WASHINGTON--(BUSINESS WIRE)--Today’s vast landscape of digital and social media tools have provided more opportunities for restaurants to connect with guests, but with limited budgets and time, restaurateurs are still struggling to choose the most effective mix of marketing and loyalty solutions, according to new industry research conducted by LivingSocial.

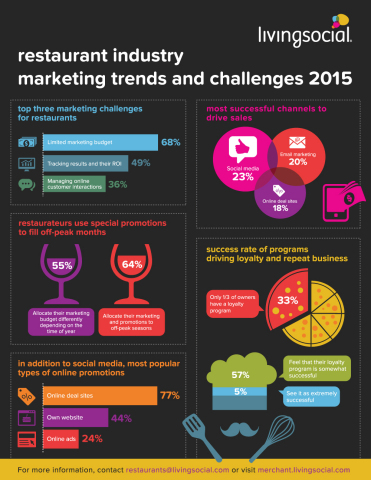

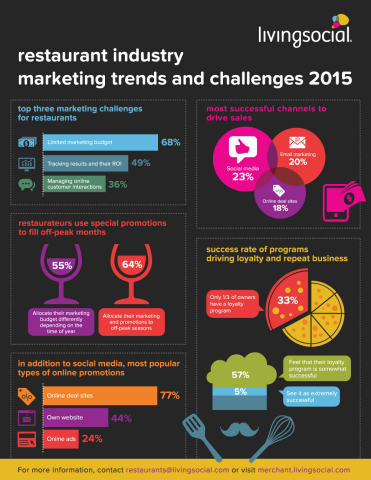

In the LivingSocial “Restaurants Trends & Insights for 2015” report, 68 percent of restaurateurs in the survey cited limited marketing budgets and 49 percent of respondents noted trouble tracking the real ROI of marketing investments as top marketing challenges. And more than a third indicated that managing customer interactions online was another top issue that their businesses faced.

Restaurateurs said they recognize the growing importance of social channels to interact with patrons, build their brand and manage their reputation, but effectively maintaining the sheer number of channels has become a complex problem.

“With the addition of these social media tools, the number of marketing channels that today’s restaurants use is so varied and broad that it’s not a surprise that making sense of the marketing mix can be overwhelming,” said Doug Miller, Chief Revenue Officer, LivingSocial.

In terms of growing the business, almost 60 percent of respondents said they plan to offer new or additional menu items, while exactly half of them said they would adjust their promotional mix to maximize ROI. At the same time, a majority of survey respondents (86 percent) said they rely on their own experience or the advice of others to make marketing decisions without the help of any supporting data.

“We know restaurateurs have little confidence in the value of their overall marketing spend as they keep experimenting to get more bang for their buck,” said Miller. “There is an information gap which presents an important opportunity to help restaurant merchants have more visibility and better tools to understand the performance of those marketing investments and to make smarter decisions.”

Additional highlights from LivingSocial’s survey include:

- Respondents identified the months of January, February, July and August as slow months for business. To compensate during these months, those surveyed said they offered special promotions.

- Nearly 80 percent of survey respondents think online deal sites, such as LivingSocial, are successful in driving sales; 18 percent stated that online deal sites are more beneficial than other marketing channels.

- Respondents that offer promotions outside of social media do so more frequently on deal sites than on their own websites (77 percent compared to 44 percent).

- Sixty-one percent of respondents said they used deal sites two to four times a year, while 17 percent leveraged them five or more times per year.

- A majority of restaurateurs find that multiple promotions are successful in driving sales and repeat business but offering a dollar savings with a minimum spend requirement is most successful in meeting both goals.

- Of the respondents who spend more marketing dollars during certain times of the year, almost two-thirds of them reported spending more during off peak seasons and less than a quarter spend more during the holidays.

- The majority of respondents allocated up to 25 percent of their budget to holiday marketing, often to promote dollar savings on a minimum spend.

Conducted from December 2014 to January 2015, the LivingSocial restaurant industry report includes both qualitative and quantitative research with full-service restaurant owners and managers. In-depth interviews were completed by phone, followed by an internet survey to confirm and quantify the research results.

For the research, more than 50 percent of respondents owned a casual dining establishment, more than 20 percent were from upper casual, 16 percent were from fast casual and eight percent were from fine dining restaurants. Most of the respondents belonged to restaurants that served 50 to 100 diners and nearly half served American cuisine.

For more details, please visit the LivingSocial newsroom for the report and an infographic.

About LivingSocial

For more about LivingSocial, connect with us at LivingSocial.com, on our blog, or on Facebook, Twitter, Instagram, Pinterest, or YouTube.