NEW YORK--(BUSINESS WIRE)--In May 2015, UNITE HERE released a report on Au Bon Pain’s underperformance in the five years after LNK Partners acquired a majority stake, compared to peers. According to trade publication data, Au Bon Pain lost the most U.S. marketshare and ranked last in unit growth and systemwide sales growth as compared with the five largest U.S. café-bakery chains (by systemwide sales) between the fiscal years 2008 and 2013.

In July 2015, Nation’s Restaurant News released the latest year performance data (fiscal ending August 2014) for U.S. units of Au Bon Pain and peer café-bakery chains.1 During the latest fiscal year, Au Bon Pain’s performance has continued to lag in several important categories, according to a new report by UNITE HERE, linked here. Below are four key takeaways from Au Bon Pain’s most recent year’s performance:

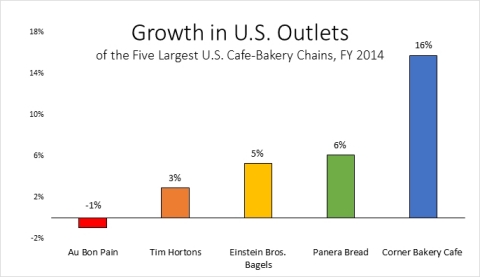

- Au Bon Pain lost net cafes for the first fiscal year since 2008. Each of the four other café-bakery chains added, net, at least twenty-five cafes in 2014. See chart below.

- Au Bon Pain’s sales per café fell for the second year in a row. Au Bon Pain’s sales per café continued to lag Panera (NASDAQ: PNRA), which increased its sales per café 18% from 2008 to 2014.

- Au Bon Pain’s systemwide sales grew the least of the five largest café-bakery chains.

- Au Bon Pain lost café-bakery market share again in the latest fiscal year, as it has done every year since it was purchased by LNK Partners in 2008.

As LNK Partners has entered the eighth year of ownership of Au Bon Pain, it may be looking to exit the investment. In 2014, deal multiples for leveraged buyouts soared to match peak 2007 levels, averaging 9.7 times EBITDA. By struggling to grow Au Bon Pain, LNK may not be able to take full advantage of this exit window, a window which may be closing.

Can LNK Partners secure an attractive valuation of Au Bon Pain given its continued underperformance?

1 Data is from Nation’s Restaurant News Top 200 data published July 2015. Data refers to U.S. outlets only. All references to Au Bon Pain’s number of cafes, sales per café, systemwide sales, café-bakery marketshare refer only to Au Bon Pain’s U.S. outlets.