OMAHA, Neb.--(BUSINESS WIRE)--While the movement to achieve financial independence and retire early (FIRE) has been gaining traction, misconceptions still abound. New research conducted by The Harris Poll on behalf of TD Ameritrade, which included a survey of 1,500 U.S. adults aged 45 and older with at least $250,000 in investable assets, debunks common myths and shines a light on other realities surrounding the growing retirement movement.

“In these uncertain times, many people are seeking a future of freedom, especially when it comes to their finances, and some are turning to FIRE as a solution,” said JJ Kinahan, chief market strategist for TD Ameritrade. “But despite its buzz-worthiness and recent media coverage, two-thirds of Americans surveyed (age 45+) have never heard of FIRE. So, we think it’s important to help consumers understand what it is, and more importantly, what it isn’t.”

Myth #1: The purpose of FIRE is to quit your job and retire early

According

to the research, the drive behind FIRE is actually the desire for

financial independence and control, not to exit the workforce:

- Three-quarters of financially independent respondents said the “FI” (financial independence) was more important to them than the “RE” (retire early)

- More than 4 in 10 of both the financially independent and their non-financially independent counterparts plan to continue working in retirement because they enjoy it

- Roughly a third of all respondents said leaving a 40-hour-a-week job was the most appealing aspect of financial independence

Myth #2: FIRE demands extreme frugality in all aspects of life

The

majority of financially independent survey respondents said FIRE isn’t

worth it if you have to live like you’re broke (67 percent) or limit

traveling or going on vacations (40 percent). And with the exception of

housing, financially independent respondents appear to have similar

spending habits across multiple categories (e.g., discretionary

expenses, utilities, transportation, etc.) to those who aren’t

financially independent.

Myth #3: Going FIRE means living lean in retirement

Pursuing

FIRE doesn’t mean scrimping through retirement; in fact, most would

rather save up more for a “fat” lifestyle:

- Nearly 7 in 10 financially independent respondents would rather retire at a normal time and live more comfortably ($2 million+) than retire early and live a leaner, low-cost lifestyle in retirement

- 37 percent of financially independent respondents are aiming at a retirement nest egg of more than $2 million, and more than half of all financially independent respondents are looking for at least $500,000 to $2 million

“If you make sacrifices early on the material-side, you can actually have a lot of material goods in the future because of the power of compounding. So I don't think FIRE is just for minimalists,” said J.P. Livingston, creator of The Money Habit, speaking of the possible growth potential. “I think it’s for everyone, as long as they understand the trade-off of building that first tiny nest egg in order to afford to set themselves up for the rest of time. It allows you to do so much more.” She explains that investors could then end up with a bigger nest egg and perhaps even be able to spend more freely and enjoy decades of retirement.1

Reality #1: FIREes think of themselves as investors first

- More than 6 in 10 financially independent respondents consider themselves to be investors, compared to 27 percent of those who aren’t financially independent

- Half of financially independent respondents started investing in the stock market by age 30, compared to one-third of those who aren’t financially independent

Reality #2: Investing is a key difference between those who are

financially independent and those who aren’t

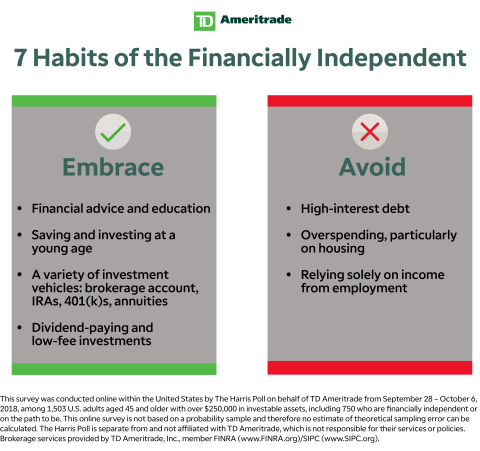

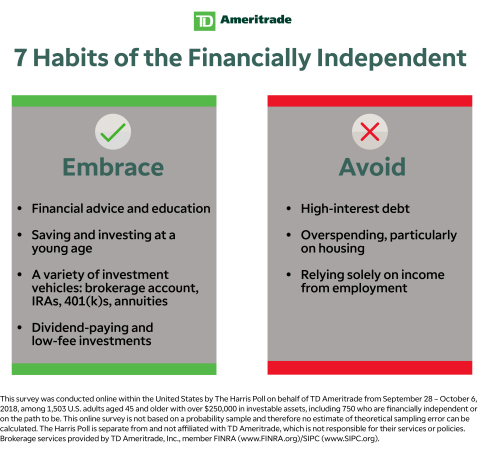

When comparing

steps that survey respondents are taking and/or would take to achieve

FIRE, including financial decisions (e.g., “sticking to a budget,”

“avoiding high-interest debt,” etc.) and lifestyle/career decisions

(e.g., “pursuing a side career,” “buying only used cars,” etc.),

investing in the stock market is a key differentiator:

- More than half of financially independent respondents are invested in the stock market as opposed to just 26 percent of those surveyed who aren’t financially independent

Reality #3: Investments have the potential to drive wealth

When

breaking down the income of financially independent respondents,

investments are the second most valued source, falling only after income

from employment. Wealth sources or investments that most contributed to

overall financial well-being include:

- Income from employment (50 percent), financial market investments (25 percent), inheritance (8 percent), and real estate (7 percent)

Top wealth sources outside of traditional work, in rank order:

- (1) dividends, (2) annuities, (3) real estate, (4) inheritance, (5) owning a business, (6) freelancing

“Discipline is at the core of the FIRE movement: self-discipline and self-mastery. A lot of people in the community pride themselves on their ability to do things themselves,” said Grant Sabatier, creator of Millennial Money and author of “Financial Freedom.”

The Money Habit and Millennial Money are separate from and not affiliated with TD Ameritrade, which is not responsible for their services or policies.

1 Of course there is no guarantee that the growth described will occur, and an individual’s risk tolerance and time horizon can greatly influence financial results.

About TD Ameritrade Holding Corporation

TD Ameritrade

provides investing

services and education

to more than 11 million client accounts totaling approximately $1.3

trillion in assets, and custodial

services to more than 6,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of approximately

800,000 trades per day for our clients, more than a quarter of which

come from mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of nearly 10,000-strong is committed to carrying it forward. Together,

we are leveraging the latest in cutting edge technologies and one-on-one

client care to transform lives, and investing, for the better. Learn

more by visiting TD Ameritrade’s newsroom

at www.amtd.com,

or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)/SIPC (www.SIPC.org).

About The Harris Poll

The Harris Poll is one of the

longest-running surveys in the U.S., tracking public opinion,

motivations and social sentiment since 1963. It is now part of Harris

Insights & Analytics, a global consulting and market research firm that

strives to reveal the authentic values of modern society to inspire

leaders to create a better tomorrow. We work with clients in three

primary areas; building twenty-first-century corporate reputation,

crafting brand strategy and performance tracking, and earning organic

media through public relations research. Our mission is to provide

insights and advisory to help leaders make the best decisions possible.

Survey Methodology

This survey was conducted online within

the United States by The Harris Poll on behalf of TD Ameritrade from

September 28 to October 6, 2018, among 1,503 U.S. adults aged 45 and

older with over $250,000 in investable assets, including 750 who are

financially independent or on the path to be. “Financial independence”

is defined as a state in which an individual or household has sufficient

wealth to live on without having to depend on income from some form of

employment. Eleven in-depth interviews were also conducted with pioneers

in the FIRE movement.