BOSTON--(BUSINESS WIRE)--Forty percent of "millennial" investors define long-term investing as less than five years, the shortest holding period of any age group in the MFS Investing Sentiment Insights survey. The survey results are striking given that millennials — adults under age 34 — have a much longer investment time horizon than older generations.

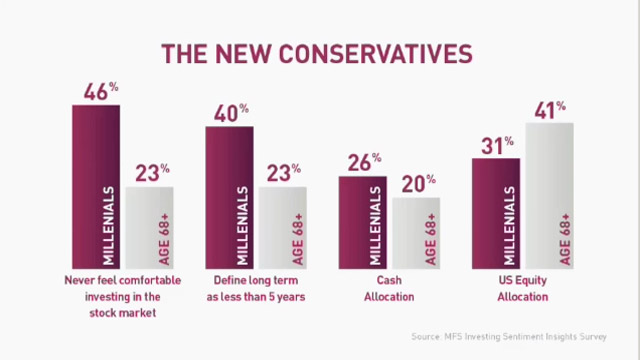

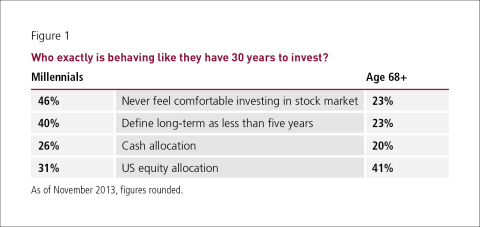

Thirty percent of millennials consider themselves short-term investors, and one quarter of them say their primary goal is protecting principal. The survey also reveals that millennials hold more cash on average, at 25.8%, and fewer US equities, at 30.5%, than older generations. [See Figure 1]

"The data confirm that we have a lost generation of investors. The impact of 2008's Great Recession has had a deep-seated secular impact on millennial investors. Their grandparents are more aggressive investors," said William Finnegan, senior managing director and head of Global Retail Marketing for MFS. "The textbook says, given their time horizon, that millennials will be all right once the economy improves, but reality shows these 'recession babies' don't trust the markets and have embraced a conservative approach that could prevent them from reaching their long-term financial goals."

Millennial sentiment may actually be slipping, as 46% of them agree with the statement that they would never be comfortable investing in the market, up from 40% in MFS' June 2011 survey. Furthermore, despite an improving economy and a large move up in stock market valuations in recent years, millennial's US equity allocation has in fact fallen from 32.7% in June 2011 to 30.5% today.

Investing Sentiment and Financial Advisors

Financial advisors surveyed by MFS remain upbeat on the economy over the next five years, with 79% saying they are optimistic. However, only 44% of investors are optimistic, while 38% are pessimistic about the economy over the next five years.

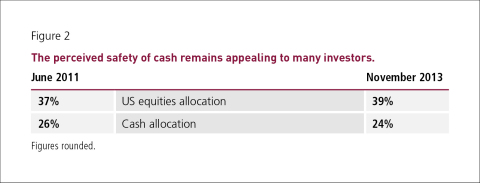

Furthermore, only 44% of investors are confident about their current asset allocation. As a result, the survey continues to reveal that investors are holding relatively high levels of cash, currently 24%, which is down slightly from 26% in June 2011. US equity allocations increased modestly, to 39% from 37% in June 2011. On the plus side, 37% of all investors agree that US equities are an excellent or very good place to invest over the next year, higher than any other asset class. [See Figure 2]

"While equity exposure may be ticking up slightly for all age cohorts, investors continue to hold larger-than-expected cash allocations, which will make it very hard for them to meet their long-term financial goals," added Finnegan. "A significant number of investors are pessimistic, and the memories of 2008 are still fresh in their minds. Regardless of their time horizon, they continue to trade growth for safety."

Misunderstanding Passive Investing

The survey also revealed that many investors own a mix of passive and active investments and do not show a strong preference for one type over the other. In fact, nearly two-thirds of investors who owned passive investments also owned active investments, and 20% of all investors say they planned to increase their allocation to actively managed mutual funds in the next 12 months.

"In the minds of most investors, it's not active OR passive, but active AND passive," said Finnegan. "However, the survey clearly revealed a lack of understanding about the key characteristics of these two investment approaches."

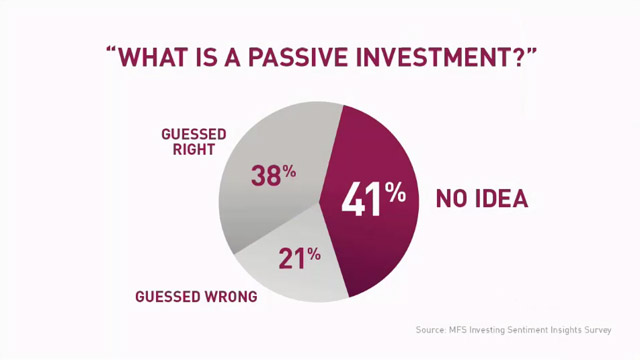

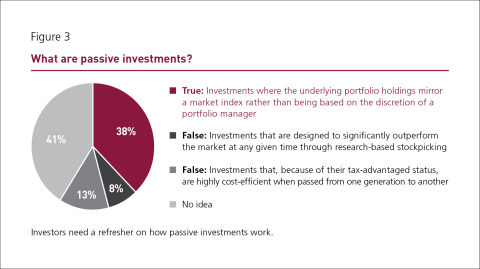

Of note, among investors who have ever owned passive investments, 48% said a major factor for owning them was "minimal risk." Furthermore, less than half (48%) of owners of passive investment products know the correct definition for these strategies. Moreover, when given three potential definitions, only 38% of all investors choose the correct one, while 41% say they have "no idea." [See Figure 3]

Investors do not appear to have a strong understanding of actively managed investments as well, despite the fact that they have been widely used for several decades. Twenty-seven percent of survey participants described active investments as "complex," while only 29% said that they were either extremely or very knowledgeable about active investments.

"Whether it's passive or active, we are concerned investors don't understand what they own and the investment risks associated with these strategies," noted Finnegan. "Given the impact of the last recession on investors, the risk of not knowing why they own something could dramatically impact investors' financial futures and their ability to meet their long-term goals. Financial advisors are uniquely positioned to bridge this knowledge gap."

About the current survey

MFS, through Research Collaborative, an independent research firm, sponsored an online survey from November 6 - 15, 2013, of 958 individual US investors with $100,000 or more in household investable (non-retirement) assets and 636 licensed US financial advisors (either FINRA or SEC) who have been licensed for at least three years with $500,000 or more in annual mutual fund sales. All investor respondents make or share in making financial decisions for their households. MFS was not identified as the sponsor of the survey. Millennial (Generation Y) investors are those under the age of 34; 209 participated in the survey. Generation X is defined as investors between the ages of 34 and 48; 246 participated in the survey. Baby boomer investors are those between the ages of 49 and 67; 317 participated in the survey. There were 186 participants age 68 or older.

About MFS Investment Management®

Established in 1924, MFS is an active, global asset manager with investment offices in Boston, Hong Kong, London, Mexico City, São Paulo, Singapore, Sydney, Tokyo and Toronto. We employ a uniquely collaborative approach to build better insights for our clients. Our investment approach has three core elements: integrated research, global collaboration and active risk management. As of January 31, 2014, MFS manages US$400.4 billion in assets on behalf of individual and institutional investors worldwide. Please visit mfs.com for more information.

29814.2