SANTA MONICA, Calif.--(BUSINESS WIRE)--TrueCar, Inc. (NASDAQ: TRUE), the negotiation-free car buying and selling mobile marketplace, finds July’s revenue for new vehicles will likely set a U.S. record high for the month of $47 billion, up 2.1 percent versus the same period last year.

Amid the best auto industry and economic fundamentals in a decade, vigorous consumer demand for1 premium and utility vehicles continues while automakers maintain discipline with incentive spending.

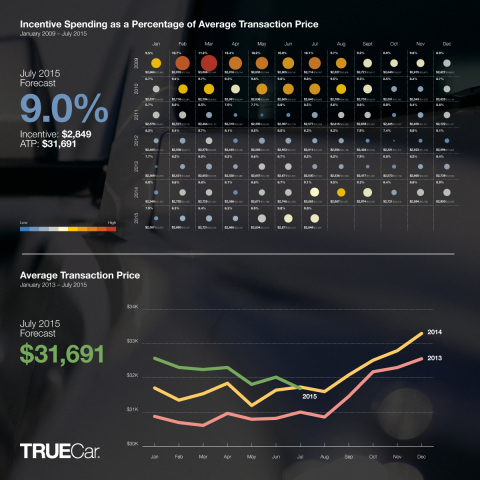

TrueCar estimates the average transaction price (ATP) for a new light vehicle was $31,691 in July, unchanged from a year ago, while average incentive spending per unit shrank by $34 to $2,849. The ratio of incentive spending to ATP was 9 percent, down 1 percent from a year ago.

“Right now the industry is genuinely vibrant, benefiting from robust consumer demand that is enabling automakers to pull back incentive spending,” said TrueCar President John Krafcik. “Consumers are feeling more affluent, and with more disposable income to invest back into the economy, the auto sector is thriving. These factors create an ecosystem that’s poised to deliver record high revenues.”

TrueCar estimates U.S. retail sales of new vehicles will grow by 4.2 percent this month, with the total industry expanding 2.6 percent. The Seasonally Adjusted Annual Rate (SAAR) should reach 17.2 million units in July, keeping the industry on pace to reach 17.1 million units this year. That’s the highest volume for new light vehicle sales since 2001.

On the TrueCar platform, midsize utilities/crossovers were very popular, with a 6.9 percent increase in customer searches over last month. This gain was driven partially by the all-new 2016 Honda Pilot and Chevrolet Traverse. Large utility interest was up by 5.8 percent this month from the level in June, while luxury, sports and midsize car searches all dropped.

“Consumer interest in Honda’s new Pilot is very strong on our platform, with a 50 percent jump compared to last month,” Krafcik said. “We are seeing the average price for this model transact around $40,000, a 17 percent premium versus the last generation.”

|

Average Transaction Price (ATP) |

||||||||||||||||||||

|

Manufacturer |

July 2015 Forecast |

July 2014 |

June 2015 |

Percent Change vs. July 2014 |

Percent Change vs. June 2015 |

|||||||||||||||

| BMW (BMW, Mini) | $52,004 | $47,948 | $52,644 | 8.5% | -1.2% | |||||||||||||||

| Daimler (Mercedes-Benz, Smart) | $57,213 | $55,890 | $58,591 | 2.4% | -2.4% | |||||||||||||||

| FCA (Chrysler, Dodge, Jeep, Ram, Fiat) | $32,369 | $31,855 | $32,520 | 1.6% | -0.5% | |||||||||||||||

| Ford (Ford, Lincoln) | $33,991 | $33,140 | $33,674 | 2.6% | 0.9% | |||||||||||||||

|

GM (Buick, Cadillac, Chevrolet, GMC) |

$34,314 | $36,568 | $34,266 | -6.2% | 0.1% | |||||||||||||||

| Honda (Acura, Honda) | $27,643 | $27,123 | $27,327 | 1.9% | 1.2% | |||||||||||||||

