NEW YORK--(BUSINESS WIRE)--Viacom Inc. (NASDAQ: VIAB, VIA) today reported financial results for the first quarter of fiscal 2017 ended December 31, 2016 and provided an update on strategic priorities.

Bob Bakish, President and Chief Executive Officer, said, "Today we share a strategy that will enable Viacom to realize the full potential of its premier global portfolio of entertainment brands. Building on our leading domestic and growing international footprint, this strategy will expand the depth and reach of our flagship brands across multiple platforms and around the world, while also providing for more competitive differentiation and increased adaptability for our business overall. There is much work to be done, but we are confident we have the plan and people to take our brands to greater heights and build a bright future for our company.”

“Viacom’s first quarter results reflect improvement in our core businesses, with increases in revenues and operating cash flow, continued strong international performance, including initial contributions from the acquisition of Telefe, and a return to positive growth in affiliate revenues. We are already benefiting from changes made early in the second quarter and seeing green shoots in our strongest businesses, as well as those that are poised for a turnaround. As we implement our strategy across the company, we believe we can drive significant value for shareholders.”

|

FISCAL YEAR 2017 RESULTS |

||||||||||||

| (in millions, except per share amounts) |

Quarter Ended |

B/(W) | ||||||||||

| 2016 | 2015 |

2016 vs. |

||||||||||

|

GAAP |

||||||||||||

| Revenues | $ | 3,324 | $ | 3,154 | 5 | % | ||||||

| Operating income | 706 | 839 |

(16) |

|

||||||||

| Net earnings attributable to Viacom | 396 | 449 |

(12) |

|

||||||||

| Diluted EPS | 1.00 | 1.13 |

(12) |

|

||||||||

| Net cash provided by/(used in) operating activities | 159 | (126 | ) | NM | ||||||||

|

Non-GAAP* |

||||||||||||

| Adjusted operating income | $ | 748 | $ | 839 |

(11) |

% |

||||||

| Adjusted net earnings attributable to Viacom | 413 | 470 |

(12) |

|

||||||||

| Adjusted diluted EPS | 1.04 | 1.18 |

(12) |

|

||||||||

| Operating free cash flow | 113 | (152 | ) | NM | ||||||||

| NM - Not Meaningful | ||||||||||||

|

* Non-GAAP measures referenced in this release are detailed in the Supplemental Disclosures at the end of this release. |

||||||||||||

Revenues in the first fiscal quarter were $3.32 billion, an increase of 5%, or $170 million, compared to the previous year. This increase reflects improved theatrical revenues, a return to growth in domestic affiliate revenues, continued strength internationally and ancillary revenue growth. Operating income declined 16% to $706 million, and adjusted operating income declined 11% to $748 million. Reported operating income reflects restructuring costs related to executive severance incurred in the first fiscal quarter. Net earnings attributable to Viacom declined to $396 million, and adjusted net earnings attributable to Viacom declined to $413 million. Diluted earnings per share for the quarter declined to $1.00, and adjusted diluted earnings per share to $1.04.

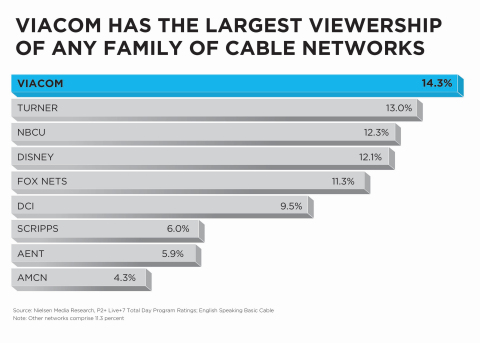

MEDIA NETWORKS

Media Networks revenues increased 1% to $2.59 billion. Excluding the adverse 2% impact of foreign exchange, worldwide revenues increased 3%, including a 1-percentage point favorable impact from the acquisition of Telefe. Domestic revenues remained flat at $2.06 billion, while international revenues grew 5% to $534 million.

Affiliate revenues improved 2% to $1.14 billion, with domestic and international affiliate revenues increasing 2% to $985 million and 3% to $159 million respectively. The increase in domestic revenues reflects rate increases and the impact of SVOD and other OTT agreements, partially offset by a modest decline in subscribers. The increase in international revenues reflects the impact of rate increases, subscriber growth and new channel launches, as well as SVOD and other OTT agreements. Excluding an unfavorable 9-percentage point foreign exchange impact, international affiliate revenues increased 12%.

