DOWNERS GROVE, Ill.--(BUSINESS WIRE)--DeVry Inc. (NYSE: DV), a global provider of educational services, today reported academic, operational and financial results for its fiscal 2013 third-quarter ended March 31, 2013. DeVry also reported enrollment results at DeVry Brasil, Chamberlain College of Nursing, Carrington Colleges Group, and DeVry University and its Keller Graduate School of Management.

Academic and operational results this quarter included:

- DeVry University received reaccreditation from the Higher Learning Commission through 2019

- DeVry University new undergraduate student enrollment down 21 percent

- 17.5 percent increase in new enrollments at Carrington

- 17 percent total student growth at Chamberlain College of Nursing

- Chamberlain opened a new campus in Cleveland, bringing the total number of campuses to 12

- Becker Professional Education prepared 37 of 39 of Elijah Watts Sells winners for the 2012 CPA Exam

- 60 percent revenue growth at DeVry Brasil in the quarter, including acquisitions

Selected financial data for the three months ended March 31, 2013:

- Revenues decreased 5.9 percent to $509 million

- Reported net income decreased 15.4 percent to $57 million, and net income excluding discrete items was $58 million, down 13.5 percent

- Reported diluted earnings per share decreased 12 percent to $0.88, and earnings per share excluding discrete items was $0.90, down 10.0 percent

Selected financial data for the nine months ended March 31, 2013:

- Revenues decreased 5.5 percent to $1,497 million

- Reported net income increased 4.2 percent to $139 million, and net income excluding discrete items was $146 million, down 21.8 percent

- Reported diluted earnings per share increased 9.7 percent to $2.15, and earnings per share excluding discrete items was $2.26, down 17.5 percent

- Operating cash flow was $282 million, compared to $355 million last year

- Repurchased approximately 2 million shares of common stock at an average price of $23.97

“While most of our institutions are performing well, we were disappointed with new student enrollment at DeVry University,” said Daniel Hamburger, DeVry’s president and chief executive officer. “We are focused on better communicating the return on educational investment of DeVry University degrees to potential students. In addition, we are aggressively managing our costs and now expect to achieve $100 million in cost savings this fiscal year.”

Reported results for both the current and prior year periods include discrete items. The results for the three and nine months ended March 31, 2013, include after-tax restructuring charges of $1.3 million and $7.2 million, respectively, related to severance and real estate consolidation. The results for the nine months ended March 31, 2012, include impairment charges of $55.8 million after-tax, and a $2.2 million gain, net of tax (see “Use of Non-GAAP Financial Information and Supplemental Reconciliation Schedule”).

Organizational Highlights

Business, Technology and Management Segment

DeVry University

For the March 2013 session at DeVry University new undergraduate enrollments decreased 21.2 percent to 5,146 versus 6,533 the previous year. Total undergraduate students decreased 16.5 percent to 47,537 versus 56,958 for the session a year ago.

At the graduate level, including Keller Graduate School of Management, total coursetakers in the March session decreased 18.4 percent to 19,075 versus 23,366 for the same session a year ago.

The total number of online undergraduate and graduate coursetakers in the March session decreased 10.6 percent to 60,834 versus 68,083 in the same session a year ago.

Enrollment results continue to be impacted by lower cyclical demand among the university’s target segment of students. The plan to improve enrollment results includes enhancing communications to students about DeVry University’s excellent graduate employment results; addressing affordability through scholarships and pricing; and enhancing partnerships with corporate and government organizations.

During the quarter, DeVry University received reaccreditation from the Higher Learning Commission through 2019.

Medical and Healthcare Segment

DeVry Medical International

In the third quarter, American University of the Caribbean School of Medicine appointed Heidi Chumley, M.D. as executive dean and chief academic officer. Chumley most recently served as associate vice chancellor for educational resources and interprofessional education at the University of Kansas School of Medicine.

Ross University School of Medicine recently announced a new affiliation agreement with Atlanta Medical Center that will enable students to complete required clinical rotations in family practice, internal medicine, pediatrics, psychiatry, obstetrics and gynecology and surgery.

Enrollment for the May semester at DeVry Medical International will be reported with the fourth-quarter and year-end results on August 8, 2013.

Chamberlain College of Nursing

Chamberlain's new online student enrollment in the March session increased 15.9 percent to 1,344 compared to 1,160 in March 2012. New enrollments in the March session were impacted by a realignment of Chamberlain’s academic calendar, which resulted in no new campus-based students in the session. Total student enrollment increased 16.9 percent to 13,235 compared to 11,321 during the same period last year.

During the quarter, Chamberlain announced the launch of the Doctor of Nursing Practice (DNP) program, which will be offered in May. In addition, Chamberlain received approvals from the Illinois Board of Higher Education for a Family Nurse Practitioner (FNP) program, which is expected to begin in the fall of 2013, pending accreditor approval.

Chamberlain also opened a new Cleveland location in January, and will open the new Tinley Park, Ill., location in May.

Carrington Colleges Group

Carrington continues to make progress on its turnaround plan. For the three month period ending March 31, 2013, new student enrollment for Carrington Colleges Group increased 17.5 percent to 2,391 versus 2,035 in the previous year, marking its third consecutive quarter with double-digit new student enrollment growth. Total enrollment increased 8.8 percent to 7,951 compared to 7,309 in the prior year.

International, K-12, and Professional Education Segment

Becker Professional Education

Becker recently announced that 37 of 39 of the Elijah Watts Sells winners for the 2012 CPA Exam prepared using the Becker CPA Exam Review. During the quarter, Becker opened new locations in New York and Chicago for the U.S. Medical Licensing Exam preparation course.

DeVry Brasil

DeVry Brasil’s new student enrollment in the March session increased 2.0 percent to 7,390 compared to 7,244 in the prior year. Total student enrollment increased 7.2 percent to 29,083 students compared to 27,133 during the same period last year.

DeVry Brasil’s Ruy Barbosa and Faculdade Boa Viagem each received top five rankings by the Ministry of Education among institutions located in the cities of Salvador and Recife.

Balance Sheet/Cash Flow

For the first nine months of fiscal year 2013, DeVry generated $282 million of operating cash flow. As of March 31, 2013, cash, marketable securities and investment balances totaled $281 million and there were no outstanding borrowings.

Share Repurchase Plan

During the quarter, DeVry repurchased 347,280 shares of its common stock for approximately $9.8 million, at an average cost of $28.18 per share.

Conference Call and Webcast Information

DeVry will host a conference call on April 23, 2013, at 4:00 p.m. Central Daylight Time (5:00 p.m. Eastern Daylight Time) to discuss its fiscal 2013 third-quarter results. The conference call will be led by Daniel Hamburger, president and CEO, Tim Wiggins, senior vice president and chief financial officer, and Pat Unzicker, vice president of finance and chief accounting officer.

For those wishing to participate by telephone, dial 866-318-8613 (domestic) or 617-399-5132 (international). Use passcode 13010926 or say “DeVry Call”. DeVry Inc. will also broadcast the conference call live via the Web. Interested parties may access the webcast through the Investor Relations section of the company's website, or http://www.media-server.com/m/p/52fbwnf4. Please access the website at least 15 minutes prior to the start of the call to register, download and install any necessary audio software.

DeVry will archive a telephone replay of the call until May 20, 11:59 p.m. To access the replay, dial 888-286-8010 (domestic) or 617-801-6888 (international), passcode 96882536. To access the webcast replay, please visit the company's website, or http://www.media-server.com/m/p/52fbwnf4.

About DeVry Inc.

DeVry's purpose is to empower its students to achieve their educational and career goals. DeVry (NYSE: DV; member S&P MidCap 400 Index) is a global provider of educational services and the parent organization of Advanced Academics, American University of the Caribbean School of Medicine, Becker Professional Education, Carrington College, Carrington College California, Chamberlain College of Nursing, DeVry Brasil, DeVry University, Ross University School of Medicine and Ross University School of Veterinary Medicine. These institutions offer a wide array of programs in business, healthcare, technology, accounting and finance. For more information, please call 630.353.3800 or visit http://www.devryinc.com.

Certain statements contained in this release concerning DeVry's future performance, including those statements concerning DeVry's expectations or plans, may constitute forward-looking statements subject to the Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as DeVry or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Actual results may differ materially from those projected or implied by these forward-looking statements. Potential risks, uncertainties and other factors that could cause results to differ are described more fully in Item 1A, "Risk Factors," in DeVry's most recent Annual Report on Form 10-K for the year ending June 30, 2012 and filed with the Securities and Exchange Commission on August 28, 2012.

Selected Operating Data (in thousands, except per share data)

| Third Quarter | |||||||||

| FY 2013 | FY 2012 | Change | |||||||

| Revenues | $ | 508,752 | $ | 540,807 | -5.9 | % | |||

| Net Income | $ | 56,821 | $ | 67,131 | -15.4 | % | |||

| Earnings per Share (diluted) | $ | 0.88 | $ | 1.00 | -12.0 | % | |||

| Number of common shares (diluted) | 64,279 | 67,225 | -4.4 | % | |||||

| Nine Months | |||||||||

| FY 2013 | FY 2012 | Change | |||||||

| Revenues | $ | 1,496,732 | $ | 1,583,894 | -5.5 | % | |||

| Net Income | $ | 139,096 | $ | 133,480 | +4.2 | % | |||

| Earnings per Share (diluted) | $ | 2.15 | $ | 1.96 | +9.7 | % | |||

| Number of common shares (diluted) | 64,639 | 68,235 | -5.3 | % | |||||

Use of Non-GAAP Financial Information and Supplemental Reconciliation Schedule

During the third quarter of fiscal year 2013, DeVry recorded a restructuring charge to consolidate a facility at Carrington Colleges as well as for the severance charges within DeVry University and DeVry Medical International. During the second quarter of fiscal year 2013, DeVry recorded a restructuring charge for the write-down of land, building and equipment related to its decision to relocate a facility in Wood Dale, IL, in order to consolidate administrative operations in the Chicagoland area. DeVry also recorded restructuring charges to consolidate facilities at Carrington College and DeVry University. During the second quarter of fiscal year 2012, DeVry recorded impairment charges related to its Carrington Colleges reporting unit. DeVry also recorded a gain from the sale of Becker’s Stalla CFA review operations. The following table illustrates the effects of these restructuring and impairment charges and gain on sale of assets on DeVry’s results. Management believes that the non-GAAP disclosure of net income and earnings per share provides investors with useful supplemental information regarding the underlying business trends and performance of DeVry’s ongoing operations and is useful for period-over period comparisons of such operations given the discrete nature of the restructuring and impairment charges and gain on the sale of assets. DeVry uses these supplemental financial measures internally in its management and budgeting processes. However, the non-GAAP financial measures should be viewed in addition to, and not as a substitute for, DeVry’s reported results prepared in accordance with GAAP. The following table reconciles these items to the relevant GAAP information (in thousands, except per share data):

| For The Three Months | For The Nine Months | ||||||||||||

| Ended March 31: | Ended March 31: | ||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||

| Net Income | $ | 56,821 | $ | 67,131 | $ | 139,096 | $ | 133,480 | |||||

| Earnings per Share (diluted) | $ | 0.88 | $ | 1.00 | $ | 2.15 | $ | 1.96 | |||||

| Restructuring Expense (net of tax) | $ | 1,271 | -- | $ | 7,211 | -- | |||||||

| Effect on Earnings per Share (diluted) | $ | 0.02 | -- | $ | 0.11 | -- | |||||||

| Impairment Charges (net of tax) | -- | -- | -- | $ | 55,751 | ||||||||

| Effect on Earnings per Share (diluted) | -- | -- | -- | $ | 0.81 | ||||||||

| Gain on Sale of Assets (net of tax) | -- | -- | -- | $ | (2,216 | ) | |||||||

| Effect on Earnings per Share (diluted) | -- | -- | -- | $ | (0.03 | ) | |||||||

| Net Income Excluding the Restructuring | |||||||||||||

| and Impairment Charges and Gain | |||||||||||||

| on Sale of Assets | $ | 58,092 | $ | 67,131 | $ | 146,307 | $ | 187,015 | |||||

| Earnings per Share Excluding the | |||||||||||||

| Restructuring and Impairment Charges | |||||||||||||

| and Gain on Sale of Assets (diluted) | $ | 0.90 | $ | 1.00 | $ | 2.26 | $ | 2.74 | |||||

