TORONTO--(BUSINESS WIRE)--More than seven in ten Canadian individual investors (72%) feel financially secure in today’s market environment, as compared to during the financial crisis, but the market’s strong performance and historic calm aren’t enough to ease their fear of losses, according to a new survey of investors from Natixis Global Asset Management. Although three in five investors (62%) are comfortable taking risks to get ahead, most (83%) are more concerned with losses than with gains and would choose safety over performance.

Natixis surveyed 300 individual investors across Canada and found:

- Market volatility, a significant worry during the financial crisis, remains a concern despite today’s more stable markets. Half of investors (52%) say that market volatility undermines their ability to reach their savings and retirement goals.

- Accordingly, understanding risk is a leading concern of investors, topped only by tax planning. Expertise matters here: Two-thirds (66%) of investors with financial advisors are broadly comfortable with risk, compared to just slightly more than half (53%) of self-directed investors.

- Fewer than half (49%) trust themselves to make investment decisions on their own. Two-thirds (68%) would prefer to have an expert find the market’s best investment opportunities.

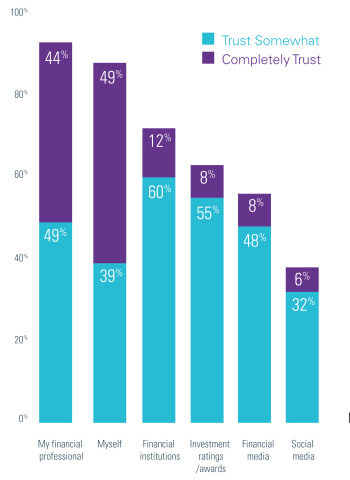

- Ninety-three percent of investors at least somewhat trust their financial advisor, topping other sources including financial institutions (72%), industry analysts (71%), close friends and family (68%), investment ratings and awards (63%), the financial media (56%) and least of all, social media (38%).

- Investors build such strong bonds with their advisors that half of them (51%) would follow their current advisor if (s)he switched firms.

- Asset managers generate less trust than advisors: Slightly more than half (56%) of investors say that asset managers provide value for money.

“Wary of the markets and swamped by information from numerous sources that can be hard to digest, today’s investors want forthright, actionable advice and guidance from trustworthy sources to aid them in their financial decision-making,” said Abe Goenka, CEO of Natixis Global Asset Management Canada. “Our most recent survey indicates that investors are looking for financial advisors to demonstrate their value by providing investors with the advice, tools and confidence they need to make informed decisions consistent with their goals and risk tolerance.”

Investors Tend to Overvalue Passive Investing

Investors’ doubts about the value asset managers bring to the table may be a hangover of the financial crisis, which led to skepticism about the effectiveness of active versus passive investing. Since then, investors wary of higher fees have moved to index funds and other low-cost passive investments. The industry brought some of this skepticism on itself through the proliferation of “closet indexers,” managers who charge active management fees for performance that merely tracks benchmark returns, just as index funds do. These views are borne out by some of the study’s findings:

- Three-quarters (76%) of investors think that some fund managers charge high fees even though they are really just tracking an index, which investors say they could do just as well at lower cost.

- Nearly four in five investors (77%) want fund managers to be more transparent about the fees they charge.

- Only half (50%) of investors believe that fund managers are open about their products’ limitations.

Six in ten investors (62%) surveyed by Natixis say their investment knowledge is strong; however, only 17% agreed strongly. This and other findings suggest that better education is at the heart of serving the best interests of clients. For example, Natixis found that many investors overestimate the virtues of passive investing. At the same time, many investors do not understand or appreciate the benefit of alternative investment strategies that are available to them beyond the traditional mix of stocks and bonds. The study found that:

- More than half (56%) of investors think that passive investments are less risky, 63% think they help minimize risk and 59% think they are a way to access the best opportunities in the market, despite the fact that index funds, by their very nature, lack diversification and internal risk management.

- Four in five investors (79%) say they are willing to invest in assets other than stocks and bonds, and 62% think alternative investments would give them higher returns than traditional stocks and bonds.

- However, investor perceptions of alternatives suggest the need for better education and guidance. More than three-quarters (71%) of investors say alternatives are too complex and 65% think they are riskier than traditional asset classes.

- Thirteen percent of investors do not know whether their investment holdings include alternatives.

Natixis suggests that investors may be confusing the term “alternative investments” with a smaller group of complex, higher-risk strategies such as hedge funds. Yet, many alternative strategies have been designed to provide non-correlated returns, minimize volatility and, ultimately, help reduce overall portfolio risk. This is an area in which the asset management industry and financial advisors alike can help with increased investor education.

