NEWARK, N.J.--(BUSINESS WIRE)--College graduates say a crushing load of student loan debt is compromising their ability to buy a home, begin saving for retirement, or even start families, according to a recent survey from Prudential Financial, Inc. (NYSE: PRU).

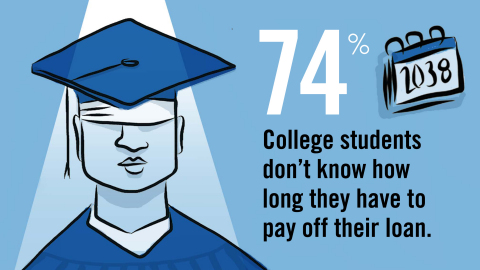

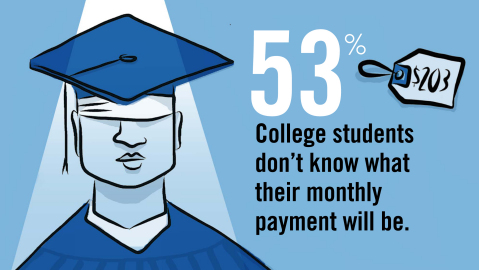

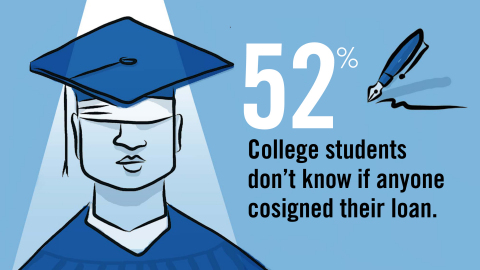

The findings, summarized in Student Loan Debt: Implications on Financial and Emotional Wellness, show a lack of understanding of college loan debt among students and graduates: Many student borrowers—53 percent—didn’t know their future monthly repayment amounts. Most—74 percent—were unsure of how long they would be making payments, and 25 percent had no idea whether they had private or government loans.

Student borrowing in the U.S. has almost tripled in the past 10 years to $1.31 trillion at the end of 2016. And while 90 percent of students and graduates Prudential surveyed said college was worth the expense, only one-fourth of those with student loans called college debt “good debt.”

“We wanted to understand how student loan debt affects students and graduates in their daily lives,” said Prudential Advisors President Caroline Feeney. “The findings are troubling, given the amount of emotional and financial stress graduates face as they struggle to save enough money to establish families and households, plan for retirement or protect themselves against unexpected life events.”

“Encouragingly, we learned graduates continue to value the benefits of higher education,” Feeney continued. “But by understanding the terms of borrowing, taking advantage of all funding sources and carefully managing finances, students and their families can minimize the burden of student loan debt after graduation and improve their financial wellness.”

Debt delays hopes and dreams

Student borrowers say they worry college loan debt may affect their financial well-being for the rest of their lives. Graduates with outstanding loans find themselves falling behind debt-free graduates when it comes to achieving the milestones of adulthood. Most say they would have done things differently if they had a better grasp of financial obligations. Among key findings for graduates carrying debt:

- 55 percent say their debt prevents or forces them to delay saving for emergencies.

- 42 percent of those carrying debt are delaying buying a home.

- 40 percent say their debt prevents or forces them to delay retirement savings.

- 25 percent are delaying or have delayed having children.

- 20 percent delayed or are delaying getting married.

Looking for good advice

While most graduates saddled with student loans say they wouldn’t call the loans “good debt,” only 12 percent said they would have skipped college. A sampling of their advice to the college-bound:

- “Pay rent, buy food and throw all extra money at your student loans at the end of every month. It makes your late 20s way better.” – Graduate with loans paid off earning between $80,000 and $119,999 a year.

- “Really think carefully about how you’re spending your discretionary income. You do NOT need that pair of jeans. You do NOT need to have that expensive shot at the bar.” – Graduate still paying on student loans who earns between $80,000 and $119,999 a year.

- “Only spend the student loans on school. Don’t buy things unrelated to school with your student loans. If there is extra money from the loans, don’t use it.” – Graduate still paying on loans who is making between $80,000 and $119,999 a year.

- “Work as much as you can handle during college, don’t take the max loan, make sacrifices as needed.” – Graduate still paying on student loans who makes between $50,000 and $79,999 a year.

-

“Find a side job, something that you do once or twice a week to

make extra money. Put that money toward your loans.”

– Graduate still paying on student loans who makes less than $29,999 a year. -

“Attack it with your life, and get it gone.”

– Graduate still paying on loans who makes between $30,000 and $49,999 a year.

Time is power

The study suggests several actions for college-bound students, current students and graduates to consider so they can take control of their education costs—before they get into debt. Among them:

- For high school students: Work and save more now.

-

For college students: Avoid loading up on credit-card debt.

- For graduates: Take control of your money by creating a budget that includes paying down student loan debt, preparing for financial emergencies and saving for long-term goals, such as home ownership and retirement.

Student loans in and of themselves aren’t necessarily bad. The Pew Research Center reported that, on average, college graduates between 25 and 32 earn $17,500 a year more than those with only a high school diploma. Student loans enable many to go to college, and the increased pay often offsets the debt.

“The big takeaway here isn’t that students should skip college to avoid debt,” said James Mahaney, vice president, Strategic Initiatives at Prudential. “Rather, it is that college-bound students can learn from graduates to avoid burdensome debt as they find ways to take advantage of all options, including applying for more grants and scholarships, participating in work-study programs and managing their money responsibly, even before college.”

About the research

The Prudential student loan survey was conducted online by Chadwick Martin Bailey on behalf of Prudential between September 13 and October 3, 2016. A total of 2,369 people completed the survey, including 1,011 current college students and 1,358 graduates. Among current students, 756 had student loans and 255 did not.

About Prudential

Prudential Financial, Inc. (NYSE: PRU), a financial services leader with more than $1 trillion of assets under management as of March 31, 2017, has operations in the United States, Asia, Europe and Latin America. Prudential’s diverse and talented employees are committed to helping individual and institutional customers grow and protect their wealth through a variety of products and services, including life insurance, annuities, retirement-related services, mutual funds and investment management. In the U.S., Prudential’s iconic Rock symbol has stood for strength, stability, expertise and innovation for more than a century. For more information, please visit news.prudential.com.