LONDON--(BUSINESS WIRE)--Growing Interest in Risk Premia & Smart Beta Solutions

Risk Premia and Smart Beta, investment solutions traditionally defined as strategies that aim to capture risk-adjusted returns and improve portfolio diversification, remain at the forefront of investors’ agendas, a recent survey conducted by Citi’s Prime Finance Capital Introduction team shows.

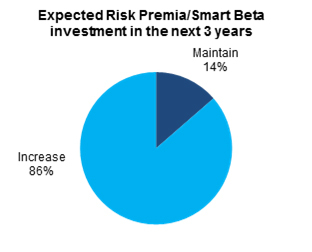

The findings are based on a survey of investors and intermediaries, primarily institutional, representing close to $1 trillion of combined assets under management1. 81% of respondents are currently investing in, or looking to invest in, Risk Premia solutions, and 83% of those who are currently investing in Risk Premia are doing so through Multi-Factor strategies. The main drivers for Risk Premia investing are volatility mitigation (46% of respondents) followed by return optimization (36% of respondents).

1 Survey respondents representing $935 billion of combined AUM

According to research conducted by Citi, AUM in Smart Beta and Risk Premia funds are projected to rise from $265 billion in 2014 to $1.2 trillion by the end of 2019 - making this the fastest growing product set in the asset management industry2. Citi analysts have also noted a strong interest in Smart Beta ETFs, with 45 new products launched in 2015 including 19 “Multi-Factor” products.3

Risk Premia Portfolio Management

The identification of factor-based investment themes (“Factors”) is at the core of Risk Premia and Smart Beta strategies. Factors such as “value”, “momentum” or “growth” have been identified as key characteristics driving the behaviour, performance and volatility of a security beyond traditional sector or geographical exposure.

The shift from a traditional to a factor-based, risk-adjusted portfolio can be a complex exercise as it requires dynamic collection of factor data. With 48% of survey respondents having less than 20 in-house investment professionals, there is often limited capacity to analyze portfolios in the necessary depth or timeframe. Against that background, the rising interest in Risk Premia investment solutions is likely to drive an increased need for resources in technology and in-house data management skills. It will also encourage fund managers to use strategic partners that can advise on tactical portfolio adjustments based on real-time position reporting.

“The adoption of style and factor-based strategies can help investment managers identify determinant market shifts and implement differentiated strategies away from consensus trades,” Christian Raute, Global Head of Citi’s Central Risk Desk Strategy explains. “These strategies require sophisticated technology and trading solutions in order to be fully effective.”

In order to help clients achieve this goal, Citi has developed a tradable suite of equity indices based on a wide spectrum of Risk Premia Factors. Citi’s Equity Quantitative Strategy team also provides clients with a unique tool that assesses portfolios according to traditional measures (beta, delta, country exposure and sector), as well as macro factors (rates, GDP, spreads, commodity prices, FX), and investment Factors (value, growth, quality, low risk, price momentum, estimates momentum, and size).

2 Increasing Institutional Portfolio Complexity & the

Resulting Shift from a Product to a Solutions Mindset, Citi Business

Advisory, June 2015

3 Smart

Beta: Following the Flows, Citi Research, February 2016

Risk Premia and Smart Beta Appetite Supporting Hedge Fund Industry

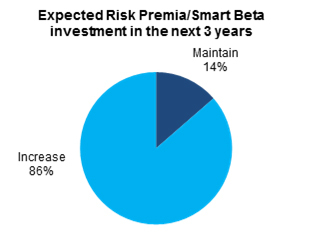

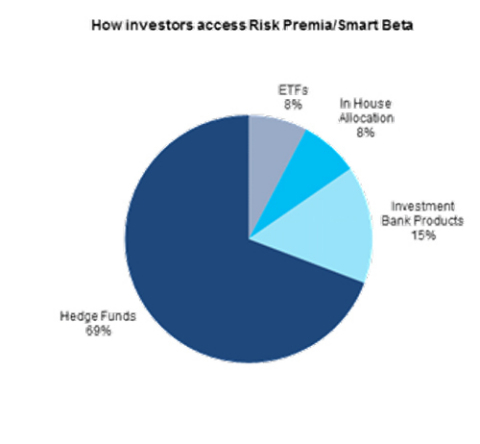

According to 69% of respondents, hedge funds are the preferred investment vehicle for accessing Risk Premia, followed by investment bank products (15% of respondents), customized solutions developed in-house (8%), and ETFs (8%).

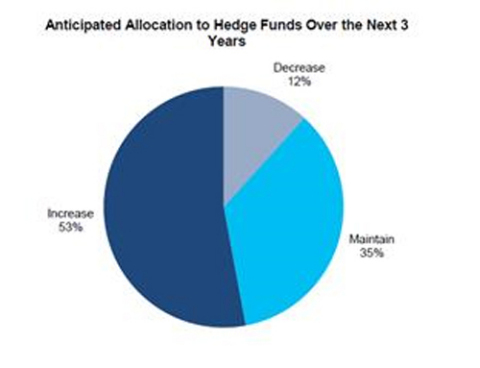

Long-term confidence in hedge funds remains strong amongst the institutional investor community: 63% of respondents have more than $1bn allocated to hedge funds, with half of investor allocation exceeding $2bn. A majority (53%) of asset allocators stated they were planning on increasing their exposure to hedge funds over the next 3 years – with Macro, Equity Long-Short and CTAs being the preferred investment strategies.

Commenting on the findings, Daniel Caplan, EMEA Head of Investor Services Sales, Citi, said: “Hedge funds represent a third of profits generated by the asset management industry and these findings confirm the importance of the sector to institutional investors. As interest in Risk Premia solutions continues to rise, we expect hedge funds to play an increasingly important role in providing diversification through risk-aligned strategies.”

###

About Citi:

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at http://www.citigroup.com | Twitter: @Citi | YouTube: http://www.youtube.com/citi | Blog: http://blog.citigroup.com/ | Facebook: http://www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi