LONDON--(BUSINESS WIRE)--Technavio has announced the top five leading vendors in their recent global automotive spare parts logistics market report. This research report also lists 11 other prominent vendors that are expected to impact the market during the forecast period.

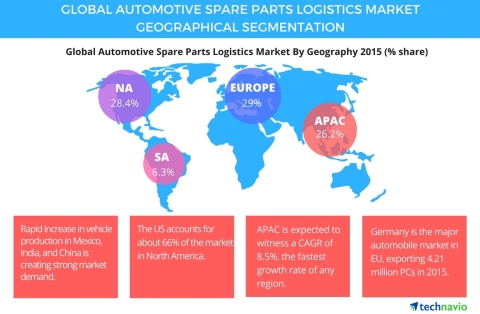

The major reason behind the growth of the automotive spare parts logistics market is the increase in demand from major end-users such as automotive, and machinery. The largest revenue contributor to the automotive spare parts logistics market is the replacement tire segment. The automotive industry has been witnessing increased demand from emerging economies in APAC such as Indonesia, India, and China. In addition, the used car market in China has been growing steadily and reached around 6 million units in 2014.

Competitive vendor landscape

The market is fragmented and localized with many establishments catering to each logistics sub-segment. It is composed of both big and small players but is largely dominated by SMEs. With the growing production and trade worldwide, the requirement for outsourced logistics is increasing. Hence, new players are entering the market. Competition is intensifying, and vendors are seeking an edge by adapting to the changing market conditions.

“To cope better with competition, several companies are entering into mergers and acquiring companies. Mergers and acquisitions are enabling the market players to increase their presence and expand their service portfolios and leading to market consolidation. The market is capital-intensive and requires advanced technologies. The key differentiating elements in the market are the VAS offered by the market players,” says Sharan Raj, a lead logistics analyst from Technavio.

The market players also compete based on price, delivery speed, reliability, and supply chain capacity. Advances in logistics processes through the incorporation of IT will help the market players increase efficiency and effectiveness. Customers have high expectations for logistics performance. To meet these expectations, the vendors need to keep a tab on the workings of various sectors and provide customized services.

Request a sample report: http://www.technavio.com/request-a-sample?report=54561

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five automotive spare parts logistics market vendors

CEVA Logistics

CEVA Logistics is a non-asset based supply chain solutions and logistics services company. The company was formed through the merger of TNT Logistics and Eagle Global Logistics. The company provides supply chain solutions in freight management, contract logistics, and distribution and transportation management to large- and medium-sized companies.

The company's integrated service offerings comprise the entire supply chain. Its freight management services include international ocean, air, ground, customs brokerage, and additional value-added services and its contract logistics services include manufacturing support, inbound logistics, aftermarket or reverse logistics, and outbound or distribution logistics.

DB Schenker

DB Schenker is an integrated logistics services provider. The company supports global industry and trade in the exchange of goods including land transport, worldwide air and ocean freight, SCM and contract logistics. The company is a part of Deutsche Bahn.

It caters to the automotive, beverages, building materials, consumer, chemicals, electronics, marine parts, semiconductor/solar, healthcare/pharma, industrial, metals and coal, and retail industries. The company has a presence in around 140 countries worldwide.

Deutsche Post DHL

The company mainly operates under two brands: Deutsche Post (Europe’s leading postal service provider) and DHL, which provides a range of freight transportation, international express, e-commerce, and SCM services worldwide.

The company delivers around 64 million letters each working day in Germany. It provides various solutions to both business and private customers, ranging from hybrid, physical, and electronic letters and merchandise to special services such as registered mail, cash on delivery, and insured items. The German network of its post-ecommerce-parcel segment comprises 33 parcel centers, 82 mail centers, 2,750 pack stations, and 29,000 retail outlets or points of sale.

Kuehne + Nagel

Kuehne + Nagel, along with its subsidiaries, provides integrated logistics services to customers in various industries worldwide. It operates through over 1,000 offices across 100 countries. For the FY2015, the company reported revenue of USD 22.51 billion.

The company provides its customers with advanced logistics solutions globally. It provides logistics services to various sectors including aerospace, automotive, fast-moving consumer goods, high tech, industrials, oil and gas logistics, pharma and healthcare, and retail. The company provides integrated logistics services such as SCM solutions, customs clearance services, export and import documentation, door-to-door services, and logistics supply movement arrangement services. Further, it also offers risk management and insurance services for the transport and logistics industry.

UPS

For FY2015, the company reported revenue of USD 13.05 billion from its international operations. In 2015, the company's international daily average delivery volume was about 2.7 million packages and documents. Europe is the company's largest market outside the US, which accounts for about half of its international revenue. The company has committed to invest around USD 2 billion of capital in Europe to expand its infrastructure to meet the rising demand for cross-border commerce.

Browse Related Reports:

- Global Spare Parts Logistics Market 2016-2020

- Global Oil and Gas Logistics Market 2016-2020

- Global Cold Chain Logistics for Pharmaceuticals Market 2015-2019

Do you need a report on a market in a specific geographical cluster or country but can’t find what you’re looking for? Don’t worry, Technavio also takes client requests. Please contact enquiry@technavio.com with your requirements and our analysts will be happy to create a customized report just for you.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.