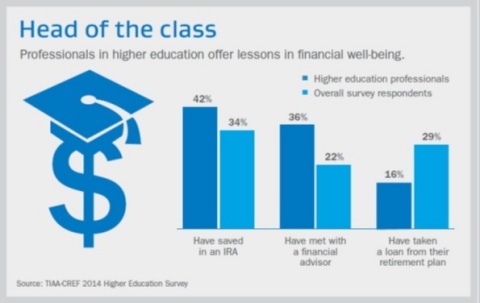

NEW YORK--(BUSINESS WIRE)--College faculty and staff are better prepared for retirement than the general population, according to a new TIAA-CREF survey. In addition to saving in their employer-sponsored retirement plan, 42 percent of higher education employees have saved in an IRA, compared to 34 percent of American employees overall. While 36 percent of college faculty and staff say they have met with a financial advisor, only 22 percent of the general population report the same. Their actions set a good example for Americans as a whole when it comes to planning and saving for retirement.

These findings come from TIAA-CREF’s Higher Education Survey, which was conducted by an independent research firm and polled a random sample of 727 higher education professionals nationwide currently contributing to an employer-sponsored retirement plan. Statistics about the general population of adults come from a TIAA-CREF survey, also conducted by KRC Research, which polled a random sample of 1,000 adults nationwide with an employer-sponsored retirement plan.

Planning for a secure retirement

While these preparations could help many retire early, the survey found that higher education professionals are not in a rush to leave the workforce – almost two-thirds (64 percent) of higher education faculty and staff plan to retire at age 65 or older. The recent economic downturn doesn’t seem to be a factor in this decision: Nearly the same percentage (63 percent) of respondents say they had planned to retire at age 65 or older 10 years ago. Even while retired, many plan to remain active. College and university employees are more likely than Americans overall to say they will work part-time (37 percent vs. 31 percent) or do more volunteer work (37 percent vs. 21 percent) during retirement.

What factors have contributed to their retirement preparedness? Nearly three-fourths (73 percent) of higher education employees say their employer offers a matching incentive for retirement plan contributions. Those who get matches are more likely to get a substantial match from their employer: Forty-three percent get a 5-8 percent salary match, compared to 34 percent of the general population.

These preparations contribute to a high level of confidence within higher education: A separate study from the TIAA-CREF Institute found that 83 percent of tenured and tenure-track faculty felt very or somewhat confident they will have enough money to live comfortably throughout their retirement years, compared to 55 percent of workers overall.1

“TIAA-CREF has been helping people in higher education prepare for a secure retirement for nearly a century – in fact, we were founded for that purpose,” said Teresa Hassara, executive vice president of TIAA-CREF's Institutional Business. “We know that many of our clients are so deeply engaged in what they do that they often continue to work past age 65. We are ready to help people set up retirement income plans at whatever age they choose.”

TIAA-CREF is the leading retirement plan provider for the higher education market, serving clients with nearly 10,400 employees, including more than 600 financial advisors, from more than 120 offices nationwide.

Protecting retirement plan savings

The survey also found that higher education employees are less likely to take loans from their retirement plans. Only 16 percent say they have taken a loan from their plan, compared to 29 percent of the general population. This employee group also is more likely to keep contributing to their retirement plan at the same rate while paying back their loan – 54 percent say their contribution rate did not change while they repaid their loan vs. 43 percent of Americans overall.

“People who take loans from their retirement plans are actually borrowing from their future selves. Keeping savings in their retirement plans helps them optimize earnings from rising markets,” said Hassara. “It’s encouraging to see that most people in higher education do not take loans from their plans, but we encourage those who do to keep loans small to ensure they will have the income they need later in life.”

Employees in all sectors can adopt these and other best practices for retirement planning and saving by working closely with a financial advisor. Doing so can be helpful in meeting financial goals, including a secure retirement, by focusing on what they want to achieve and putting a plan in place to get there.

“It’s great that faculty and staff in higher education really value financial advice,” added Hassara. “It can help them set a strategy for achieving financial well-being and chart their progress. We work in close collaboration with employers, who are a trusted source of financial information, to ensure that employees have access to advice and other resources to put them on the path to achieving their retirement goals.”

For more information, view the TIAA-CREF Higher Education Survey fact sheet.

Survey Methodology

These findings come from TIAA-CREF’s Higher Education Survey, which was conducted by an independent research firm and polled a random sample of 727 higher education professionals nationwide currently contributing to an employer-sponsored retirement plan. The survey was conducted between May 19 and June 16, 2014.

Statistics about the general population of adults come from a TIAA-CREF survey, also conducted by KRC Research, which polled a random sample of 1,000 adults nationwide with an employer-sponsored retirement plan. The survey was conducted between May 19 and May 28, 2014. Data was weighted by key demographic variables to ensure the sample is representative of the employed population contributing to defined-contribution plans. Participants in each survey were asked identical questions.

Respondents for these surveys were selected from among those who have volunteered to participate in online surveys and polls. Because the samples are based on those who initially self-selected for participation, no estimates of sampling error can be calculated. All sample surveys and polls may be subject to multiple sources of error, including, but not limited to, sampling error, coverage error, error associated with nonresponse, error associated with question wording and response options.

About TIAA-CREF

TIAA-CREF (www.tiaa-cref.org) is a national financial services organization with $840 billion in total assets under management (as of 10/1/2014) and is the leading provider of retirement services in the academic, research, medical and cultural fields.

Disclosures

The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate. Certain products and services may not be available to all entities or persons. Past performance does not guarantee future results. Results experienced by one individual may not be typical of all participants. Individual results and experiences will vary.

TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC, Members FINRA and SIPC, distribute securities products.

© 2014 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017

C20950

1Faculty Career and Retirement Survey, 2014