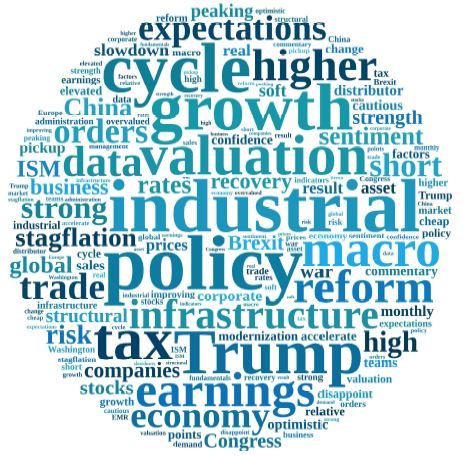

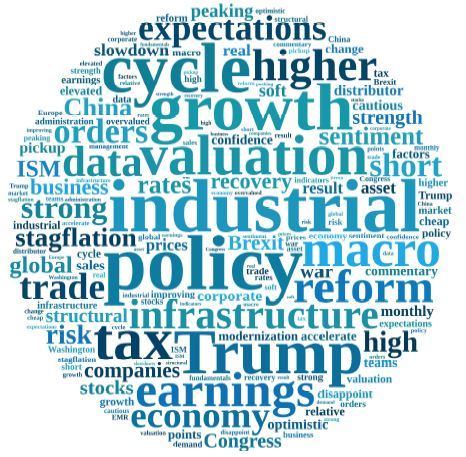

HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Advisors, a specialized investor relations (IR) advisory firm, today released its quarterly Industrial Sentiment Survey, which reveals the highest level of positivity since the report’s inception in June 2015. The survey, part of Corbin’s Inside The Buy-side® publication, is based on responses from 25 investors and analysts globally who follow the Industrial sector.

Building upon a strong 4Q16, 2017 is off to a good start as post-election optimism continues. Indeed, heading into 1Q17 earnings season, 96% expect industrial earnings to be in line with or better than consensus, with the number predicting misses falling to only 4%. Similarly, management tone continues to strengthen, as 84% now describe executive stances as neutral to bullish or outright bullish.

With regard to the political-economic climate, industrials in particular benefited from the Trump administration’s proposed infrastructure spending bill, which some analysts project can top $1 trillion. The majority of survey respondents, or 79%, believe the program will be positive or very positive for the U.S. economy and 74% expect it to pass in 2017. Continuing, most believe the benefits are 25% to 50% priced in while 70% anticipate it will take at least one to two years before we see the impact, making industrial stocks particularly vulnerable to political execution risk. To that end, ability to pass legislation is cited as the top concern.

Though animal spirits are evident across the industrial landscape, the percentage of net buyers in the sector has declined amid the overwhelming majority view that industrial stocks are fairly to overvalued. As one buy-side investor notes, “Expectations may have gotten ahead of reality as it pertains to reflation and corporate tax reform.”

“Industrials are trading on a wave of positive, pro-growth sentiment emanating from the promise of business-friendly policy in the U.S. Expectations for the quarter are quite high considering the promise has yet to materialize,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. Ms. Corbin added, “Investors seem to be betting that the current upbeat psychology surrounding global growth will be self-fulfilling and sufficient to stimulate revenue and EPS growth in advance of policy implementation. Thus, they are looking beyond lofty valuations for the fear of missing the opportunity.”

The survey also identifies several significant shifts in industrial sub-sector sentiment, as those most likely to benefit from the Trump Administration’s proposals – Defense, Industrial Equipment & Components and Machinery – gained significant favor. Meanwhile, sentiment on Autos is the most bearish and saw the biggest spike in negative views, followed closely by Water.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at www.CorbinAdvisors.com.

About Corbin Advisors

Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting.

Inside the Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit www.CorbinAdvisors.com.