CAMPBELL, Calif.--(BUSINESS WIRE)--Market research firm Infonetics Research released market share and preliminary analysis for application delivery controllers and WAN optimization products from its 4th quarter 2013 (4Q13) and year-end Data Center Network Equipment report.

Market revenue for data center Ethernet switches and Ethernet switches sold in bundles, along with updated forecasts and more detailed analysis for all product categories, will be available March 11.

ANALYST NOTE

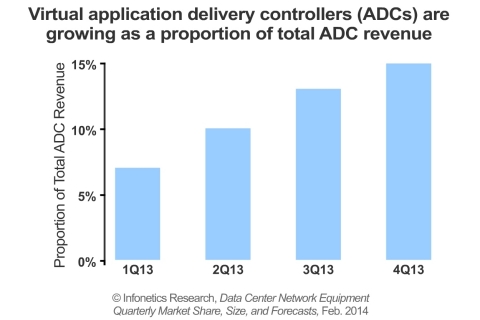

“Virtual application delivery controller (ADC) revenue is growing fast as cloud services, hybrid cloud, and the shift to cloud-architected data centers create demand for virtual appliances,” notes Cliff Grossner, Ph.D., directing analyst for data center and cloud at Infonetics Research.

“Hardware-based ADCs aren’t going away anytime soon. They still provide the performance required by larger-scale deployments, and vendors are working to fold in other services such as security, application traffic monitoring, and predictive analytics,” continues Grossner. “This will keep the market for hardware-based appliances healthy even as a portion of the ADC market turns to virtual appliances.”

DATA CENTER MARKET HIGHLIGHTS

- Global application delivery controller (ADC) revenue grew 10% in 4Q13 from 3Q13, and finished 2013 at $1.75 billion, up 4% over 2012, when the previous record high was set

- ADC virtual appliances are going mainstream, accounting for 14% of ADC revenue in 4Q13; Citrix is the market share leader in this segment

- F5 continues to lead the overall ADC market, but Citrix was the big winner upon Cisco’s exit from the space, gaining 5 points in market share

- In 4Q13, WAN optimization revenue is up 4% sequentially, but remains on an overall downward trajectory, down 8% from the year-ago 4th quarter

- Vendors are adding mobility functionality to WAN optimization products to drive new revenue while waiting for the cloud to have a positive impact

- The top 3 vendors in the WAN optimization space are Riverbed, Cisco, and Blue Coat

DATA CENTER VIRTUALIZATION WEBINAR

Join analyst Cliff Grossner March 25 for Virtualizing Networks with SDN NVOs and Bare Metal Switches, a live event exploring how network virtualization overlays (NVOs) and bare metal networking make data center network virtualization faster, easier, and more affordable: http://w.on24.com/r.htm?e=746584&s=1&k=F8942DEE951A3E32B8495DE59289A1E3

ABOUT THE DATA CENTER REPORT

Infonetics’ quarterly data center equipment report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for data center network equipment including data center Ethernet switches, application delivery controllers (ADCs), WAN optimization appliances, and Ethernet switches sold in bundles. Vendors tracked: A10, Alcatel-Lucent, Arista, Array Networks, Barracuda, Blue Coat, Brocade, Cisco, Citrix, Dell, F5, HP, Huawei, IBM (BNT), Juniper, Kemp, Radware, Riverbed, and others. To buy report, contact Infonetics: http://www.infonetics.com/contact.asp.

RELATED REPORT EXCERPTS

- Infonetics’ March Data Center and Cloud research brief: http://bit.ly/O2tyet

- QLogic challenging Emulex’s lead in converged data center network adapters

- Hybrid cloud is next big thing in the data center

- Virtual servers and switches to dominate data center by 2015, paving the way to SDN

- New Infonetics report projects data center and enterprise SDN market will top $3B by 2017

RECENT AND UPCOMING DATA CENTER RESEARCH

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

- Research Note: Hybrid Cloud, DC Virtualization & SDN for 2014 (Jan.)

- Research Note: MNV: The Commencement of a Very Long Journey to SDN & NFV (Feb.)

- Research Note: Dell Ushers In the Year of the White Box Switch (Feb.)

- SAN & Converged Data Center Network Equipment Market Share & Forecasts (Mar.)

- Data Center SDN Strategies: Global Service Provider Survey (Mar.)

- SDN Strategies: North America Enterprise Survey (Apr.)

- Data Center Network Equipment Market Share & Forecasts (June)

- Cloud Service Strategies: Global Service Provider Survey (June)

INFONETICS WEBINARS

Visit https://www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on demand, or learn about sponsoring a webinar.

- Using Big Data Analytics to Amplify Security Intelligence (Mar. 20: Attend)

- Virtualizing Networks with SDN NVOs and Bare Metal Switches (Mar. 25: Attend)

- The Great 802.11ac Migration: Upgrade Now, or Wait? (Mar. 27: Attend)

- The Increasing Threat of Compromised Web Servers and How to Mitigate It (Apr. 2: Attend)

- Deploying IMS in the Cloud with NFV (Apr. 16: Attend)

- Enterprise Shift to the Cloud - Agility to Meet Business Requirements (June: Sponsor)

- A Practical Guide to Preparing the Enterprise for SDN (2H14: Sponsor)

TO BUY DATA CENTER REPORTS, CONTACT:

N. America (West), Asia Pacific: Larry Howard, larry@infonetics.com, +1 408-583-3335

N. America (East, Midwest), L. America: Scott Coyne, scott@infonetics.com, +1 408-583-3395

EMEA, India, Singapore: George Stojsavljevic, george@infonetics.com, +44 755-488-1623

Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

ABOUT INFONETICS

Infonetics Research (www.infonetics.com) is an international market research and consulting firm serving the communications industry since 1990. A leader in defining and tracking emerging and established technologies in all world regions, Infonetics helps clients plan, strategize, and compete effectively. View Infonetics’ About Us slides at http://bit.ly/QUrbrV.