March 2013 Enrollment Results

| 2012 | 2013 | % Change | ||||

| DeVry Inc. Student Enrollments(1) | ||||||

| New students | 19,741 | 18,468 | -6.4 | |||

| Total students | 128,269 | 119,623 | -6.7 | |||

| DeVry University | ||||||

| Undergraduate – March Session | ||||||

| New students | 6,533 | 5,146 | -21.2 | |||

| Total students | 56,958 | 47,537 | -16.5 | |||

| Graduate – March Session | ||||||

| Coursetakers(2) | 23,366 | 19,075 | -18.4 | |||

| Online | ||||||

| March Session | ||||||

| Total coursetakers(2)(3) | 68,083 | 60,834 | -10.6 | |||

| Chamberlain College of Nursing | ||||||

| March Session | ||||||

| New students (online only) | 1,160 | 1,344 |

+15.9(4) |

|||

| Total students | 11,321 | 13,235 | +16.9 | |||

| The Carrington Colleges Group | ||||||

| 3 months ending Mar. 31, 2013 | ||||||

| New students | 2,035 | 2,391 | +17.5 | |||

| Total students | 7,309 | 7,951 | +8.8 | |||

| DeVry Brasil | ||||||

| March Term | ||||||

| New students | 7,244 | 7,390 | +2.0 | |||

| Total students | 27,133 | 29,083 | +7.2 |

1. Excludes Becker and Advanced Academics. Includes enrollment at DeVry Medical International reported in February 2013.

2. The term “coursetaker” refers to the number of courses taken by a student. Thus one student taking two courses equals two coursetakers.

3. Includes both undergraduate and graduate students.

4. New enrollment comparisons for the March session were impacted by a realignment of Chamberlain’s academic calendar, which resulted in no new campus-based students in the session.

Chart 1: DeVry Inc. Remaining Calendar 2013 Announcements & Events

| August 8, 2013 | Fiscal 2013 Fourth Quarter/Year-End and May/July Enrollment | ||

| DeVry University | |||

| Chamberlain College of Nursing | |||

| Carrington Colleges Group | |||

| DeVry Medical International | |||

| October 24, 2013 | Fiscal 2014 First Quarter Results and September Enrollment | ||

| DeVry University | |||

| Chamberlain College of Nursing | |||

| Carrington Colleges Group | |||

| DeVry Medical International | |||

| DeVry Brasil | |||

| November 6, 2013 | Annual Shareholders’ Meeting | ||

Chart 2: Academic Calendar Transitions for Carrington Colleges Group and Chamberlain College of Nursing

Carrington Colleges Group Starts Per Quarter:

| Carrington | Carrington | |||||||||||||||||

| College | College | |||||||||||||||||

| Q1 | Q2 | Q3 | Q4 | California | Q1 | Q2 | Q3 | Q4 | ||||||||||

| FY12 | 3 | 3 | 3 | 2 | FY12 | 2 | 2 | 2 | 2 | |||||||||

| FY13 | 2 | 2 | 2 | 2 | FY13 | 3 | 1 | 3 | 2 | |||||||||

| FY14 | 2 | 2 | 2 | 2 | FY14 | 2 | 2 | 2 | 2 | |||||||||

Chamberlain College of Nursing Starts Transition:

|

Q1 |

Q3

|

Q2 |

Q4 |

|||||||||||

| Chamberlain | July | September | November | January | March | May | # of | |||||||

| Starts | Starts | |||||||||||||

| Online |

|

|

|

|

|

|

6 | |||||||

| Campus | ||||||||||||||

| 2012 |

|

|

|

3 | ||||||||||

| 2013 |

|

|

|

|

4 | |||||||||

| 2014 |

|

|

|

3 | ||||||||||

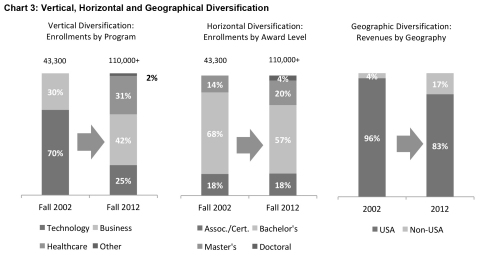

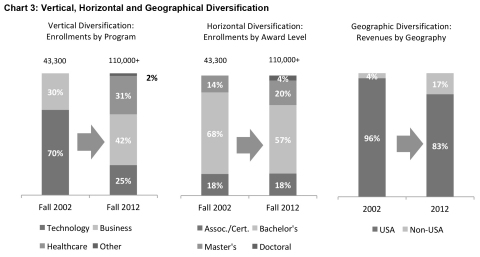

Chart 3: Vertical, Horizontal and Geographic Diversification

Please see multimedia asset.

