||

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

VIACOM INC. |

|||||||||||

CONSOLIDATED BALANCE SHEETS |

|||||||||||

(Unaudited) |

|||||||||||

(in millions, except par value) |

June 30,

|

|

September 30,

|

||||||||

|

|

||||||||||

|

|

|

|

||||||||

ASSETS |

|

|

|

||||||||

Current assets: |

|

|

|

||||||||

Cash and cash equivalents |

$ |

722 |

|

|

$ |

1,557 |

|

||||

Receivables, net |

3,386 |

|

|

3,141 |

|

||||||

Inventory, net |

819 |

|

|

896 |

|

||||||

Prepaid and other assets |

515 |

|

|

482 |

|

||||||

Total current assets |

5,442 |

|

|

6,076 |

|

||||||

Property and equipment, net |

891 |

|

|

919 |

|

||||||

Inventory, net |

3,963 |

|

|

3,848 |

|

||||||

Goodwill |

11,886 |

|

|

11,609 |

|

||||||

Intangibles, net |

328 |

|

|

313 |

|

||||||

Other assets |

1,138 |

|

|

1,018 |

|

||||||

Total assets |

$ |

23,648 |

|

|

$ |

23,783 |

|

||||

|

|

|

|

||||||||

LIABILITIES AND EQUITY |

|

|

|

||||||||

Current liabilities: |

|

|

|

||||||||

Accounts payable |

$ |

441 |

|

|

$ |

433 |

|

||||

Accrued expenses |

837 |

|

|

848 |

|

||||||

Participants’ share and residuals |

711 |

|

|

719 |

|

||||||

Program obligations |

730 |

|

|

662 |

|

||||||

Deferred revenue |

474 |

|

|

398 |

|

||||||

Current portion of debt |

320 |

|

|

567 |

|

||||||

Other liabilities |

490 |

|

|

427 |

|

||||||

Total current liabilities |

4,003 |

|

|

4,054 |

|

||||||

Noncurrent portion of debt |

8,638 |

|

|

9,515 |

|

||||||

Participants’ share and residuals |

430 |

|

|

523 |

|

||||||

Program obligations |

335 |

|

|

498 |

|

||||||

Deferred tax liabilities, net |

318 |

|

|

296 |

|

||||||

Other liabilities |

1,191 |

|

|

1,186 |

|

||||||

Redeemable noncontrolling interest |

250 |

|

|

246 |

|

||||||

Commitments and contingencies |

|

|

|

||||||||

Viacom stockholders’ equity: |

|

|

|

||||||||

Class A common stock, par value $0.001, 375.0 authorized; 49.4 and 49.4 outstanding, respectively |

— |

|

|

— |

|

||||||

Class B common stock, par value $0.001, 5,000.0 authorized; 354.3 and 353.7 outstanding, respectively |