| Hyundai | $22,489 | $23,748 | $22,774 | -5.3% | -1.2% | |||||||||||||||

| Kia | $23,799 | $22,971 | $24,012 | 3.6% | -0.9% | |||||||||||||||

| Nissan (Nissan, Infiniti) | $27,528 | $26,501 | $27,821 | 3.9% | -1.1% | |||||||||||||||

| Subaru | $27,230 | $26,028 | $27,008 | 4.6% | 0.8% | |||||||||||||||

| Toyota (Lexus, Scion, Toyota) | $29,529 | $29,838 | $29,950 | -1.0% | -1.4% | |||||||||||||||

| Volkswagen (Audi, Porsche, Volkswagen) | $38,961 | $39,001 | $39,659 | -0.1% | -1.8% | |||||||||||||||

|

Industry |

$31,691 |

$31,735 |

$32,023 |

-0.1% |

-1.0% |

|||||||||||||||

TrueCar estimates the average incentive for light vehicles in July will decrease $34, or 1.2 percent, from a year ago, and decreasing $22, or 0.8 percent, from June 2015.

|

Incentive per Unit Spending |

||||||||||||||||||||

|

Manufacturer |

July 2015 Forecast |

July 2014 |

June 2015 |

Percent Change vs. July 2014 |

Percent Change vs. June 2015 |

|||||||||||||||

| BMW (BMW, Mini) | $4,339 | $4,747 | $4,290 | -8.6% | 1.1% | |||||||||||||||

| Daimler (Mercedes-Benz, Smart) | $4,199 | $4,226 | $4,209 | -0.6% | -0.2% | |||||||||||||||

| FCA (Chrysler, Dodge, Jeep, Ram, Fiat) | $3,413 | $3,451 | $3,393 | -1.1% | 0.6% | |||||||||||||||

| Ford (Ford, Lincoln) | $2,678 | $3,501 | $2,595 | -23.5% | 3.2% | |||||||||||||||

| GM (Buick, Cadillac, Chevrolet, GMC) | $3,983 | $3,680 | $3,909 | 8.2% | 1.9% | |||||||||||||||

| Honda (Acura, Honda) | $1,935 | $1,834 | $1,915 | 5.5% | 1.0% | |||||||||||||||

| Hyundai | $2,546 | $1,744 | $2,485 | 46.0% | 2.5% | |||||||||||||||

| Kia | $2,490 | $2,277 | $2,686 | 9.4% | -7.3% | |||||||||||||||

| Nissan (Nissan, Infiniti) | $3,168 | $2,891 | $3,398 | 9.6% | -6.8% | |||||||||||||||

| Subaru | $770 | $645 | $767 | 19.4% | 0.4% | |||||||||||||||

| Toyota (Lexus, Scion, Toyota) | $2,034 | $2,164 | $2,006 | -6.1% | 1.4% | |||||||||||||||

| Volkswagen (Audi, Porsche, Volkswagen) | $3,138 | $3,222 | $3,099 | -2.6% | 1.3% | |||||||||||||||

|

Industry |

$2,849 |

$2,883 |

$2,871 |

-1.2% |

-0.8% |

|||||||||||||||

Last month’s ratio of incentive to ATP for light vehicles was 9.0 percent, down 1.0 percent from July 2014, and unchanged from June 2015, based on TrueCar analysis. Ford and BMW showed the most improvement in ATP ratio in July versus the year-earlier month.

|

Incentive Spending as a Percentage of ATP |

||||||||||||||||||||

|

Manufacturer |

July 2015 Forecast |

July 2014 |

June 2015 |

Percent Change vs. June 2014 |

Percent Change vs. May 2015 |

|||||||||||||||

| BMW (BMW, Mini) | 8.3% | 9.9% | 8.1% | -15.7% | 2.4% | |||||||||||||||

| Daimler (Mercedes-Benz, Smart) | 7.3% | 7.6% | 7.2% | -2.9% | 2.2% | |||||||||||||||

| FCA (Chrysler, Dodge, Jeep, Ram, Fiat) | 10.5% | 10.8% | 10.4% | -2.7% | 1.1% | |||||||||||||||