| DEVRY INC. | |||||||||||||||||

|

CONSOLIDATED BALANCE SHEETS |

|||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| PRELIMINARY | |||||||||||||||||

| March 31, | June 30, | March 31, | |||||||||||||||

| 2013 | 2012 | 2012 | |||||||||||||||

|

ASSETS |

|||||||||||||||||

|

Current Assets |

|||||||||||||||||

| Cash and Cash Equivalents | $ | 277,994 | $ | 174,076 | $ | 329,440 | |||||||||||

| Marketable Securities and Investments | 2,952 | 2,632 | 2,665 | ||||||||||||||

| Restricted Cash | 7,151 | 2,498 | 13,194 | ||||||||||||||

| Accounts Receivable, Net | 194,398 | 113,911 | 254,661 | ||||||||||||||

| Deferred Income Taxes, Net | 24,459 | 27,845 | 23,019 | ||||||||||||||

| Refundable Income Taxes | 657 | 40,278 | 742 | ||||||||||||||

| Prepaid Expenses and Other | 40,414 | 39,874 | 41,647 | ||||||||||||||

| Total Current Assets | 548,025 | 401,114 | 665,368 | ||||||||||||||

|

Land, Buildings and Equipment |

|||||||||||||||||

| Land | 66,063 | 65,172 | 66,019 | ||||||||||||||

| Buildings | 389,345 | 386,028 | 382,972 | ||||||||||||||

| Equipment | 485,570 | 433,949 | 422,271 | ||||||||||||||

| Construction In Progress | 64,412 | 61,752 | 50,192 | ||||||||||||||

| 1,005,390 | 946,901 | 921,454 | |||||||||||||||

| Accumulated Depreciation and Amortization | (435,427 | ) | (387,924 | ) | (374,904 | ) | |||||||||||

| Land, Buildings and Equipment, Net | 569,963 | 558,977 | 546,550 | ||||||||||||||

|

Other Assets |

|||||||||||||||||

| Intangible Assets, Net | 292,098 | 285,220 | 292,118 | ||||||||||||||

| Goodwill | 566,497 | 549,961 | 567,316 | ||||||||||||||

| Perkins Program Fund, Net | 13,450 | 13,450 | 13,450 | ||||||||||||||

| Other Assets | 27,953 | 29,894 | 27,400 | ||||||||||||||

| Total Other Assets | 899,998 | 878,525 | 900,284 | ||||||||||||||

| TOTAL ASSETS | $ | 2,017,986 | $ | 1,838,616 | $ | 2,112,202 | |||||||||||

| DEVRY INC. | |||||||||||||||||

|

CONSOLIDATED BALANCE SHEETS |

|||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||

| (Unaudited) | |||||||||||||||||

| PRELIMINARY | |||||||||||||||||

| March 31, | June 30, | March 31, | |||||||||||||||

| 2013 | 2012 | 2012 | |||||||||||||||

|

LIABILITIES |

|||||||||||||||||

|

Current Liabilities |

|||||||||||||||||

| Accounts Payable | $ | 53,999 | $ | 63,094 | $ | 53,208 | |||||||||||

| Accrued Salaries, Wages and Benefits | 81,290 | 77,741 | 72,443 | ||||||||||||||

| Accrued Expenses | 76,442 | 76,243 | 56,328 | ||||||||||||||

| Advance Tuition Payments | 17,226 | 20,580 | 23,257 | ||||||||||||||

| Deferred Tuition Revenue | 180,498 | 77,551 | 349,200 | ||||||||||||||

| Total Current Liabilities | 409,455 | 315,209 | 554,436 | ||||||||||||||

|

Non-Current Liabilities |

|||||||||||||||||

| Deferred Income Taxes, Net | 58,354 | 62,276 | 63,693 | ||||||||||||||

| Deferred Rent and Other | 92,037 | 96,496 | 91,415 | ||||||||||||||

| Total Non-current Liabilities | 150,391 | 158,772 | 155,108 | ||||||||||||||

| TOTAL LIABILITIES | 559,846 | 473,981 | 709,544 | ||||||||||||||

| NON-CONTROLLING INTEREST | 9,017 | 8,242 | 8,168 | ||||||||||||||

|

SHAREHOLDERS' EQUITY |

|||||||||||||||||

| Common Stock, $0.01 par value, 200,000,000 Shares Authorized; | |||||||||||||||||

| 62,989,000, 64,722,000 and 68,831,000 Shares issued | |||||||||||||||||

| and outstanding at March 31, 2013, June 30, 2012 | |||||||||||||||||

| and March 31, 2012, respectively. | 744 | 741 | 741 | ||||||||||||||

| Additional Paid-in Capital | 285,242 | 272,962 | 267,285 | ||||||||||||||

| Retained Earnings | 1,616,850 | 1,488,988 | 1,490,371 | ||||||||||||||

| Accumulated Other Comprehensive Income | (5,934 | ) | (5,889 | ) | 3,163 | ||||||||||||

