CINCINNATI--(BUSINESS WIRE)--Fifth Third Bank introduces the Fifth Third MomentumTM app to help college graduates pay off student loans faster by automating frequent micropayments toward the balance on student loan accounts.

Fifth Third Bank customers with a Fifth Third debit card can link student loans held by over thirty different servicers to the app. Once the loan is connected, customers can choose to round their debit card purchases up to the next dollar or add one dollar to every purchase. Either way, the extra amount is applied to the balance on the designated loan on a weekly basis once a minimum of five dollars in round ups is achieved. They can download the app and set it up through their smart phone.

Customers who choose to round up using Fifth Third Momentum can, for example, apply 55 cents to their designated loan balance when purchasing lunch for $9.45 for a total of $10. The same customer who chooses the dollar pay-down would pay $10.45 for the same lunch, with $1 of that being applied toward the student loan.

Student loan debt totaled $1.3 billion in 2016.1

“College debt affects our communities and our economy. This isn’t just a millennial or student issue,” said Greg Carmichael, president and CEO of Fifth Third Bancorp. “As a bank, we need to bring innovative solutions to the market, to lead the way in helping the next generation pay off their student loans faster. Fifth Third Momentum is a simple digital tool to help pay these debts faster.”

Fifth Third estimates that customers who round up $25 a month using the Fifth Third Momentum app could pay off a 20-year loan three years sooner and pay 8 percent less in total by avoiding interest that would have accumulated.*

Family members can help, too

Student-loan debt affects more than the borrower. It has a crippling effect on the economy and society at large. The burden of student-loan debt is causing graduates to delay marriages2 and to delay or reject first-time home purchases3. Student-loan payments are also preventing many young workers from being able to start saving for retirement4, contributing to a widening generational wealth gap. It also affects families as more students5 plan to move back in with their parents to save money after graduation to pay off their debts

That’s why the Fifth Third Momentum app allows graduates’ family members to use the app, too. They can sign up with their own Fifth Third debit cards and connect their purchases to help their loved ones pay down the student debt they owe.

Fifth Third invested a year to understand millennials' needs and aspirations better, talking with hundreds of millennials and surveying thousands. We talked with millennials in six markets across the U.S. and three around the world.

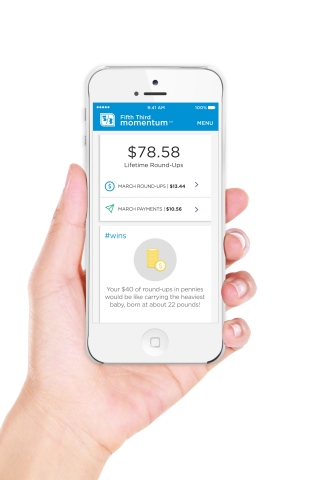

We learned that, when it comes to banking, and specifically to pay their student loans, millennials want a product that is positive, approachable and celebrates their wins. They want it available on an app, and they want it to make them feel better while saving them money.

“We wanted to offer a solution that would help people pay off their student loans faster and make them feel good while doing it,” said Melissa Stevens, Fifth Third Bank’s chief digital officer. “We aimed at creating an intuitive solution that was integrated into their daily lives instead of something that would feel like they needed to come to us.”

How to use Momentum

Fifth Third Momentum can be used with more than 30 major student-loan servicers — public and private. Fifth Third Bank does not offer student loans. Because the app is easy to set up and doesn’t require much daily thought, the bank hopes the automated micropayments platform will make reducing debt something as easy and inexpensive day-to-day as buying a cup of coffee.

Fifth Third Momentum is available to any Fifth Third debit card user. To get started, customers can download the Android or Apple app and enter the name of the institution servicing the student loan. The app gives tips to help locate the loan number. Customers then decide on their preferences — whether to round up purchases or contribute $1 for every debit-card transaction. Once $5 in payments is accumulated, the money is automatically sent to the student-loan account at the end of the week. To keep our customers motivated, they earn badges, called #Wins, for continuing to stick with this new habit.

About Fifth Third

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio. As of June 30, 2017, the Company had $141 billion in assets and operated 1,157 full-service Banking Centers and 2,461 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia and North Carolina. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Wealth & Asset Management. Fifth Third is among the largest money managers in the Midwest and, as of June 30, 2017, had $330 billion in assets under care, of which it managed $34 billion for individuals, corporations and not-for-profit organizations through its Trust and Registered Investment Advisory businesses. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the Nasdaq® Global Select Market under the symbol “FITB.” Fifth Third Bank was established in 1858. Member FDIC, Equal Housing Lender.

SOURCES:

1-

Press Briefing on Household Debt, with Focus on Student Debt,

Federal Reserve Bank of New York

2- Marriage,

Millennials, and Massive Student Loan Debt, Concordia Law

Review

3- Student

Loan Debt and Housing Report 2016, National Association of

Realtors® and Salt®

4- Half

of American families with student loan debt delay saving for retirement,

Journal of Accountancy

5- Young

Money Survey, TD Ameritrade

*Example is based on a loan

amount of $37,172.00 with a fixed interest rate of 6.80%.