Advertising revenues declined 2% to $1.29 billion, as a 1% increase in international advertising revenues was more than offset by a 3% decrease in domestic advertising revenues. The decline in domestic advertising revenues reflects softer ratings at certain networks, but were positively impacted by higher pricing. Excluding a 15-percentage point unfavorable impact of foreign exchange, international advertising revenues increased 16%, driven by the acquisition of Telefe and growth in Europe.

Ancillary Revenues increased 20%, to $151 million in the quarter. Domestic ancillary revenues increased 10%, principally driven by higher home video sales. International ancillary revenues increased 33%, reflecting growth in consumer product revenue.

Media Networks reported adjusted operating income of $987 million, compared to $1.06 billion in the first fiscal quarter of 2016, representing a decline of 7% and reflecting increased programming expenses.

Performance highlights:

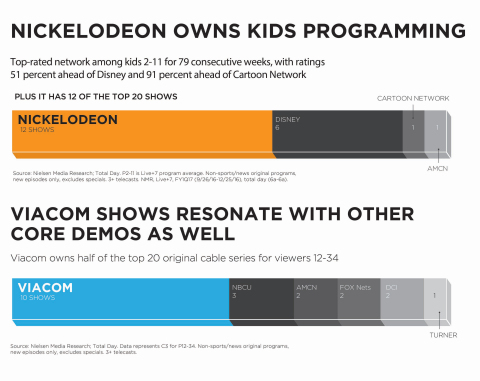

- Nickelodeon extended its winning streak in all major kids’ demos (#1 with kids 2-11 and kids 2-5 for six quarters), taking the #1 spot with ages 6-11, its best performance in this demo in five years. Nickelodeon’s performance this quarter was buoyed by the launch of more than 140 new episodes of new and returning series and specials

- MTV closed the quarter with a strong December, showing its first ratings growth since 2014

- At Comedy Central, The Daily Show wrapped the year on a ratings high for Trevor Noah, driven by debate and election coverage. The show was #1 with millennial men for the 5th consecutive quarter and ranked #2 with all millennials for the first quarter

- Affiliate revenues returned to positive growth with increases both domestically and in international markets

- Domestic advertising revenue performance improved 500 basis points versus Q4 2016

- International revenues increased 5%, with gains in advertising, affiliate and ancillary revenue

FILMED ENTERTAINMENT

Filmed Entertainment revenues grew 24% to $758 million. The increase was primarily driven by improved theatrical revenues of $192 million, an increase of 104%. Domestic theatrical revenues increased 128% and international theatrical revenues increased 73%. Foreign exchange had a 3-percentage point unfavorable impact on international theatrical revenues.

Licensing revenues grew 3% to $245 million in the quarter. Domestic licensing revenues increased 41%, primarily driven by the release of television product, while international licensing revenues decreased 17%.

Home entertainment revenues increased 2% to $243 million in the quarter. Domestic home entertainment revenues increased 12% on strong holiday sales, while international home entertainment revenues decreased 14%. Foreign exchange had a 6-percentage point unfavorable impact on international home entertainment revenues.

Ancillary revenues increased 86% to $78 million. Domestic ancillary revenues increased 109%, driven by the impact of a film slate co-financing agreement signed in the quarter. International ancillary revenues increased 10%.

Filmed Entertainment reported an adjusted operating loss of $180 million in the quarter, a decline of 23%, largely due to the timing of marketing expenses for fiscal 2017 theatrical titles.

Performance highlights:

- Revenue growth extended across all business units: theatrical, home entertainment, licensing and ancillary

- Unprecedented three-year strategic agreement closed with Shanghai Film Group and Huahua Media to co-finance approximately twenty-five percent of the value of Paramount’s slate of films for a three-year period, with an option for an additional year

- Paramount Television continues its strong growth with 14 shows ordered to production and over 50 projects in development

- Strong recognition for Paramount’s films included 18 Academy Awards nominations, three Screen Actors Guild Awards and a Golden Globe

BALANCE SHEET AND LIQUIDITY

At December 31, 2016, total debt outstanding was $12.30 billion, compared with $11.91 billion at September 30, 2016. In October 2016, the Company issued $400 million in aggregate principal amount of 2.250% senior notes due 2022 and $900 million in aggregate principal amount of 3.450% senior notes due 2026. A portion of the proceeds was utilized in November 2016 for the redemption of all $400 million of the Company's outstanding 2.500% senior notes due December 2016 and all $500 million of the Company's outstanding 3.500% senior notes due April 2017. The Company’s cash balances were $443 million at December 31, 2016, an increase from $379 million at September 30, 2016. Operating cash flow grew to $159 million in the quarter, an increase of $285 million compared with the prior year.