| Treasury Stock, at Cost (11,409,000, 9,386,000 and 8,266,000 | |||||||||||||||||

| Shares, Respectively) | (447,779 | ) | (400,409 | ) | (367,070 | ) | |||||||||||

| TOTAL SHAREHOLDERS' EQUITY | 1,449,123 | 1,356,393 | 1,394,490 | ||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 2,017,986 | $ | 1,838,616 | $ | 2,112,202 | |||||||||||

| DEVRY INC. | |||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME |

|||||||||||||||||||||

| (Dollars in Thousands Except for Per Share Amounts) | |||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||

| PRELIMINARY | |||||||||||||||||||||

| For The Quarter | For The Nine Months | ||||||||||||||||||||

| Ended March 31, | Ended March 31, | ||||||||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||||||||

| REVENUES: | |||||||||||||||||||||

| Tuition | $ | 472,239 | $ | 505,651 | $ | 1,400,199 | $ | 1,488,432 | |||||||||||||

| Other Educational | 36,513 | 35,156 | 96,533 | 95,462 | |||||||||||||||||

| Total Revenues | 508,752 | 540,807 | 1,496,732 | 1,583,894 | |||||||||||||||||

| OPERATING COSTS AND EXPENSES: | |||||||||||||||||||||

| Cost of Educational Services | 241,020 | 244,195 | 726,966 | 723,655 | |||||||||||||||||

| Student Services and Administrative Expense | 192,100 | 201,158 | 572,955 | 596,125 | |||||||||||||||||

| Restructuring Charges | 2,029 | - | 11,513 | ||||||||||||||||||

| Asset Impairment Charge | - | - | - | 75,039 | |||||||||||||||||

| Total Operating Costs and Expenses | 435,149 | 445,353 | 1,311,434 | 1,394,819 | |||||||||||||||||

| Operating Income | 73,603 | 95,454 | 185,298 | 189,075 | |||||||||||||||||

| INTEREST AND OTHER INCOME (EXPENSE): | |||||||||||||||||||||

| Interest Income | 415 | 110 | 1,206 | 520 | |||||||||||||||||

| Interest Expense | (756 | ) | (650 | ) | (3,006 | ) | (1,653 | ) | |||||||||||||

| Net Gain on Sale of Assets | - | - | - | 3,695 | |||||||||||||||||

| Net Interest and Other Income (Expense) | (341 | ) | (540 | ) | (1,800 | ) | 2,562 | ||||||||||||||

| Income Before Income Taxes | 73,262 | 94,914 | 183,498 | 191,637 | |||||||||||||||||

| Income Tax Provision | 16,102 | 27,610 | 43,292 | 57,741 | |||||||||||||||||

| NET INCOME | 57,160 | 67,304 | 140,206 | 133,896 | |||||||||||||||||

| Net Income Attributable to Noncontrolling Interest | (339 | ) | (173 | ) | (1,110 | ) | (416 | ) | |||||||||||||

| NET INCOME ATTRIBUTABLE TO DEVRY INC. | $ | 56,821 | $ | 67,131 | $ | 139,096 | $ | 133,480 | |||||||||||||

| EARNINGS PER COMMON SHARE ATTRIBUTABLE | |||||||||||||||||||||

| TO DEVRY INC. SHAREHOLDERS | |||||||||||||||||||||

| Basic | $ | 0.89 | $ | 1.01 | $ | 2.16 | $ | 1.97 | |||||||||||||

| Diluted | $ | 0.88 | $ | 1.00 | $ | 2.15 | $ | 1.96 | |||||||||||||

| Cash Dividend Declared per Common Share | $ | - | $ | - | $ | 0.17 | $ | 0.15 | |||||||||||||

| DEVRY INC. | ||||||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||||

| (Dollars in Thousands) | ||||||||||||||

| (Unaudited) | ||||||||||||||

| PRELIMINARY | ||||||||||||||

| For The Nine Months | ||||||||||||||

| Ended March 31, | ||||||||||||||

| 2013 | 2012 | |||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||

| Net Income | $ | 140,206 | $ | 133,896 | ||||||||||

| Adjustments to Reconcile Net Income to Net | ||||||||||||||

| Cash Provided by Operating Activities: | ||||||||||||||

| Stock-Based Compensation Expense | 12,090 | 12,891 | ||||||||||||

| Depreciation | 63,717 | 56,512 | ||||||||||||

| Amortization | 7,605 | 8,336 | ||||||||||||

| Impairment of Goodwill and Intangible Assets | - | 75,039 | ||||||||||||

| Provision for Refunds and Uncollectible Accounts | 62,432 | 73,058 | ||||||||||||

