WASHINGTON--(BUSINESS WIRE)--Results from the Business Roundtable’s first quarter 2014 CEO Economic Outlook Survey show a moderate uptick in CEO expectations for hiring, sales and capital expenditures and some improvement in the Business Roundtable CEO Economic Outlook Index. But the survey’s expectation for 2014 GDP growth was 2.4 percent, representing below-normal growth compared to past economic recoveries. This latest reading follows an expectation for 2.2 percent growth in the CEO survey taken in the fourth quarter last year.

“CEO expectations for overall economic growth are well below our economy’s potential,” said Randall L. Stephenson, Chairman of Business Roundtable and Chairman and CEO of AT&T Inc. “This underscores why the Roundtable put forward a clear, simple economic growth strategy earlier this year. It starts with the idea that increased private-sector capital investment is the critical foundation for economic growth, and its key planks are fiscal stability, business tax reform, expanded trade, and immigration reform. These issues have broad support, they are critical to driving job growth, and we urge Congress to act on them this year.”

The survey, which has been conducted quarterly since the third quarter of 2002, is designed to capture CEO sentiment regarding the current state and future direction of the U.S. economy. The survey results showed that 72 percent of CEOs anticipate sales will increase in the next six months, but only 37 percent expect to add U.S. employees and less than half expect to increase their companies’ U.S. capital investment.

In addition to expectations on sales, hiring and investment, the latest survey also included special questions posed this quarter on tax, trade, immigration policy and regulation:

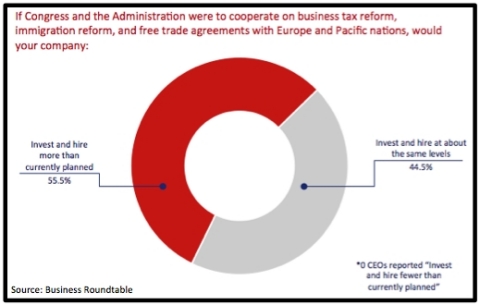

- 56 percent of CEOs said they would invest and hire more if Congress and the Administration were to cooperate on business tax and immigration reform and move forward on free trade agreements with European Union and Pacific nations.

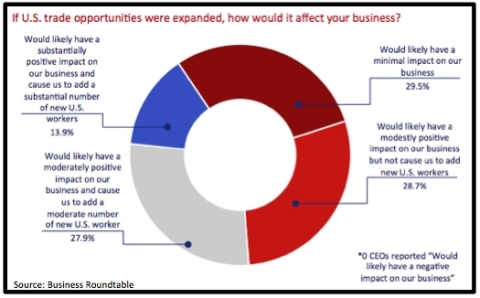

- More than 70 percent said that expanded U.S. trade opportunities would have a positive effect on their businesses, with 42 percent saying they would hire additional employees if global trade expanded.

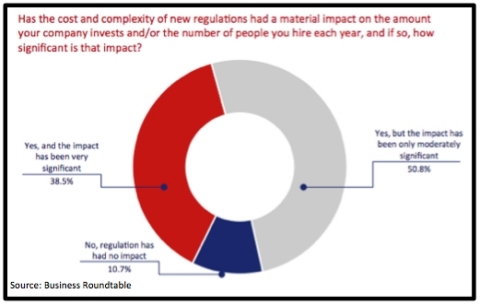

- Nearly 9 in 10 CEOs (89 percent) said regulation has had either a moderately significant or very significant material impact on their investment and hiring activities.

Survey Results

While CEO expectations over the next six months increased for investment, hiring and sales, the increase in the sales expectations index was a result of decreased pessimism, rather than increased optimism. The survey’s key findings from this quarter and the fourth quarter of 2013 include:

|

CEO Survey Results & |

2013 Q4 | 2014 Q1 |

Quarter-Quarter |

|||||||||||||||

| Increase | No Change | Decrease |

Sub-Index |

Increase | No Change | Decrease | Sub-Index | |||||||||||

| How do you expect your company’s sales to change in the next six months? | 73% | 18% | 8% | 114.7 | 72% | 23% | 5% | 117.2 | +2.5 | |||||||||

| How do you expect your company’s U.S. capital spending to change in the next six months? | 39% | 50% | 12% | 76.9 | 48% | 44% | 7% | 91 | +14.1 | |||||||||

| How do you expect your company’s U.S. employment to change in the next six months? | 34% | 45% | 22% | 61.8 | 37% | 44% | 19% | 68.2 | +6.4 | |||||||||

First Quarter 2014 Business Roundtable CEO Economic Outlook Index

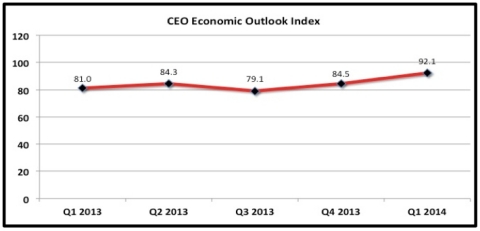

The Business Roundtable CEO Economic Outlook Index – a composite index of CEO expectations for the next six months of sales, capital spending and employment – increased in the first quarter of 2014 to 92.1 from 84.5 in the fourth quarter of 2013. The Index now stands above its long-term average level of 79.7.

About the Business Roundtable CEO Economic Outlook Survey

Business Roundtable’s CEO Economic Outlook Survey, conducted quarterly since the third quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs. The survey is designed to capture CEO sentiment regarding the current state and future direction of the U.S. economy by asking CEOs to provide their expectations about their company’s sales, capex and employment in the following six months. The data are used to create the Business Roundtable CEO Economic Outlook Index, and sub-indices for sales, capex and hiring expectations – diffusion indices that range between -50 and 150 – where readings above 50 indicate an economic expansion, and readings below 50 indicate an economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase minus the percentage who report that the measure will decrease.

In March 2011, Steve Leisman, Senior Economics Reporter for CNBC, showed that the index was an accurate tracker of real GDP. Several investment banks including UBS and Morgan Stanley include the index in their regular economic commentary, and it is one of only a handful of business surveys available through Haver Analytics, a leading data provider to investment banks, financial institutions and the media. A study in 2013 showed that the change in the index provides a statistically significant leading signal of the change in U.S. GDP.

The first quarter 2014 survey was completed between February 21 and March 7, 2014. Responses were received from 122 member CEOs, 61 percent of the total Business Roundtable membership. The percentages in some categories may not equal 100 due to rounding. Results of this and all previous surveys can be found at www.brt.org/resources/ceo-survey.

Business Roundtable (BRT) is an association of chief executive officers of leading U.S. companies working to promote sound public policy and a thriving U.S. economy.

BRT-member companies produce $7.4 trillion in annual revenues and employ more than 16 million people. Comprising more than a third of the total value of the U.S. stock market, these companies invest $158 billion annually in research and development – equal to 62 percent of private U.S. R&D spending. In addition, they pay more than $200 billion in dividends to shareholders and generate more than $540 billion in sales for small and medium-sized businesses annually. BRT companies give more than $9 billion a year in combined charitable contributions.

Please visit us at www.brt.org, check us out on Facebook and LinkedIn, and follow us on Twitter.