STRATEGIC UPDATE

Today Viacom also provided an update on the Company’s strategic priorities following a comprehensive review of its operations and performance. Going forward, Viacom will be focused on a five-point plan to:

- Put the full power of Viacom behind six flagship brands: BET, Comedy Central, MTV, Nickelodeon, Nick Jr. and Paramount

- Revitalize and elevate approach to content and talent

- Deepen partnerships to drive traditional revenue

- Make big moves in the digital world and physical world

- Continue to optimize and energize the organization

Viacom’s flagship brands will be the company’s highest priorities and will benefit from significant and increased resource commitments. These six brands each have compelling, valuable and distinct brand propositions. They serve diverse, substantial audiences with largely-owned content, have global reach and distribution potential across linear, digital, film, and consumer products, events and experiences. Viacom’s other brands - some of which hold strong positions in their categories and maintain diverse and loyal followings - will be realigned to reinforce the six flagship brands.

The company has also identified opportunities to bring the best of Paramount to the network business, and the best of the network business to Paramount. Paramount’s film slate will now include co-branded releases from each of the flagships, along with Paramount branded films focused on franchises, tentpoles and other projects. In an initial step, the company today is announcing a commitment between Nickelodeon and Paramount to move forward on a slate of four films. The first of these films, Amusement Park, will premiere in theaters in summer 2018 and will launch a TV series on Nickelodeon the following year.

Additionally, Spike will be rebranded in early 2018 as The Paramount Network, and will serve as Viacom’s premier general entertainment brand. The Paramount Network will take Spike’s strong and growing programming expertise and amplify it with the globally-recognized Paramount brand - an iconic symbol of cinematic production with a history of rich, compelling storytelling. The network will leverage the very best in Viacom original scripted and non-scripted programming, and incorporate even more high-quality original and third party programming.

Viacom today announced plans to invest in new content experiences, and will establish its first ever dedicated short-form content unit, building on existing programming as well as all-new original IP. In addition, the company plans to further extend the reach of Viacom’s brands through live experiences and consumer products - creating valuable new channels for marketing, talent development and connecting with audiences.

In order to drive the scale, market strength and financial flexibility Viacom needs to be successful, the company is refocusing its approach to partnerships and is committing to deeper, more client-centric relationships with distribution and advertising partners. These partnerships may include working with distributors to create new and improved pay TV experiences or broadening advertising offerings to include unmatched cross-portfolio access.

These strategic priorities will be discussed in greater depth on today’s investor call.

About Viacom

Viacom is home to premier global media brands that create compelling television programs, motion pictures, short-form content, apps, games, consumer products, social media experiences, and other entertainment content for audiences in more than 180 countries. Viacom's media networks, including Nickelodeon, Comedy Central, MTV, VH1, Spike, BET, CMT, TV Land, Nick at Nite, Nick Jr., Logo, Nicktoons, TeenNick, Channel 5 (UK), Telefe (Argentina) and Paramount Channel, reach over 3.9 billion cumulative television subscribers worldwide. Paramount Pictures is a major global producer and distributor of filmed entertainment.

For more information about Viacom and its businesses, visit www.viacom.com. Viacom may also use social media channels to communicate with its investors and the public about the company, its brands and other matters, and those communications could be deemed to be material information. Investors and others are encouraged to review posts on Viacom’s company blog (blog.viacom.com), Twitter feed (twitter.com/viacom) and Facebook page (facebook.com/viacom).