| Deferred Income Taxes | (2,760 | ) | (5,157 | ) | ||||||||||

| Loss on Disposals of Land, Buildings and Equipment | 7,914 | 805 | ||||||||||||

| Realized Gain on Sale of Assets | - | (3,695 | ) | |||||||||||

| Changes in Assets and Liabilities, Net of Effects from | ||||||||||||||

| Acquisitions and Divestitures of Businesses: | ||||||||||||||

| Restricted Cash | (4,653 | ) | (10,886 | ) | ||||||||||

| Accounts Receivable | (139,481 | ) | (212,973 | ) | ||||||||||

| Prepaid Expenses And Other | 34,216 | (5,392 | ) | |||||||||||

| Accounts Payable | (9,095 | ) | (11,327 | ) | ||||||||||

| Accrued Salaries, Wages, Expenses and Benefits | 10,812 | (26,149 | ) | |||||||||||

| Advance Tuition Payments | (3,527 | ) | 877 | |||||||||||

| Deferred Tuition Revenue | 102,947 | 269,294 | ||||||||||||

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 282,423 | 355,129 | ||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||

| Capital Expenditures | (79,329 | ) | (92,167 | ) | ||||||||||

| Marketable Securities Purchased | (268 | ) | (66 | ) | ||||||||||

| Marketable Securities Sales | - | - | ||||||||||||

| Payment for Purchase of Businesses, Net of Cash Acquired | (31,386 | ) | (250,150 | ) | ||||||||||

| Cash Received from Sale of Assets | - | 4,475 | ||||||||||||

| Other | - | - | ||||||||||||

| NET CASH USED IN INVESTING ACTIVITIES | (110,983 | ) | (337,908 | ) | ||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||

| Proceeds from Exercise of Stock Options | 1,774 | 6,041 | ||||||||||||

| Proceeds from Stock issued Under Employee Stock Purchase Plan | 1,278 | 1,298 | ||||||||||||

| Repurchase of Common Stock for Treasury | (48,353 | ) | (124,160 | ) | ||||||||||

| Cash Dividends Paid | (20,707 | ) | (18,430 | ) | ||||||||||

| Excess Tax Benefit from Stock-Based Payments | (332 | ) | 727 | |||||||||||

| Payment of Debt Financing Fees | - | (70 | ) | |||||||||||

| NET CASH USED IN FINANCING ACTIVITIES | (66,340 | ) | (134,594 | ) | ||||||||||

| Effects of Exchange Rate Differences | (1,182 | ) | (332 | ) | ||||||||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 103,918 | (117,705 | ) | |||||||||||

| Cash and Cash Equivalents at Beginning of Period | 174,076 | 447,145 | ||||||||||||

| Cash and Cash Equivalents at End of Period | $ | 277,994 | $ | 329,440 | ||||||||||

| DEVRY INC. | ||||||||||||||||||||||||

|

SEGMENT INFORMATION |

||||||||||||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| PRELIMINARY | ||||||||||||||||||||||||

| For The Quarter | For The Nine Months | |||||||||||||||||||||||

| Ended March 31, | Ended March 31, | |||||||||||||||||||||||

| Increase | Increase | |||||||||||||||||||||||

| 2013 | 2012 | (Decrease) | 2013 | 2012 | (Decrease) | |||||||||||||||||||

| REVENUES: | ||||||||||||||||||||||||

| Business, Technology and Management | $ | 283,540 | $ | 338,790 | -16.3 | % | $ | 848,393 | $ | 1,001,959 | -15.3 | % | ||||||||||||

| Medical and Healthcare | 175,125 | 160,483 | 9.1 | % | 501,228 | 461,456 | 8.6 | % | ||||||||||||||||

| International, K-12 and Professional Education | 51,209 | 41,534 | 23.3 | % | 148,233 | 120,479 | 23.0 | % | ||||||||||||||||

| Intersegment Revenues | (1,122 | ) | - | NM | (1,122 | ) | - | NM | ||||||||||||||||

| Total Consolidated Revenues | 508,752 | 540,807 | -5.9 | % | 1,496,732 | 1,583,894 | -5.5 | % | ||||||||||||||||