— |

|

|

— |

|

||||||

Additional paid-in capital |

10,157 |

|

|

10,145 |

|

||||||

Treasury stock, 392.5 and 393.1 common shares held in treasury, respectively |

(20,541 |

) |

|

(20,562 |

) |

||||||

Retained earnings |

19,656 |

|

|

18,561 |

|

||||||

Accumulated other comprehensive loss |

(832 |

) |

|

(737 |

) |

||||||

Total Viacom stockholders’ equity |

8,440 |

|

|

7,407 |

|

||||||

Noncontrolling interests |

43 |

|

|

58 |

|

||||||

Total equity |

8,483 |

|

|

7,465 |

|

||||||

Total liabilities and equity |

$ |

23,648 |

|

|

$ |

23,783 |

|

||||

|

|

|

|

||||||||

VIACOM INC. |

|||||||||||||

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||||||

(Unaudited) |

|||||||||||||

|

Nine Months Ended

|

||||||||||||

(in millions) |

2019 |

|

2018 |

||||||||||

OPERATING ACTIVITIES |

|

|

|

||||||||||

Net earnings (Viacom and noncontrolling interests) |

$ |

1,265 |

|

|

$ |

1,352 |

|

||||||

Discontinued operations, net of tax |

(22 |

) |

|

(23 |

) |

||||||||

Net earnings from continuing operations |

1,243 |

|

|

1,329 |

|

||||||||

Reconciling items: |

|

|

|

||||||||||

Depreciation and amortization |

159 |

|

|

159 |

|

||||||||

Feature film and program amortization |

3,234 |

|

|

3,402 |

|

||||||||

Equity-based compensation |

41 |

|

|

45 |

|

||||||||

Deferred income taxes |

36 |

|

|

27 |

|

||||||||

Gain on marketable securities |

(21 |

) |

|

— |

|

||||||||

Operating assets and liabilities, net of acquisitions: |

|

|

|

||||||||||

Receivables |

(232 |

) |

|

(211 |

) |

||||||||

Production and programming |

(3,320 |

) |

|

(3,373 |

) |

||||||||

Accounts payable and other current liabilities |

7 |

|

|

(384 |

) |

||||||||

Other, net |

(44 |

) |

|

3 |

|

||||||||

Net cash provided by operating activities |

1,103 |

|

|

997 |

|

||||||||

|

|

|

|

||||||||||

INVESTING ACTIVITIES |

|

|

|

||||||||||

Acquisitions and investments, net |

(396 |

) |

|

(90 |

) |

||||||||

Capital expenditures |

(119 |

) |

|

(102 |

) |

||||||||

Proceeds received from asset sales |

5 |

|

|

57 |

|

||||||||

Grantor trust proceeds |

4 |

|

|

7 |

|

||||||||

Net cash used in investing activities |

(506 |

) |

|

(128 |

) |

||||||||

|

|

|

|

||||||||||

FINANCING ACTIVITIES |

|

|

|

||||||||||

Debt repayments |

(1,100 |

) |

|

(1,000 |

) |

||||||||

Dividends paid |

(242 |

) |

|

(241 |

) |

||||||||

Exercise of stock options |

— |

|

|

2 |

|

||||||||

Other, net |

(87 |

) |

|

(70 |

) |

||||||||

Net cash used in financing activities |

(1,429 |

) |

|

(1,309 |

) |

||||||||

Effect of exchange rate changes on cash and cash equivalents |

(3 |

) |

|

(20 |

) |

||||||||

Net change in cash and cash equivalents |

(835 |

) |

|

(460 |

) |

||||||||

Cash and cash equivalents at beginning of period |

1,557 |

|

|

1,389 |

|

||||||||

Cash and cash equivalents at end of period |

$ |

722 |

|

|

$ |

929 |

|

||||||

|

|

|

|

||||||||||

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES

We utilize certain financial measures that are not in accordance with accounting principles generally accepted in the United States of America (“GAAP”), including consolidated adjusted operating income, adjusted earnings from continuing operations before provision for income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations attributable to Viacom and adjusted diluted earnings per share (“EPS”) from continuing operations, to evaluate our actual operating performance and for planning and forecasting of future periods.

We also utilize free cash flow, which is a non-GAAP financial measure, because we believe the use of this measure provides investors with an important perspective on our liquidity, including our ability to service debt and make investments in our business.

In addition, because foreign currency headwinds can be significant and unpredictable and are outside of our control, we provide certain financial information on a constant currency basis, excluding the impact of currency fluctuations, in order to provide a clearer view of our operating performance. This information compares results between periods as if exchange rates had remained constant period-over-period. We calculate this information by converting current-period local currency results using prior-year period average foreign currency exchange rates.

We believe that each of these adjusted measures provides relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies, facilitate period-to-period comparisons of our business performance and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, operating income, earnings from continuing operations before provision for income taxes, provision for income taxes, net earnings from continuing operations attributable to Viacom, diluted EPS from continuing operations and net cash provided by operating activities as indicators of operating performance and they may not be comparable to similarly titled measures employed by other companies.

The following tables reconcile our results of operations reported in accordance with GAAP for the quarter and nine months ended June 30, 2019 and 2018 to adjusted results that exclude the impact of certain items identified as affecting comparability (non-GAAP).

