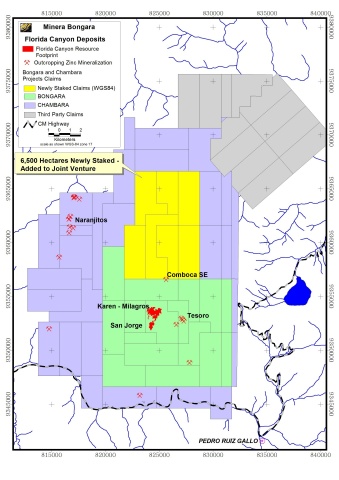

DENVER--(BUSINESS WIRE)--Solitario Exploration & Royalty Corp. (“Solitario;” NYSE MKT: XPL; TSX: SLR) is pleased to announce that it, together with its funding joint venture partner, Compañia Minera Milpo S.A.A. (“Milpo”), significantly increased joint venture property holdings in northern Peru by acquiring 6,500 hectares (16,055 acres) of new mineral concessions in early January 2017. The acquired property fills an ownership gap in our consolidated claim position held by the Bongará and Chambara joint ventures, both of which are mutually owned by Solitario and Milpo (see attached map).

The newly acquired concessions were previously held by a third party for approximately the past 20 years, but the claims recently expired allowing Milpo/Solitario to acquire the property the first day it became available for staking. With these new mineral rights, the joint ventures have secured the most attractive geologic terrain for the future expansion of zinc mineralization outside of our core Bongará claim group.

The attached map shows the position of the existing Bongará joint venture claims, the Chambara claims and the new Chambara claims. Although the Bongará and Chambara joint venture agreements with Milpo are similar (see “Terms of the Bongará and Chambara Joint Ventures” below), current participating interests differ significantly with Solitario owning 39% of the Bongará joint venture and 85% of the Chambara joint venture (Milpo 61% and 15%, respectively).

Chris Herald, President and CEO of Solitario, stated, “We are excited about the acquisition of these highly prospective mineral rights. We believe this large newly acquired area has excellent exploration potential as it is squarely on trend with Bongará mineralization and known mineralized structures and favorable stratigraphy.”

This release has been reviewed for accuracy by Walter Hunt, Chief Operating Officer of Solitario, a “qualified person” as that term is defined in NI 43-101.

Terms of the Bongará and Chambara Joint Ventures

Currently, Solitario owns a 39% interest in the Bongará project concessions and an 85% interest in the contiguous Chambara project concessions. Peruvian mining company Milpo owns 61% and 15% of these two projects, respectively. Since inception of both of these joint ventures, the Brazilian conglomerate Votorantim and its subsidiary, Milpo, have funded 100% of project expenditures. Milpo can earn a 70% interest in the Bongará project by continuing to fund all project expenditures1 and committing to place the project into production based upon a positive feasibility study. After earning 70%, and at the request of Solitario, Milpo has further agreed to finance Solitario's 30% participating interest for construction. Solitario will repay the loan facility through 50% of its net cash flow distributions for production on Bongará joint venture properties. If Milpo earns a 70% interest in the Chambara JV and funds construction, then Solitario would repay any financing of Chambara initial capital construction from 80% of its net cash flow distributions.

1 except the PEA that is currently in preparation and funded by Solitario

About Solitario

Solitario is an exploration and royalty company traded on the NYSE MKT (“XPL”) and on the Toronto Stock Exchange (“SLR”). Solitario has a joint venture with Milpo on its high-grade Bongará zinc project and its Chambara exploration project in Peru and a 9.97% equity interest in Vendetta Mining. Solitario’s Management and Directors hold approximately 7.6% (excluding options) of the Company’s 38.7 million shares outstanding. Solitario’s cash balance and marketable securities currently stand at approximately US$17 million. Additional information about Solitario is available online at www.solitarioxr.com.

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934, and as defined in the United States Private Securities Litigation Reform Act of 1995 (and the equivalent under Canadian securities laws), that are intended to be covered by the safe harbor created by such sections. Forward-looking statements are statements that are not historical fact. They are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and address activities, events or developments that Solitario expects or anticipates will or may occur in the future, and are based on current expectations and assumptions. Forward-looking statements involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements include, without limitation, statements regarding the Company’s expectation of the projected timing and outcome of engineering studies; expectations regarding the receipt of all necessary permits and approvals to implement a mining plan, if any, at Bongará; the potential for confirming, upgrading and expanding zinc, lead and silver mineralized material at Bongará; future operating and capital cost estimates may indicate that the stated resources may not be economic; estimates of zinc, lead and silver grades provided are not diluted mining grades and the predicted or actual mining grade could be substantially lower; estimates of recovery rates for the three types of mineralization, sulfide, oxide and mixed could be lower than estimated for establishing the cutoff grade; and other statements that are not historical facts; risks associated with our funding partner’s (Votorantim Metais and/or Milpo) ability to finance continued development and potential construction of the Bongará project. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, risks relating to fluctuations in the price of zinc; the inherently hazardous nature of mining-related activities; uncertainties concerning reserve and resource estimates; uncertainties relating to obtaining approvals and permits from governmental regulatory authorities and country risks of operations outside of the United States; the possibility that environmental laws and regulations will change over time and become even more restrictive; and availability and timing of capital for financing the Company’s exploration and development activities, including uncertainty of being able to raise capital on favorable terms or at all; as well as those factors discussed in Solitario’s filings with the U.S. Securities and Exchange Commission (the “SEC”) including Solitario’s latest Annual Report on Form 10-K and its other SEC filings (and Canadian filings) including, without limitation, its latest Quarterly Report on Form 10-Q. The Company does not intend to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.