HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Perception, a leading investor research and investor relations (IR) advisory firm, today released its quarterly research report, Inside The Buy-side®, which captures trends in institutional investor sentiment. The survey is based on responses from 101 institutional investors and sell side analysts globally.

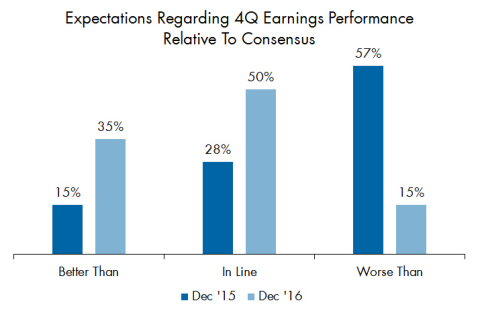

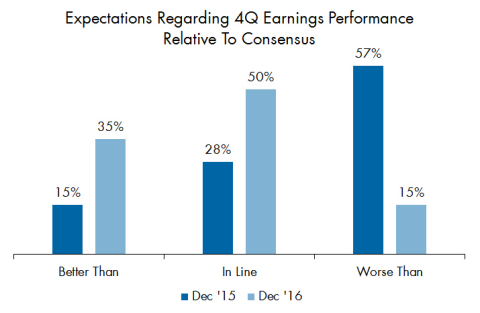

This quarter, our survey identifies a significant positive shift in sentiment and finds that optimism about 2017 is broad-based and prevalent. In addition to the majority expecting in line or better than 4Q16 results, 62% anticipate 2017 annual guidance to be higher than last year.

“Even though earnings expectations have risen, I expect earnings to generally meet or exceed consensus based on consumer spending trends, wage gains and job growth,” commented Steve Gattuso, Portfolio Manager at Courier Capital.

Survey findings also reveal that executive tone is perceived as increasingly more positive with 62% of participants describing management as neutral to bullish or bullish compared to 39% last quarter.

“Coming off fourth quarter 2015, which marked a low in terms of outlook for growth and earnings, sentiment has rebounded strongly with expectations of improving EPS and organic revenue growth up 43% and 29%, respectively,” commented Rebecca Corbin, Founder and Managing Partner of Corbin Perception.

The U.S. is a consistent positive theme in the post-election era, as 67% report feeling better about the economy. As well, from a global perspective, respondents are most optimistic on the U.S., which doubled in bullish votes. On the flip side and amid Trump rhetoric, views are downbeat on regions most likely to be harmed by protectionist trade policy, such as China and Mexico. In this vein, greater than one-third of investors and analysts expect global trade to worsen over the next six months.

Ms. Corbin added, “We are witnessing an almost cathartic response to the administration change in the U.S. Animal spirits are back and the question now becomes whether Congress and President-elect Trump can implement real business-friendly policy reforms.”

Finally, rate hikes are prominently coloring investor views on sector outlooks. After years of underperformance in the wake of the Great Recession, Financials leap to the top of the pack of favored sectors while Utilities and REITs remain under continued pressure as their yields become less attractive to fixed income alternatives. An overwhelming 98% believe the U.S. Fed will continue to raise rates in 2017 with most predicting two hikes. Meanwhile, Healthcare experiences the most significant reversal in sentiment, Industrials are back in favor and Materials sees the highest level of confidence in three years.

Since 2006, Corbin Perception has tracked investor sentiment on a quarterly basis. Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies are available at CorbinPerception.com.

About Corbin Perception

We are Corbin Perception, a leading investor research and investor relations advisory firm that specializes in shareholder value creation.

We leverage our broad company and industry experience, knowledge of best practices and benchmarking capabilities to provide research-driven counsel that enables our clients, publicly-traded companies across diverse industries, to positively differentiate their company in the market. We bring a unique perspective to our engagements, one that is based on a proven methodology and customized approach.

Our industry-leading research, Inside The Buy-side®, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit our website at

CorbinPerception.com

http://www.corbinperception.com/research-portal/