LOS ANGELES--(BUSINESS WIRE)--CBRE Group, Inc.:

|

OVERVIEW: |

Specialists from CBRE Group, Inc., the world’s largest commercial real estate services and investment firm, are available to discuss the impact of the labor slowdown at the West Coast ports on the U.S. supply chain. In addition, CBRE has released a new report that focuses on the potential impact on the economy, supply chain and the industrial real estate market. |

|||

|

AREAS OF EXPERTISE: |

||||

|

CBRE EXPERTS: |

Kurt Strasmann, Senior Managing Director, Port Logistics Group |

|||

| “If the dispute is not resolved quickly, we will see significant ripple effects throughout our regional and national economies. In the short term, shippers will need to divert their cargo through other ports based on their individual supply chain models. However, the long-term impact will be less severe, as supply chain strategies are deeply rooted in the West and the population demand is too great for shippers to abandon the West Coast ports." | ||||

|

David Egan, Head of Industrial Research, Americas |

||||

| “We’re starting to see major retailers reporting losses as a result of this on-going dispute, and this is likely to continue for some time even after a resolution is reached as backed-up product works its way through the supply chain.” |

REPORT HIGHLIGHTS:

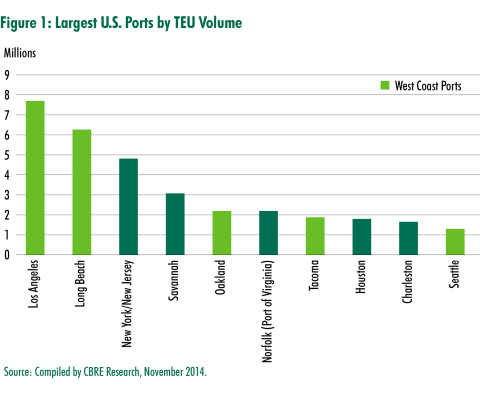

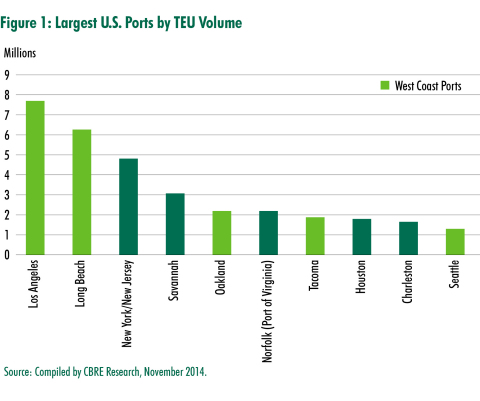

- The 29 West Coast ports, which handle 44% of container cargo in the U.S., are currently running at approximately 50-60 percent capacity. Five of these ports—Los Angeles, Long Beach, Oakland, Tacoma and Seattle—are among the top 10 largest and busiest ports (by total TEU volume) in the U.S.

- With over 30 ships (and growing) waiting to dock at the Port of Los Angeles and Long Beach, the backlog for ships to unload their containers is currently 45-60 days. As such, the supply chain implications will last well beyond the date of any agreement between labor and management.

- In response to the situation, retailers and manufacturers have been stockpiling inventory in warehouses, moving goods by air and shifting some shipments to East and Gulf Coast ports. This movement of goods has put significant stress on the “just in time” inventory scheme used by many supply chain networks and has added significant costs.

- The immediate impact on industrial real estate located near the West Coast ports will be minimal, but port markets on the East Coast may see a short-term boost in warehousing demand as shippers shift cargo away from the West Coast gridlock.

About CBRE Group, Inc.

CBRE Group, Inc., a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2014 revenue). The Company has more than 52,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 370 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.