STOCKHOLM--(BUSINESS WIRE)--Regulatory News:

Sandvik (STO:SAND):

Today, at the Capital Markets Day in Sandviken, Sweden, Björn Rosengren, President and CEO and Tomas Eliasson, Executive Vice President and CFO of Sandvik, presented the fundamentals of Sandvik’s strategy.

“We will run our businesses with focus on stability, profitability and growth – with our different businesses currently at different stages. Through increased decentralization of our business model, decisions are made closer to the customers and we will improve the speed in responding to our customers’ requirements and to changed market activity”, said Björn Rosengren who continued:

“Within the business areas, each product area will have total ownership and accountability of the respective operations, which will generate improved transparency. This creates an entrepreneurial environment, developing strong leaders. There will be no quantum leaps, but I expect each business to achieve constant improvements”.

“Despite the relatively short time I have been with Sandvik we have already announced consolidation of business areas as well as identified some non-strategic operations. That said, the review of the business portfolio is ongoing and continuous”, said Björn Rosengren”.

The business area presidents presented the strategy and mid-term focus for their respective operations:

Sandvik Machining Solutions, Jonas Gustavsson

· Defend and strengthen the core offering: 11,000 new products to be launched in 2016, including the first intelligent tool

· Drive and acquire growth both in core and adjacent areas

· Focus on digital manufacturing and intelligent tools

· Launch of a new product area, Powder and Blanks Technology, to capture the growth potential in the round tools segment

· Operational excellence through supply chain optimization and cost efficiency in the whole organization

Sandvik Mining and Rock Technology, Lars Engström

· Implement decentralized business model with eight product areas based on the product offering. The decentralized business model enables an even clearer focus and faster response to our customers

· Grow the aftermarket business by the global roll-out of customer service centers, new or improved customer offerings such as new e-solutions and increased productivity through data-driven predictive maintenance

· Improve profitability through e.g. product launches and technologies supporting value based pricing, grow the aftermarket business, ongoing supply chain optimization program, focus on cost efficiency

Sandvik Materials Technology, Petra Einarsson

· Maintain the decentralized business model with nine separate business units within the three product areas

· Further strengthen the leading position for strategic growth products - and improve profitability in the core and standard product offering by operational excellence and a more lean business model

· Contingency plans are in place to manage different market scenarios

· Long-term market fundamentals remain solid, and several new products and materials are being launched to meet the energy and climate challenges

Sandvik introduces new financial targets

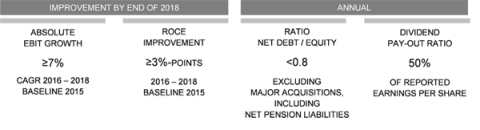

The new targets are set until 2018, with 2015 outcome as a starting point. [image]

“Previous targets were based on a different macro environment than what we currently have. In my view, our new targets are appropriate and ambitious for Sandvik in times of change as well as in expectations of a continued muted macro environment, yet signaling my strong belief that the new decentralized business model will result in a more cost efficient organization with higher pace. Targets can be achieved both through support from top-line growth as well as internal performance improvement”, said Björn Rosengren.

≥7% EBIT growth (Compound Annual Growth Rate)

Target is based on adjusted operating profit in 2015 for new business area structure and excluding metal price effects in Sandvik Materials Technology. Improvement excludes potential nonrecurring items, impact from changed exchange rates for Sandvik Group as well as metal price effects in Sandvik Materials Technology.

≥3%-points improvement of return on capital employed (ROCE)

Target is based on adjusted operating profit and capital employed in 2015. Improvement excludes potential non-recurring items.

Net debt / Equity ratio of <0.8

The absolute ratio remains unchanged, however this implies a strengthening of the balance sheet as the net debt calculation will include net pension liabilities, which previously were excluded.

50% dividend payout ratio, of reported earnings per share

The target remains unchanged.

Previous targets were through cycle: 1) 8% growth, combined organic and acquired, 2) 25% ROCE, 3) net debt / equity ratio of <0.8

Sandvik Group

Sandvik is a high-tech and global engineering group offering advanced products and services that enhance customer productivity, profitability and safety. We hold world-leading positions in selected areas – tools for metal cutting, equipment and tools for the mining and construction industries, stainless materials, special alloys, metallic and ceramic resistance materials as well as process systems. In 2015, the Group had about 46,000 employees and sales of about 91 billion SEK in more than 150 countries.

This information was brought to you by Cision http://news.cision.com