| OPERATING INCOME: | ||||||||||||||||||||||||

| Business, Technology and Management | 34,431 | 64,667 | -46.8 | % | 98,836 | 183,850 | -46.2 | % | ||||||||||||||||

| Medical and Healthcare | 34,635 | 25,963 | 33.4 | % | 86,522 | (2,681 | ) | NM | ||||||||||||||||

| International, K-12 and Professional Education | 8,582 | 7,214 | 19.0 | % | 22,210 | 14,378 | 54.5 | % | ||||||||||||||||

| Reconciling Items: | ||||||||||||||||||||||||

| Amortization Expense | (2,421 | ) | (2,800 | ) | -13.5 | % | (7,111 | ) | (7,844 | ) | -9.3 | % | ||||||||||||

| Depreciation and Other | (1,624 | ) | 410 | NM | (15,159 | ) | 1,372 | NM | ||||||||||||||||

| Total Consolidated Operating Income | 73,603 | 95,454 | -22.9 | % | 185,298 | 189,075 | -2.0 | % | ||||||||||||||||

| INTEREST AND OTHER INCOME (EXPENSE): | ||||||||||||||||||||||||

| Interest Income | 415 | 110 | 277.3 | % | 1,206 | 520 | 131.9 | % | ||||||||||||||||

| Interest Expense | (756 | ) | (650 | ) | 16.3 | % | (3,006 | ) | (1,653 | ) | 81.9 | % | ||||||||||||

| Net Gain on Sale of Assets | - | - | NM | - | 3,695 | NM | ||||||||||||||||||

| Net Interest and Other Income (Expense) | (341 | ) | (540 | ) | -36.9 | % | (1,800 | ) | 2,562 | NM | ||||||||||||||

| Total Consolidated Income before Income Taxes | $ | 73,262 | $ | 94,914 | -22.8 | % | $ | 183,498 | $ | 191,637 | -4.2 | % | ||||||||||||

| Restructuring charges were recorded for the three and nine months ended March 31, 2013. These charges are related to DeVry Inc. (not related to any segment), the Business, Technology and Management segment and DeVry's Carrington Colleges Group and DeVry Medical International both of which are part of the Medical and Healthcare segment. Intangible asset and goodwill impairment charges were recorded for the three and nine month periods ended March 31, 2012. These charges are related to DeVry's Carrington Colleges Group, Inc. The following table illustrates the effects of these impairment charges on the operating income of the Business, Technology and Management segment and the Medical and Healthcare segment. Management believes that the non-GAAP disclosure of operating earnings provides investors with useful supplemental information regarding the underlying business trends and performance of DeVry’s ongoing operations and are useful for period-over-period comparisons of such operations given the discrete nature of these restructuring and impairment transactions. DeVry uses these supplemental financial measures internally in its budgeting process. However, the non-GAAP financial measures should be viewed in addition to, and not as a substitute for, DeVry’s reported results prepared in accordance with GAAP. The following table reconciles these items to the relevant GAAP information: | ||||||||||||||||||||||||

| For The Quarter | For The Nine Months | |||||||||||||||||||||||

| Ended March 31, | Ended March 31, | |||||||||||||||||||||||

| Increase | Increase | |||||||||||||||||||||||

| 2013 | 2012 | (Decrease) | 2013 | 2012 | (Decrease) | |||||||||||||||||||

| Business, Technology and Management Operating Income | $ | 34,431 | $ | 64,667 | -46.8 | % | $ | 98,836 | $ | 183,850 | -46.2 | % | ||||||||||||

| Restructuring Charge | 986 | - | NM | 1,186 | - | NM | ||||||||||||||||||

| Business, Technology and Management Operating Income | ||||||||||||||||||||||||

| Excluding Restructuring Charge | $ | 35,417 | $ | 64,667 | -45.2 | % | $ | 100,022 | $ | 183,850 | -45.6 | % | ||||||||||||

| Medical and Healthcare Operating Income | $ | 34,635 | $ | 25,963 | 33.4 | % | $ | 86,522 | $ | (2,681 | ) | NM | ||||||||||||

| Restructuring Charge | 1,043 | - | NM | 2,459 | - | NM | ||||||||||||||||||

| Asset Impairment Charge | - | - | NM | - | 75,039 | NM | ||||||||||||||||||

| Medical and Healthcare Operating Income | ||||||||||||||||||||||||

| Excluding Charge for Asset Impairments | $ | 35,678 | $ | 25,963 | 37.4 | % | $ | 88,981 | $ | 72,358 | 23.0 | % | ||||||||||||