SUNRISE, Fla.--(BUSINESS WIRE)--As the IRS struggles to curb rising tax-identity theft rates, business tax e-filing service efile4biz.com is protecting its users by taking every possible precaution to keep stored data from falling into the wrong hands.

Tax-related identity theft on the rise

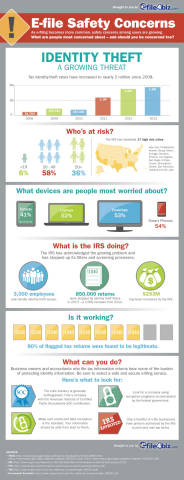

In 2012, the IRS identified over 1.8 million incidents of identity theft, a 78% increase over 2011 and more than four times the number reported in 2010. The number could be even higher in 2013, given that IRS investigations of tax-related identity theft increased 66% last year.

And the reality may be even worse: the number of actual incidents is “significantly greater than the amount the IRS detects and prevents,” according to a 2012 report by the Treasury Inspector General for Tax Administration (TIGTA), an independent office in charge of overseeing Department of Treasury matters involving the IRS. A follow-up report estimates that the IRS may have issued more than $3.6 billion in refunds to identity thieves in 2012 alone.

SSNs and TINs must be protected

In the most common tax identity fraud scenario, a thief uses a stolen Social Security Number (SSN) or Tax Identification Number (TIN) to file a fake tax return and claim a refund. ”Social Security Numbers are like gold to identity thieves,” says Christian Ferris, Director of Customer Experience at efile4biz.com. “They need to be protected at all costs.”

That burden of protection extends to business owners and accountants preparing to file 1099s online, according to Ferris. “As an employer, you’ve been entrusted with a highly sensitive piece of information. You have to treat it that way when preparing your tax information returns.” That includes, for example, being cautious when entering employee or contractor data on e-filing websites.

“The problem is that the e-filing industry is under a self-governing model when it comes to data security,” says Ferris. “Many of the e-file websites are mom-and-pop businesses with homegrown websites, printing Social Security Numbers on forms in their garages,” he points out. “They don’t have the resources to invest in top-notch security technologies. And they don’t have the expertise to keep data secure against hackers.”

Look for ‘multiple layers’ of security

The key, says Ferris, is to seek out an e-file provider that uses “multiple layers of security” to keep identity data safe. As an example, efile4biz.com uses state-of-the-art encryption technology from the instant the user enters data on the website, and all the way through the printing, mailing and e-filing process. “We use the security technology the government recommends for websites handling sensitive data,” says Ferris.

“But that’s not enough for us,” explains Ferris. “We’ve also been audited and certified by an independent organization to make sure we are up to the Service Organization Control (SOC) standards set by American Institute of Certified Public Accountants (AICPA).” The certification is only awarded to organizations that implement strict end-to-end business technologies and processes to protect customer data.

“Even our print facility is highly secure,” says Ferris. “It’s one of the few print-and-mail facilities in the country authorized by the IRS to print tax forms.” And for recipients who would rather not have their 1099s and W-2s mailed at all, efile4biz.com offers an e-delivery option. “If you provide an email address for your recipients, we’ll give them the option to download their forms via a secure link instead of sending it by mail. That way, they get to choose how they receive their forms.”

“We know we’re dealing with very sensitive data, and we want our customers to rest assured that it’s safe with us,” said Ferris. “That’s why we’ve gone to great lengths to ensure it is.”

About efile4biz.com

Industry leader and IRS-authorized e-file provider, efile4biz.com (previously eFileforBusiness.com) has made online processing of 1099s and W-2s more convenient and economical than paper forms and installed software. Efile4biz.com offers comprehensive, front-to-back processing of tax information returns, including printing and mailing, optional electronic delivery to your recipients, and electronic filing with the IRS and SSA. Visit efile4biz.com.

Efile4biz.com is a member of the HRdirect family of brands. HRdirect brands include Poster Guard® Compliance Protection (the nation's leading labor law poster replacement service), G.Neil® (the nation's leading provider of employee management products), TrackSmart.com™ (online employee recordkeeping and attendance tracking for small businesses), and FMLA101.com (online tool for managing employee leave under the Family Medical Leave Act). For more information, visit HRdirect.com.