Cautionary Statement Concerning Forward-Looking Statements

This news release contains both historical and forward-looking statements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements reflect our current expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These risks, uncertainties and other factors include, among others: the effect of recent changes in management and our board of directors; the public acceptance of our brands, programs, motion pictures and other entertainment content on the various platforms on which they are distributed; the impact of inadequate audience measurement on our program ratings and advertising and affiliate revenues; technological developments and their effect in our markets and on consumer behavior; competition for content, audiences, advertising and distribution; the impact of piracy; economic fluctuations in advertising and retail markets, and economic conditions generally; fluctuations in our results due to the timing, mix, number and availability of our motion pictures and other programming; the potential for loss of carriage or other reduction in the distribution of our content; changes in the Federal communications or other laws and regulations; evolving cybersecurity and similar risks; other domestic and global economic, business, competitive and/or regulatory factors affecting our businesses generally; and other factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our 2016 Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The forward-looking statements included in this document are made only as of the date of this document, and we do not have any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances. If applicable, reconciliations for any non-GAAP financial information contained in this news release are included in this news release or available on our website at http://www.viacom.com.

|

VIACOM INC.

CONSOLIDATED STATEMENTS OF EARNINGS (Unaudited) |

|||||||||||||

|

Quarter Ended December 31, |

|||||||||||||

| (in millions, except per share amounts) | 2016 | 2015 | |||||||||||

| Revenues | $ | 3,324 | $ | 3,154 | |||||||||

| Expenses: | |||||||||||||

| Operating | 1,819 | 1,593 | |||||||||||

| Selling, general and administrative | 701 | 667 | |||||||||||

| Depreciation and amortization | 56 | 55 | |||||||||||

| Restructuring | 42 | — | |||||||||||

| Total expenses | 2,618 | 2,315 | |||||||||||

| Operating income | 706 | 839 | |||||||||||

| Interest expense, net | (156 | ) | (155 | ) | |||||||||

| Equity in net earnings of investee companies | 13 | 31 | |||||||||||

| Other items, net | 3 | 2 | |||||||||||

| Earnings before provision for income taxes | 566 | 717 | |||||||||||

| Provision for income taxes | (158 | ) | (256 | ) | |||||||||

| Net earnings (Viacom and noncontrolling interests) | 408 | 461 | |||||||||||

| Net earnings attributable to noncontrolling interests | (12 | ) | (12 | ) | |||||||||

| Net earnings attributable to Viacom | $ | 396 | $ | 449 | |||||||||

| Basic earnings per share attributable to Viacom | $ | 1.00 | $ | 1.13 | |||||||||

| Diluted earnings per share attributable to Viacom | $ | 1.00 | $ | 1.13 | |||||||||

| Weighted average number of common shares outstanding: | |||||||||||||

| Basic | 397.0 | 396.6 | |||||||||||

| Diluted | 397.9 | 398.4 | |||||||||||

| Dividends declared per share of Class A and Class B common stock | $ | 0.20 | $ | 0.40 | |||||||||

|

VIACOM INC.