ESG Increasing in Visibility

Increasingly, investors want to make investment decisions that reflect their personal environmental, social and governance (ESG) values. In fact, two-thirds (68%) of investors say it is important for them to make a positive social impact through their investments. One challenge: Such targeted investments are difficult with passive funds that own all the companies in a broad market index. As a result, ESG-minded investors are looking towards targeted investments selected according to specific criteria. In addition:

- Three-quarters (74%) of investors say there are companies that they would not want to own because they violate their personal principles, and two-thirds (66%) would sell the shares of a company they owned that had negative environmental or social issues.

- Eighty-three percent of investors believe it is important to invest in companies that are managed ethically, and 70% want the companies in which they invest to have good environmental records.

- Nearly four in ten (39%) investors have not discussed ESG investing with their advisor; however, the share of those who are talking with their advisor about ESG investments jumped to 61% this year from 47% last.

Where Advisors Can Make a Difference

When asked what they are looking for from their financial advisor, the most frequent response investors gave was the need for clarification on fees – followed by doing a better job at aligning their investments with their personal values. In rank order of importance, investors say they seek the following:

1. Explain fees clearly

2. Offer investments that reflect personal values

3. Listen

4. Help manage market volatility

5. Help manage tax issues

“Investors receive a constant barrage of information, but what they really need is clarity,” said David Goodsell, Executive Director of Natixis’ Durable Portfolio Construction Research Center. “Despite historically low volatility, investors still worry it will undermine their financial goals. After an eight-year bull market, investors still define risk as a loss of assets rather than missing out on opportunity. And despite very high hopes for returns, they say they want safety over investment performance. Investors clearly need a financial professional to help them reconcile these conflicts and achieve their goals.”

Methodology

Natixis surveyed 300 individual investors across Canada with a minimum of $123,661 CAD (US$100,000) in investable assets. The online survey was conducted in February 2017 and is part of a larger global study of 8,300 investors in 22 countries and regions from Asia, Europe, the Americas and the Middle East. The report, entitled “Trust, Transparency and the Quest for Clarity: Investor Attitudes on Markets and the Business of Investing,” is available at: ngam.natixis.com/us/research/individual-investor-survey-trust-2017.

About Natixis Global Asset Management

Natixis Global Asset

Management serves thoughtful investment professionals worldwide with

more insightful ways to invest. Through our Durable Portfolio

Construction® approach, we focus on risk to help them

construct more strategic portfolios that seek to endure today’s

unpredictable markets. We draw from deep investor and industry insights

and partner closely with our clients to put objective data behind the

discussion.

Natixis Global Asset Management is ranked among the world’s largest asset management firms.1 Uniting over 20 specialized investment managers globally ($951.7 billion AUM2), we bring a diverse range of solutions to every strategic opportunity. From insight to action, Natixis Global Asset Management helps our clients better serve their own with more durable portfolios.

Headquartered in Paris and Boston, Natixis Global Asset Management, S.A. is part of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Global Asset Management, S.A.’s affiliated investment management firms and distribution and service groups include Active Index Advisors®;3 AEW Capital Management; AEW Europe; AlphaSimplex Group; Darius Capital Partners; DNCA Investments;4 Dorval Asset Management;5 Emerise;6 Gateway Investment Advisers; H2O Asset Management;5 Harris Associates; Loomis, Sayles & Company; Managed Portfolio Advisors®;3 McDonnell Investment Management; Mirova;7 Natixis Asset Management; Ossiam; Seeyond;8 Vaughan Nelson Investment Management; Vega Investment Managers; and Natixis Global Asset Management Private Equity, which includes Seventure Partners, Naxicap Partners, Alliance Entreprendre, Euro Private Equity, Caspian Private Equity and Eagle Asia Partners. Not all offerings available in all jurisdictions. For additional information, please visit the company’s website at ngam.natixis.com | LinkedIn: linkedin.com/company/natixis-global-asset-management.

In Canada: This material is provided by NGAM Canada LP / Natixis Global Asset Management Canada.

1 Cerulli Quantitative Update: Global Markets 2017

ranked Natixis Global Asset Management, S.A. as the 15th

largest asset manager in the world based on assets under management

($877.1 billion) as of December 31, 2016.

2

Net asset value as of June 30, 2017. Assets under management (AUM) may

include assets for which non-regulatory AUM services are provided.

Non-regulatory AUM includes assets which do not fall within the SEC’s

definition of ‘regulatory AUM’ in Form ADV, Part 1.

3 A

division of NGAM Advisors, L.P.

4 A brand

of DNCA Finance.

5 A subsidiary of Natixis

Asset Management.

6 A brand of Natixis

Asset Management and Natixis Asset Management Asia Limited, based in

Singapore and Paris.

7 A subsidiary of

Natixis Asset Management. Operated in the U.S. through Natixis Asset

Management U.S., LLC.

8 A brand of Natixis

Asset Management. Operated in the U.S. through Natixis Asset Management

U.S., LLC.