NEW YORK--(BUSINESS WIRE)--Segal Consulting’s most recent survey of multiemployer pension plans’ zone status shows that among more than 200 multiemployer clients with calendar-year plans, the majority (65 percent) are in the green zone.

The average funded percentage for all plans in the survey, which have a total of $100 billion in assets and cover 2.3 million participants, is 87 percent.

“The headlines that focus on financially troubled multiemployer pension plans miss the point that the majority are healthy,” commented Diane Gleave, senior vice president and actuary for Segal. “However, this should not obscure the fact that about a quarter of participants in the survey are in critical and declining plans, and nearly one-third are in critical plans. Among the actions trustees of plans are taking to improve their funded status are plan design changes, recommending changes in contribution rates, revising investment policies and in a number of cases seeking relief under the Multiemployer Pension Reform Act.”

Under the Multiemployer Pension Reform Act, or MPRA, plans classified as in critical and declining status are generally those where the actuary projects the assets to be depleted within 20 years. A plan is classified under critical status if the actuary determines it has a funding or liquidity problem, or both, generally within four to five years.

Other key findings from the survey include:

- Critical and declining status plans have a much higher percentage of inactive participants (87 percent) than all other plans (63 percent).

- Since the financial crisis of 2008–2009, the average funded percentage has been relatively stable, between 85 and 89 percent.

- A plan’s zone status can be fluid. Between 2016 and 2017, 11 calendar-year plans changed zones, with five improving their zone status and six experiencing a decline in zone status.

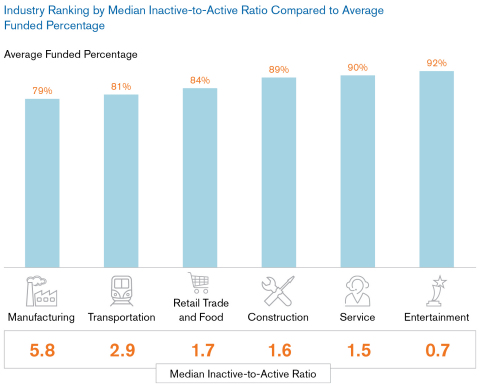

Industry Matters: More Inactive Participants = More Troubled Plans

There is some correlation between average funded percentage by industry and the inactive-to-active participant ratio. Industries with more active and fewer inactive participants tend to have better funded percentages. For example, plans in the manufacturing industry have an average of 5.8 inactive participants for each active participant, and an average funded percentage of 79 percent, well below the 87 percent overall multiemployer plan average. Conversely, plans in the entertainment industry, which, on average, have fewer than one inactive participant for each active participant, have a much higher average funded percentage of 92 percent.

Looking Ahead

“A plan’s direction is as important as its current zone status,” noted David Brenner, National Director of Multiemployer Consulting. “Trustees need to be proactive, paying careful attention to cash flow and contribution margins or deficits. They should also understand the plan’s vulnerability to all types of risk, including investment and employment risk, so they can take steps to mitigate such risks and are prepared if investment returns or employment levels come in lower than assumed.”

Segal Consulting (www.segalco.com), a member of The Segal Group, is a leading, independent firm of benefit, compensation and human resources consultants. Segal has more than 1,000 employees throughout the U.S. and in Canada. Clients include joint boards of trustees administering pension and health and welfare plans under the Taft-Hartley Act and the public sector.