CONSOLIDATED BALANCE SHEETS (Unaudited) |

|||||||||||||

| (in millions, except par value) |

December 31, 2016 |

September 30, 2016 |

|||||||||||

| ASSETS | |||||||||||||

| Current assets: | |||||||||||||

| Cash and cash equivalents | $ | 443 | $ | 379 | |||||||||

| Receivables, net | 3,125 | 2,712 | |||||||||||

| Inventory, net | 908 | 844 | |||||||||||

| Prepaid and other assets | 513 | 587 | |||||||||||

| Total current assets | 4,989 | 4,522 | |||||||||||

| Property and equipment, net | 976 | 932 | |||||||||||

| Inventory, net | 4,159 | 4,032 | |||||||||||

| Goodwill | 11,586 | 11,400 | |||||||||||

| Intangibles, net | 344 | 315 | |||||||||||

| Other assets | 1,258 | 1,307 | |||||||||||

| Total assets | $ | 23,312 | $ | 22,508 | |||||||||

| LIABILITIES AND EQUITY | |||||||||||||

| Current liabilities: | |||||||||||||

| Accounts payable | $ | 375 | $ | 453 | |||||||||

| Accrued expenses | 754 | 773 | |||||||||||

| Participants' share and residuals | 836 | 801 | |||||||||||

| Program obligations | 728 | 692 | |||||||||||

| Deferred revenue | 361 | 419 | |||||||||||

| Current portion of debt | 517 | 17 | |||||||||||

| Other liabilities | 634 | 517 | |||||||||||

| Total current liabilities | 4,205 | 3,672 | |||||||||||

| Noncurrent portion of debt | 11,783 | 11,896 | |||||||||||

| Participants' share and residuals | 336 | 358 | |||||||||||

| Program obligations | 509 | 311 | |||||||||||

| Deferred tax liabilities, net | 377 | 381 | |||||||||||

| Other liabilities | 1,393 | 1,349 | |||||||||||

| Redeemable noncontrolling interest | 200 | 211 | |||||||||||

| Commitments and contingencies | |||||||||||||

| Viacom stockholders' equity: | |||||||||||||

|

Class A common stock, par value $0.001, 375.0 authorized; 49.4 and

49.4 |

— | — | |||||||||||

|

Class B common stock, par value $0.001, 5,000.0 authorized; 347.6

and 347.6 |

— | — | |||||||||||

| Additional paid-in capital | 10,136 | 10,139 | |||||||||||

| Treasury stock, 399.1 and 399.4 common shares held in treasury, respectively | (20,796 | ) | (20,798 | ) | |||||||||

| Retained earnings | 15,945 | 15,628 | |||||||||||

| Accumulated other comprehensive loss | (827 | ) | (692 | ) | |||||||||

| Total Viacom stockholders' equity | 4,458 | 4,277 | |||||||||||

| Noncontrolling interests | 51 | 53 | |||||||||||

| Total equity | 4,509 | 4,330 | |||||||||||

| Total liabilities and equity | $ | 23,312 | $ | 22,508 | |||||||||

|

VIACOM INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

||||||||||||

|

Quarter Ended |

||||||||||||

| (in millions) | 2016 | 2015 | ||||||||||

| OPERATING ACTIVITIES | ||||||||||||

| Net earnings (Viacom and noncontrolling interests) | $ | 408 | $ | 461 | ||||||||

| Reconciling items: | ||||||||||||

| Depreciation and amortization | 56 | 55 | ||||||||||

| Feature film and program amortization | 1,089 | 1,028 | ||||||||||

| Equity-based compensation | 23 | 26 | ||||||||||

| Equity in net earnings and distributions from investee companies | 13 | (29 | ) | |||||||||

| Deferred income taxes | (63 | ) | 299 | |||||||||

| Operating assets and liabilities, net of acquisitions: | ||||||||||||

| Receivables | (323 | ) | (188 | ) | ||||||||

| Production and programming | (1,020 | ) | (1,292 | ) | ||||||||

| Accounts payable and other current liabilities | (45 | ) | (481 | ) | ||||||||

| Other, net | 21 | (5 | ) | |||||||||

| Net cash provided by/(used in) operating activities | 159 | (126 | ) | |||||||||

| INVESTING ACTIVITIES | ||||||||||||

| Acquisitions and investments, net | (343 | ) | (30 | ) | ||||||||

| Capital expenditures | (52 | ) | (26 | ) | ||||||||

| Proceeds received from grantor trusts | 46 | — | ||||||||||

| Net cash flow used in investing activities | (349 | ) | (56 | ) | ||||||||

| FINANCING ACTIVITIES | ||||||||||||

| Borrowings | 1,285 | — | ||||||||||

| Debt repayments | (900 | ) | — | |||||||||

| Commercial paper | — | 290 | ||||||||||

| Purchase of treasury stock | — | (100 | ) | |||||||||

| Dividends paid | (79 | ) | (159 | ) | ||||||||

| Exercise of stock options | — | 1 | ||||||||||

| Other, net | (14 | ) | (22 | ) | ||||||||

| Net cash flow provided by financing activities | 292 | 10 | ||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (38 | ) | (7 | ) | ||||||||

| Net change in cash and cash equivalents | 64 | (179 | ) | |||||||||

| Cash and cash equivalents at beginning of period | 379 | 506 | ||||||||||

| Cash and cash equivalents at end of period | $ | 443 | $ | 327 | ||||||||

|

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION |

The following tables reconcile our results for the quarter ended December 31, 2016 and the quarter ended December 31, 2015 to adjusted results that exclude the impact of certain items identified as affecting comparability. We use consolidated adjusted operating income, adjusted earnings before provision for income taxes, adjusted provision for income taxes, adjusted net earnings attributable to Viacom and adjusted diluted earnings per share ("EPS"), as applicable, among other measures, to evaluate our actual operating performance and for planning and forecasting of future periods. We believe that the adjusted results provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare Viacom’s results with those of other companies and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with accounting principles generally accepted in the United States of America, they should not be considered in isolation of, or as a substitute for, operating income, earnings before provision for income taxes, provision for income taxes, net earnings attributable to Viacom and diluted EPS as indicators of operating performance, and they may not be comparable to similarly titled measures employed by other companies.

