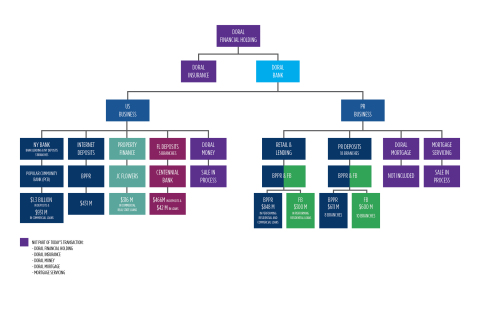

SAN JUAN, Puerto Rico--(BUSINESS WIRE)--Popular, Inc. (NASDAQ:BPOP) announced today that Banco Popular de Puerto Rico (“BPPR”), its Puerto Rico banking subsidiary, acquired certain assets and all deposits (other than certain brokered deposits) of Doral Bank from the Federal Deposit Insurance Corporation (“FDIC”) as Receiver, in alliance with other co-bidders, including its U.S. mainland banking subsidiary, Banco Popular North America, doing business as Popular Community Bank (“PCB”).

Under the FDIC’s bidding format, BPPR was the lead bidder and party to the purchase and assumption agreement with the FDIC covering all assets and deposits to be acquired by it and its alliance co-bidders. BPPR entered into back to back purchase and assumption agreements with each alliance co-bidder for the transferred assets and deposits.

The other bidders that formed part of the alliance were FirstBank Puerto Rico, Centennial Bank and an affiliate of JC Flowers III L.P. As part of the transaction, BPPR assumed approximately $1.0 billion in deposits that reside in eight of the 18 Puerto Rico branches of Doral Bank and in its online deposit platform. In addition, BPPR acquired $848 million in Puerto Rico performing residential and commercial loans. PCB assumed approximately $1.3 billion in deposits in three New York branches, and acquired $931 million in performing commercial loans primarily in the New York metropolitan area. There is no loss-sharing arrangement with the FDIC in the acquired assets.

Richard L. Carrión, CEO of Popular, Inc. said: “this transaction brings additional stability to Puerto Rico’s banking sector. Our participation in this transaction reflects our long-standing commitment to our main market, Puerto Rico. The prospect of adding deposits and loans to our Puerto Rico franchise, as well as the excellent fit of the New York operations with our existing business in the region, made this an attractive opportunity for us.”

Former Doral Bank branches will open for business at their normal operating hours on Saturday, either as branches of BPPR, PCB or another alliance bank. Doral Bank’s former customers will be able to make their transactions as usual in their former branches and delivery channels and will enjoy free access to Popular’s ample ATM network during the conversion period.

Popular announced that it expects to retain for a period of three months substantially all non-executive employees that work in the branches and operations that BPPR or PCB is acquiring. Based on Popular’s needs, some employees may be hired on a permanent basis during or at the end of the transition period.

“We are working with our alliance co-bidders to ensure the integration process is as seamless as possible for all customers. We recognize that these changes can be difficult and we are fully committed to doing everything within our reach to ensure a successful transition. We also want to welcome to Popular the new customers that join our institution today. We will continue to strive to provide you with best-in-class products and services,” said Ignacio Álvarez, President of BPPR and PCB.

Founded in 1893, Popular, Inc. is the leading banking institution by both assets and deposits in Puerto Rico and ranks among the top 50 U.S. banks by assets. In the United States, Popular has established a community-banking franchise providing a broad range of financial services and products with branches in New York, New Jersey, and Florida.