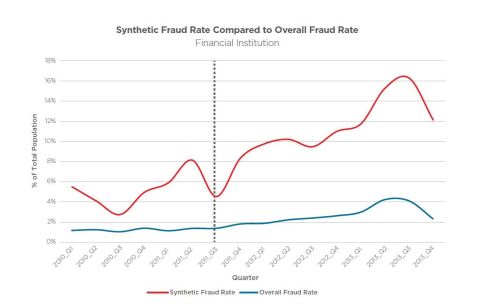

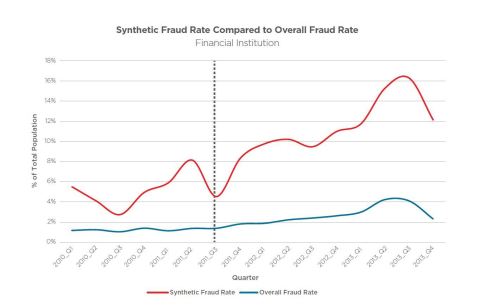

SAN DIEGO--(BUSINESS WIRE)--ID Analytics®, Inc., a leader in consumer risk management, today announced a new study from ID:A Labs that shows while the number of synthetic identities is decreasing, the average fraud rate for synthetic identities has increased more than 100 percent since 2010. The study described in ID Analytics’ white paper, “The Long Con: Analysis of Synthetic Identities,” examined new account applications in the financial services and wireless industries over a three-year period to determine the size of the synthetic identity pool and the risk level to companies.

Synthetic identity fraud occurs when a fraudster fabricates a new and false identity that is not associated with a real person. The absence of a victim may enable synthetic fraud to remain undetected for months. As described in the white paper, fraudsters use this technique for financial gain, often nurturing the synthetic identity to generate larger credit limits and therefore larger loss amounts than the average identity theft scenario. Additionally, fraudsters can also use this technique to mask other types of criminal activity.

The heightened risk associated with synthetic identities corresponds with the implementation of Social Security number (SSN) randomization, the Social Security Administration’s new approach to SSN issuance that took effect in July 2011. While this new approach was designed as a way to deter fraud, it is also difficult for legacy fraud detection systems to detect a fictitious SSN. ID Analytics’ study notes that another factor leading to the increased risk is the proliferation and availability of identity information due to a rise in the number of data breaches.

“Synthetic identity fraud is a significant and growing problem as fraudsters continue to find new ways to commit crimes despite technological advances,” said Dr. Stephen Coggeshall, chief analytics and science officer, ID Analytics. “Our latest research in this area shows that although the number of synthetic identities is decreasing, the riskiness of those synthetic identities is on the rise. One possible reason is that fraudsters are exploiting SSN randomization to help create and use false identities. Not only are synthetic identities used for financial gain, they can also be used to launder money and to support terrorist and other criminal activities.”

The study found:

- Synthetic identities are four times riskier than the overall population.

- The average fraud rate for synthetic identities increased 125.9 percent from 2010-2013.

- After Q3 2011, the average bad rate for synthetic identities is 8.2 percent higher than the fraud rate of the overall population.

Dr. Coggeshall will speak about these findings on October 21 at ID Analytics’ Advisory Council.

For more information on the latest research findings in the area of synthetic identities and how companies can protect themselves, download ID Analytics’ latest white paper, “The Long Con: Analysis of Synthetic Identities.”

About ID:A Labs

By examining identity use in the United States, ID:A Labs strives to reveal important trends in consumer behavior that impact the ability of organizations to effectively manage both opportunity and risk. ID:A Labs is a multidisciplinary group of mathematicians, computer scientists, economists, financial experts, cognitive scientists and advisors from ID Analytics and other respected institutions.

ID:A Labs conducts research and analysis in the areas of identity fraud, credit risk, marketing and segmentation, authentication and identity proofing. ID:A Labs leverages the ID Network®, one of the nation’s largest network of cross-industry consumer behavioral data. Backed by patented technology, world-class analytics and the ID Network, ID:A Labs researches, analyzes and reports on developments in consumer behavior, identity and credit-related issues, the regulatory landscape and innovations in analytics around modeling and machine learning.

About ID Analytics, Inc.

ID Analytics is a leader in consumer risk management with patented analytics, proven expertise and real-time insight into consumer behavior. By combining proprietary data from the ID Network®—one of the nation’s largest networks of cross-industry consumer behavioral data—with advanced science, ID Analytics provides in-depth visibility into identity risk and creditworthiness. Every day, many of the largest U.S. companies and critical government agencies rely on ID Analytics to make risk-based decisions that enhance revenue, reduce fraud, drive cost savings and protect consumers. ID Analytics is a wholly-owned subsidiary of LifeLock, Inc. Please visit us at www.idanalytics.com.

ID Analytics and ID Network are registered trademarks of ID Analytics, Inc.