| (in millions, except per share amounts) | ||||||||||||||||||||||||||

|

Quarter Ended December 31, 2016 |

||||||||||||||||||||||||||

|

Operating |

Earnings Before |

Provision for |

Net Earnings |

Diluted EPS |

||||||||||||||||||||||

| Reported results (GAAP) | $ | 706 | $ | 566 | $ | 158 | $ | 396 | $ | 1.00 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Restructuring (2) | 42 | 42 | 14 | 28 | 0.07 | |||||||||||||||||||||

| Loss on extinguishment of debt (3) | — | 6 | 2 | 4 | 0.01 | |||||||||||||||||||||

| Discrete tax benefit (4) | — | — | 15 | (15 | ) | (0.04 | ) | |||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 748 | $ | 614 | $ | 189 | $ | 413 | $ | 1.04 | ||||||||||||||||

|

Quarter Ended December 31, 2015 |

||||||||||||||||||||||||||

|

Operating |

Earnings Before |

Provision for |

Net Earnings |

Diluted EPS | ||||||||||||||||||||||

| Reported results (GAAP) | $ | 839 | $ | 717 | $ | 256 | $ | 449 | $ | 1.13 | ||||||||||||||||

| Factors Affecting Comparability: | ||||||||||||||||||||||||||

| Discrete tax expense (5) | — | — | (21 | ) | 21 | 0.05 | ||||||||||||||||||||

| Adjusted results (Non-GAAP) | $ | 839 | $ | 717 | $ | 235 | $ | 470 | $ | 1.18 | ||||||||||||||||

| (1) | The tax impact has been calculated by applying the tax rates applicable to the adjustments presented. | ||

| (2) | The pre-tax charge of $42 million reflected severance associated with management changes in connection with ongoing strategic initiatives. | ||

| (3) | The pre-tax charge of $6 million reflected a debt extinguishment loss on the redemption of all $400 million of our outstanding 2.500% senior notes due December 2016 and all $500 million of our outstanding 3.500% senior notes due April 2017. | ||

| (4) | The net discrete tax benefit was principally related to the reversal of a valuation allowance on net operating losses upon receipt of a favorable tax authority ruling. | ||

| (5) | The net discrete tax expense was principally related to a reduction in qualified production activity tax benefits as a result of retroactively reenacted legislation. | ||

|

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP FINANCIAL INFORMATION |

|

(continued) |

The following table includes a reconciliation of net cash provided by/(used in) operating activities (GAAP) to free cash flow and operating free cash flow (non-GAAP). We define free cash flow as net cash provided by/(used in) operating activities minus capital expenditures, plus excess tax benefits from equity-based compensation awards (actual tax deductions in excess of amounts previously recognized, which is included within financing activities in the statement of cash flows), as applicable. We define operating free cash flow as free cash flow, excluding the impact of the cash premium on the extinguishment of debt, as applicable. Free cash flow and operating free cash flow are non-GAAP measures. Management believes the use of this measure provides investors with an important perspective on, in the case of free cash flow, our liquidity, including our ability to service debt and make investments in our businesses, and, in the case of operating free cash flow, our liquidity from ongoing activities.

|

Reconciliation of net cash provided by/(used in) operating

activities

to free cash flow and operating free cash flow (in millions) |

Quarter Ended December 31, |

Better/(Worse) | ||||||||||||||||

| 2016 | 2015 | $ | ||||||||||||||||

| Net cash provided by/(used in) operating activities (GAAP) | $ | 159 | $ | (126 | ) | $ | 285 | |||||||||||

| Capital expenditures | (52 | ) | (26 | ) | (26 | ) | ||||||||||||

| Free cash flow (Non-GAAP) | 107 | (152 | ) | 259 | ||||||||||||||

| Debt retirement premium | 6 | — | 6 | |||||||||||||||

| Operating free cash flow (Non-GAAP) | $ | 113 | $ | (152 | ) | $ | 265 | |||||||||||