(in millions, except per share amounts) |

||||||||||||||||||||

|

Quarter Ended

|

|||||||||||||||||||

|

Operating

|

|

Earnings from

|

|

Provision for

|

|

Net Earnings

|

|

Diluted EPS

|

|||||||||||

Reported results (GAAP) |

$ |

757 |

|

|

$ |

666 |

|

|

$ |

122 |

|

|

$ |

538 |

|

|

$ |

1.33 |

|

|

Factors Affecting Comparability: |

|

|

|

|

|

|

|

|

|

|||||||||||

Gain on marketable securities (2) |

— |

|

|

(29 |

) |

|

(7 |

) |

|

(22 |

) |

|

(0.05 |

) |

||||||

Discrete tax benefit (3) |

— |

|

|

— |

|

|

32 |

|

|

(32 |

) |

|

(0.08 |

) |

||||||

Adjusted results (Non-GAAP) |

$ |

757 |

|

|

$ |

637 |

|

|

$ |

147 |

|

|

$ |

484 |

|

|

$ |

1.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(in millions, except per share amounts) |

||||||||||||||||||||

|

Nine Months Ended

|

|||||||||||||||||||

|

Operating

|

|

Earnings from

|

|

Provision for

|

|

Net Earnings

|

|

Diluted EPS

|

|||||||||||

Reported results (GAAP) |

$ |

1,932 |

|

|

$ |

1,595 |

|

|

$ |

352 |

|

|

$ |

1,219 |

|

|

$ |

3.02 |

|

|

Factors Affecting Comparability: |

|

|

|

|

|

|

|

|

|

|||||||||||

Restructuring, related costs and programming charges (4) |

172 |

|

|

172 |

|

|

40 |

|

|

132 |

|

|

0.32 |

|

||||||

Legal settlement (5) |

40 |

|

|

40 |

|

|

9 |

|

|

31 |

|

|

0.08 |

|

||||||

Gain on extinguishment of debt (6) |

— |

|

|

(18 |

) |

|

(4 |

) |

|

(14 |

) |

|

(0.03 |

) |

||||||

Gain on marketable securities (2) |

— |

|

|

(21 |

) |

|

(5 |

) |

|

(16 |

) |

|

(0.04 |

) |

||||||

Discrete tax benefit (3) |

— |

|

|

— |

|

|

32 |

|

|

(32 |

) |

|

(0.08 |

) |

||||||

Adjusted results (Non-GAAP) |

$ |

2,144 |

|

|

$ |

1,768 |

|

|

$ |

424 |

|

|

$ |

1,320 |

|

|

$ |

3.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

(in millions, except per share amounts) |

||||||||||||||||||||

|

|

Quarter Ended

|

||||||||||||||||||

|

|

Operating

|

|

Earnings from

|

|

Provision for

|

|

Net Earnings

|

|

Diluted EPS

|

||||||||||

Reported results (GAAP) |

|

$ |

752 |

|

|

$ |

607 |

|

|

$ |

93 |

|

|

$ |

511 |

|

|

$ |

1.27 |

|

Factors Affecting Comparability: |

|

|

|

|

|

|

|

|

|

|

||||||||||

Restructuring and related costs (4) |

|

15 |

|

|

15 |

|

|

4 |

|

|

11 |

|

|

0.03 |

|

|||||

Discrete tax benefit (3) |

|

— |

|

|

— |

|

|

47 |

|

|

(47 |

) |

|

(0.12 |

) |

|||||

Adjusted results (Non-GAAP) |

|

$ |

767 |

|

|

$ |

622 |

|

|

$ |

144 |

|

|

$ |

475 |

|

|

$ |

1.18 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

(in millions, except per share amounts) |

||||||||||||||||||||

|

|

Nine Months Ended

|

||||||||||||||||||

|

|

Operating

|

|

Earnings from

|

|

Provision for

|

|

Net Earnings

|

|

Diluted EPS

|

||||||||||

Reported results (GAAP) |

|

$ |

1,926 |

|

|

$ |

1,487 |

|

|

$ |

158 |

|

|

$ |

1,302 |

|

|

$ |

3.23 |

|

Factors Affecting Comparability: |

|

|

|

|

|

|

|

|

|

|

||||||||||

Restructuring and related costs (4) |

|

200 |

|

|

200 |

|

|

48 |

|

|

152 |

|

|

0.38 |

|

|||||

Gain on extinguishment of debt (6) |

|

— |

|

|

(25 |

) |

|

(6 |

) |

|

(19 |

) |

|

(0.05 |

) |

|||||

Gain on asset sale (7) |

|

— |

|

|

(16 |

) |

|

— |

|

|

(16 |

) |

|

(0.04 |

) |

|||||

Investment impairment (8) |

|

— |

|

|

46 |

|

|

10 |

|

|

36 |

|

|

0.09 |

|

|||||

Discrete tax benefit (3) |

|

— |

|

|

— |

|

|

196 |

|

|

(196 |

) |

|

(0.49 |

) |

|||||

Adjusted results (Non-GAAP) |

|

$ |

2,126 |

|

|

$ |

1,692 |

|

|

$ |

406 |

|

|

$ |

1,259 |

|

|

$ |

3.12 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

(1) The tax impact has been calculated by applying the tax rates applicable to the adjustments presented.

