MOUNTAIN VIEW, Calif.--(BUSINESS WIRE)--Intuit Inc. (Nasdaq: INTU) today issued its monthly Small Business Employment and Revenue Indexes. Below are topline results from each of the reports.

Small Business Employment Index – April

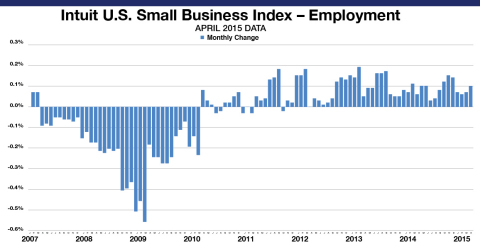

- U.S. small businesses added 15,000 new jobs, making for more than 905,000 jobs added since March 2010.

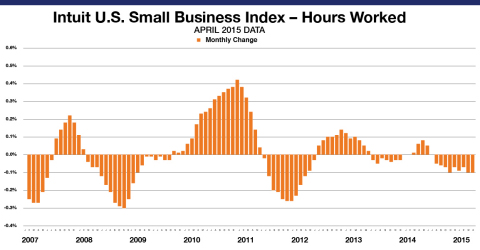

- Hourly employees worked an average of 108.3 hours, down five minutes from March’s revised figure.

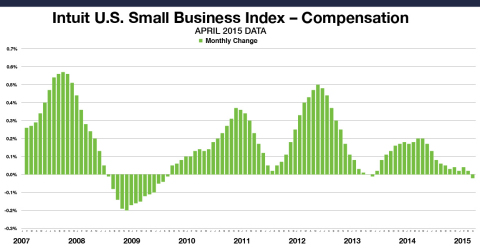

- Small business employees’ monthly pay fell by 0.02 percent, a decrease of 45 cents, with average compensation reaching $2,774.

These findings come from the monthly Intuit QuickBooks Small Business Employment Index and are based on data from Intuit Online Payroll and QuickBooks Online Payroll, covering the period from March 24 – April 23.

Small Business Revenue Index – March

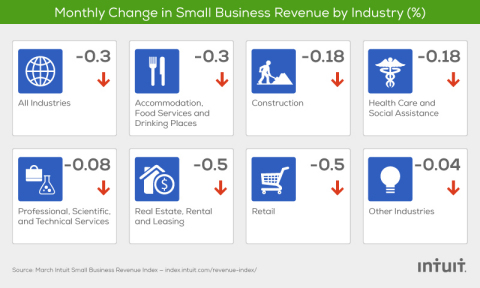

- Revenues per small business extended their decline to six-months, falling 0.3 percent across all industries. That translates to a decline of 3.4 percent when annualized.

- The Other Industries category showed the smallest monthly decrease in revenue, at 0.04 percent.

- The Real Estate and Retail categories posted the largest revenue decline, falling 0.5 percent.

This index is based on data from QuickBooks Online, covering the period from March 1-31.

A Closer Look at Results

- The Small Business Employment Index

Small business employment rose by 15,000 jobs in April, an increase of 0.1 percent. The hiring rate continued to rise moderately, as it has since 2009, reflecting the slowly improving health of the small business labor market.

“Since the recovery in small business jobs began in March 2010, small business employment has expanded by a total of 4.6 percent, in contrast to total private payrolls which have grown 11 percent,” said Susan Woodward, the economist who works with Intuit to produce the Small Business Employment and Revenue Indexes. “Small businesses are growing, but not as fast as the overall economy. This has been true for at least 50 years, but the difference has accelerated since the recession.

“One difference is the use of computers and data. Big businesses are much better poised to exploit them, on every level – marketing, advertising, inventory and product management. It is not just big, data-using, establishments displacing smaller ones, but there has been a huge expansion in the last 20 years of small entities run by big corporations. In addition, small business will not really recover until residential construction comes back in line with population growth. It is still far below normal.”

Total compensation per employee dropped 45 cents for the month, to $2,774. This figure includes both full- and part-time employees. The hourly wage for workers increased two cents, to $16.34, in April. Average hours worked for the month fell by five minutes, or 0.1 percent, to 108.3 hours for April.

“To give perspective, average monthly hours have ranged between 105 and 110 over the past 10 years for the companies tracked by Intuit,” Woodward said.

The modest rise in employment was not uniform across the nation. The states losing employment were concentrated in the upper Midwest and along the Mississippi River, with Wisconsin, Minnesota, and Missouri seeing the largest declines. States showing the largest rise were scattered, with Idaho, Washington and Virginia leading the way. Changes in hours worked and total compensation were both mixed across the country.

- Small Business Revenue Index

Revenues for small businesses continued to fall for the sixth consecutive month. The decline was 3.4 percent annualized across all industries, and dropped for all industry categories.

Over the last six months, small business revenues have dropped 2.9 percent on average, with just two of the seven sectors, Construction and Other Industries, showing revenue growth during this period. Over the past year, the average revenue growth across industries has been positive, with Real Estate services being the single sector showing a decline.

“This six-month drop in revenue in non-recessionary times is unprecedented,” said Woodward. “The overall decline in small business revenues in March, and the past six months, could be attributed to the unusually hard winter in the Northeast and Midwest. The industry patterns, and the decline in Retail and Real Estate services, are consistent with a tough winter.”

About the Intuit Small Business Indexes

The Intuit Small Business Indexes provide unique, near real-time information each month on the activity of the smallest businesses in the U.S. in terms of revenue, hiring and compensation trends.

The Employment Index is based on anonymized, non-identifiable aggregated data from approximately 269,500 small business employers, a subset of users that use Intuit Online Payroll and QuickBooks Online Payroll. The Revenue Index is based on anonymized, non-identifiable aggregated data from approximately 150,000 small businesses, a subset of users that use Intuit’s QuickBooks Online financial management offering and are matched in Dun & Bradstreet’s small business industry classifications.

Together, the indexes provide a more complete picture of the economic health of the nation’s small businesses. More information on the Intuit Small Business Indexes is available at index.intuit.com.

About Intuit Inc.

Intuit Inc. creates business and financial management solutions that simplify the business of life for small businesses, consumers and accounting professionals.

Its flagship products and services include QuickBooks®, Quicken® and TurboTax®, which make it easier to manage small businesses and payroll processing, personal finance, and tax preparation and filing. Mint.com provides a fresh, easy and intelligent way for people to manage their money, while Demandforce® offers marketing and communication tools for small businesses. ProSeries® and Lacerte® are Intuit's leading tax preparation offerings for professional accountants.

Founded in 1983, Intuit had revenue of $4.5 billion in its fiscal year 2014. The company has approximately 8,000 employees with major offices in the United States, Canada, the United Kingdom, India and other locations. More information can be found at www.intuit.com.