| Ford (Ford, Lincoln) | 7.9% | 10.6% | 7.7% | -25.4% | 2.2% | |||||||||||||||

| GM (Buick, Cadillac, Chevrolet, GMC) | 11.6% | 10.1% | 11.4% | 15.3% | 1.7% | |||||||||||||||

| Honda (Acura, Honda) | 7.0% | 6.8% | 7.0% | 3.5% | -0.1% | |||||||||||||||

| Hyundai | 11.3% | 7.3% | 10.9% | 54.2% | 3.8% | |||||||||||||||

| Kia | 10.5% | 9.9% | 11.2% | 5.5% | -6.5% | |||||||||||||||

| Nissan (Nissan, Infiniti) | 11.5% | 10.9% | 12.2% | 5.5% | -5.8% | |||||||||||||||

| Subaru | 2.8% | 2.5% | 2.8% | 14.2% | -0.4% | |||||||||||||||

| Toyota (Lexus, Scion, Toyota) | 6.9% | 7.3% | 6.7% | -5.1% | 2.8% | |||||||||||||||

| Volkswagen (Audi, Porsche, Volkswagen) | 8.1% | 8.3% | 7.8% | -2.5% | 3.1% | |||||||||||||||

|

Industry |

9.0% |

9.1% |

9.0% |

-1.0% |

0.3% |

|||||||||||||||

|

Total Net Revenue |

||||||||||||||||||

|

Manufacturer |

July 2015 Forecast |

July 2014 |

Percent Change vs. July 2014 |

|||||||||||||||

| BMW (BMW, Mini) | $1,752,536,451 | $1,548,720,400 | 13.2% | |||||||||||||||

| Daimler (Mercedes-Benz, Smart) | $1,836,537,998 | $1,719,008,730 | 6.8% | |||||||||||||||

| FCA (Chrysler, Dodge, Jeep, Ram, Fiat) | $5,632,122,244 | $5,377,092,145 | 4.7% | |||||||||||||||

| Ford (Ford, Lincoln) | $7,443,997,787 | $7,008,016,380 | 6.2% | |||||||||||||||

| GM (Buick, Cadillac, Chevrolet, GMC) | $8,623,227,388 | $9,367,258,880 | -7.9% | |||||||||||||||

| Honda (Acura, Honda) | $3,930,832,434 | $3,686,232,684 | 6.6% | |||||||||||||||

| Hyundai | $1,538,271,198 | $1,591,377,228 | -3.3% | |||||||||||||||

| Kia | $1,287,541,283 | $1,201,590,039 | 7.2% | |||||||||||||||

| Nissan (Nissan, Infiniti) | $3,551,070,480 | $3,218,599,452 | 10.3% | |||||||||||||||

| Subaru | $1,396,882,129 | $1,189,843,992 | 17.4% | |||||||||||||||

| Toyota (Lexus, Scion, Toyota) | $6,378,172,898 | $6,439,100,076 | -0.9% | |||||||||||||||

| Volkswagen (Audi, Porsche, Volkswagen) | $1,994,784,259 | $1,938,271,698 | 2.9% | |||||||||||||||

|

Industry |

$46,690,975,506 |

$45,735,737,488 |

2.1% |

|||||||||||||||

About TrueCar

TrueCar, Inc. (NASDAQ: TRUE), the negotiation-free car buying and selling mobile marketplace, gives consumers transparent insight into what others paid and access to guaranteed savings off MSRP from TrueCar Certified Dealers. TrueCar’s network of more than 10,000 trusted Certified Dealers is committed to providing upfront pricing information and a hassle-free buying experience. TrueCar powers car-buying programs for some of the largest U.S. membership and service organizations, including AARP, American Express, AAA and USAA. Not all program features are available in all states. TrueCar is headquartered in Santa Monica, California, with offices in San Francisco and Austin, Texas. For more information, go to www.truecar.com. Follow us on Facebook or Twitter.

1 TrueCar this month adds ATP estimates for BMW and the Daimler Group to its list of vehicle brands.