SAN FRANCISCO--(BUSINESS WIRE)--Xero, a global leader in small business cloud accounting software, today released research revealing the common traits separating successful small businesses from those that fail.

According to the U.S. Bureau of Labor Statistics, half of small businesses close their doors within five years of launching. It’s a worrying statistic considering small businesses account for more than 45% of GDP in the US and around 80% of jobs. The success of small business is vital to the global economy.

Xero surveyed over 2,000 entrepreneurs in the U.S. and U.K. to uncover whether there were fundamental differences between companies that make it and those that don’t. The results showed that passion, and even money, often aren’t enough for a company to flourish, as evidenced by the large numbers that don’t survive.

Entrepreneurs on the path to success are more likely to learn from past failures, invest in technology, value time with their families and build excellent relationships with business mentors, according to the findings. Nearly six in 10 respondents (58%) cited spending time with family in the evenings as crucial to their effectiveness as a business owner, and more than half (53%) said it’s important to keep their weekends free for loved ones.

“To build a successful business, which is sustainable in the long term, you need to ensure the other areas of your life don’t get neglected. Running a business isn’t easy, by taking time out to spend with your family or friends you often find you return to work energized with a clear perspective on what you need to achieve,” said Xero U.S. President Russ Fujioka. “Small business owners should be aiming to achieve work/life integration, not work/life balance. By doing this you give yourself more flexibility and set yourself up better for success.”

The Xero Make or Break Report findings strongly demonstrate a number of common traits demonstrating the mindset and habits of successful small business owners.

Here’s what the research shows successful business owners do:

- They don’t work around the clock. Instead, they have a strong belief in the value of personal time and make time for their loved ones and family. While successful owners eschew sacrificing a personal life, for most of them it’s still impossible to disconnect entirely. Just 29% say it’s vital to turn off their phones and laptops after business hours.

- They try, try and try again. A positive mindset and a willingness to fail—successful small business owners are more likely to see failure as a good thing, learn from mistakes and want to try again.

- They don’t pretend to have all the answers. Instead, they enlist the support of strong, collaborative network: family, advisors and mentors, an accountant or financial advisor. A third of successful entrepreneurs say they have turned to mentors, compared to just 14% of respondents who ran businesses that had to close.

- They have the ability to access and manage finances. Of those owners who cited a business issue as a reason for failure (as opposed to a personal issue), most at 65% blamed it on financial issues (cash flow, visibility, access to capital).

- They invest in technology for increased productivity in finance, along with dedicating funds to marketing and customer service. Nearly six in 10 survivors (58%) use software to manage their finances vs. a marginal 14% of failures, and just shy of a third (31%) allocate resources to improving customer service, versus 20% of those in the failed camp.

Entrepreneurs who had experienced prior failure reported they were better at planning and financial management the next time around. The Xero Make or Break Report highlights that the closure of an early stage business does not always indicate failure, with 71% describing the closure of their business as a positive thing.

Here’s what successful small businesses do:

- Sell services. Survivors appeared to have a better shot at creating a business with long term value if they focused on selling services rather than products. 59% of businesses selling mostly services survived in comparison to 45% of failed businesses, yet twice as many businesses that focused on selling products failed: 41% compared to only 19% of survivors.

- Understand alternative financing. While access to funding is still the biggest challenge to success for early businesses, most are now aware of new alternative methods of finance. British businesses are more savvy than U.S. businesses when it comes to knowledge about alternative finances with 67% aware of crowdfunding for example, despite only 5% actually having tried crowdfunding.

- U.S. new business starts are lean. 26% of small businesses invest less than $1,500 at start-up with more than half (51%) investing less than $7,500.

- Small businesses need technology to grow. Successful small businesses inject a productivity boost with apps, fintech and mobile tech with 86% claiming they use technology to increase their productivity. Almost half (49%) use business apps with almost a third (32%) integrating mobile payment technology into their service offering. More than one in four use business-planning tools (26%).

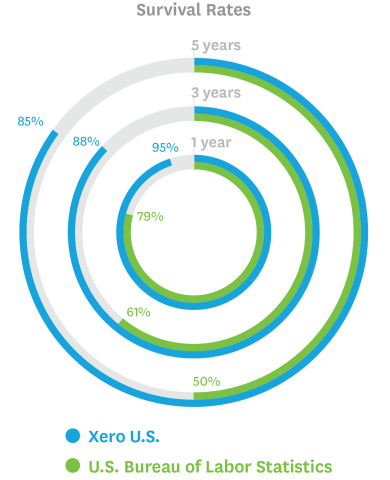

When compared to industry averages, U.S. and U.K. businesses that use Xero are markedly more likely to succeed. In the U.S., 95% of Xero customers survive their first year vs. 79% for the average. In the U.K. 97% of Xero customers make it that far compared to an average rate of 91%. The pattern becomes even more distinct over longer timeframes. At the five-year point, 85% of Xero customers in the U.S. are still up and running, while the industry average is 50%. In the U.K. the difference is greater still, with 88% of Xero customers operating after five years, compared to an industry average of just 41%. The full report is here.

Notes to editors:

Methodology

The primary research goal was to understand differences in experiences and attitudes of business owners whose businesses have survived and those that have failed.

An online survey was fielded to current and former business owners in the U.S. and the U.K. Owners of businesses no longer in operation were asked questions to determine if the business had failed or closed for some other reason. “Failure” is defined as a business that closed because of problems with demand, operations or other business issues. “Survivor” is a business that is still operating.

With a survey base of 2,087 in total, 301 former business owners in the U.S. and U.K. completed the survey. Their responses were compared to answers provided by individuals who currently own small businesses in the U.S. or U.K. All businesses included in the survey currently have 20 or fewer employees or had at the peak of operations before closing. The total base was made up of 1,052 U.K. respondents and 1,035 U.S. respondents.

About Xero

Xero is beautiful, easy-to-use online accounting software for small businesses and their advisors. The company has over 600,000 subscribers in more than 180 countries. Xero seamlessly integrates with over 400 third-party tools, and was ranked No.1 by Forbes as the World's Most Innovative Growth Company in 2014 and 2015.