(2) Pursuant to our adoption of Accounting Standards Update 2016-01, which requires the changes in fair value measurement of marketable securities to be recognized in the Consolidated Statements of Earnings, we recorded a non-operating gain on marketable securities of $29 million and $21 million in the quarter and nine months ended June 30, 2019, respectively, in the Consolidated Statements of Earnings.

(3) The net discrete tax benefit in the quarter and nine months ended June 30, 2019 was principally related to the tax benefit triggered by the bankruptcy of an investee.

The net discrete tax benefit in the quarter ended June 30, 2018 was principally related to a tax accounting method change granted by the Internal Revenue Service and the release of tax reserves with respect to certain effectively settled tax positions. In addition to the items in the quarter, the net discrete tax benefit in the nine months ended June 30, 2018 was principally related to tax reform, as well as the measurement of the deferred tax balances from the retroactive reenactment of legislation allowing for accelerated tax deductions on certain qualified film and television productions.

(4) During fiscal 2018, we launched a program of cost transformation initiatives to improve our margins. We recognized pre-tax charges of $172 million in the nine months ended June 30, 2019, associated with continuing initiatives primarily related to recent management changes and reorganization at Media Networks, comprised of $95 million of restructuring and related costs and $77 million of programming charges. The programming charges resulted from decisions by management newly in place, as part of our 2018 restructuring activities, to cease the use of certain programming, and are included within Operating expenses in the Consolidated Statements of Earnings.

We recognized restructuring and related costs of $15 million and $200 million in the quarter and nine months ended June 30, 2018, respectively, resulting from the program of cost transformation initiatives described above.

(5) An expense of $40 million was recognized in connection with the settlement of a commercial dispute in the quarter ended March 31, 2019.

(6) We redeemed senior notes and debentures totaling $1.128 billion in the nine months ended June 30, 2019. As a result, we recognized a pre-tax extinguishment gain of $18 million in the Consolidated Statements of Earnings.

We redeemed senior notes and debentures totaling $1.039 billion in the nine months ended June 30, 2018. As a result of these transactions, we recognized a pre-tax extinguishment gain of $25 million in the Consolidated Statements of Earnings.

(7) We completed the sale of a 1% equity interest in Viacom18 to our joint venture partner for $20 million, resulting in a gain of $16 million in the nine months ended June 30, 2018, included within Other items, net in the Consolidated Statements of Earnings.

(8) We recognized a $46 million impairment loss in the nine months ended June 30, 2018, included within Other items, net in the Consolidated Statements of Earnings, in connection with the write off of certain cost method investments.

The following table reconciles our net cash provided by operating activities (GAAP) for the quarter and nine months ended June 30, 2019 and 2018 to free cash flow (non-GAAP). We define free cash flow as net cash provided by operating activities minus capital expenditures.

Reconciliation of net cash provided by operating activities to free cash flow (in millions) |

Quarter Ended

|

|

Better/

|

|

Nine Months Ended

|

|

Better/

|

|||||||||||||||||||||||

2019 |

|

2018 |

|

$ |

|

2019 |

|

2018 |

|

$ |

||||||||||||||||||||

Net cash provided by operating activities (GAAP) |

$ |

384 |

|

|

$ |

698 |

|

|

$ |

(314 |

) |

|

$ |

1,103 |

|

|

$ |

997 |

|

|

$ |

106 |

|

|||||||

Capital expenditures |

(42 |

) |

|

(38 |

) |

|

(4 |

) |

|

(119 |

) |

|

(102 |

) |

|

(17 |

) |

|||||||||||||

Free cash flow (Non-GAAP) |

$ |

342 |

|

|

$ |

660 |

|

|

$ |

(318 |

) |

|

$ |

984 |

|

|

$ |

895 |

|

|

$ |

89 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||