HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Advisors, a specialized investor relations (IR) advisory firm, today released its quarterly Inside The Buy-side® Earnings Primer report, which captures trends in institutional investor sentiment. The survey is based on responses from 71 institutional investors and sell-side analysts globally.

Heading into 2Q17 earnings season, those expecting improved EPS growth register the highest since the firm began tracking the measure in 1Q12, driven by economic improvement and elevated executive tone. Notably, 80% describe management messaging as Neutral to Bullish or Bullish, up from 69% last quarter and 55% of investors now classify their sentiment as such, up from 48% in 1Q17.

Sentiment toward Europe continues to trend upward, building on last quarter’s momentum, as investors seemingly applaud Macron election and shrug off Brexit.

“Investors are playing catch up and are afraid to miss further upside; people are adjusting their valuation metrics higher,” commented Jade Rahmani, analyst at Keefe, Burette & Woods.

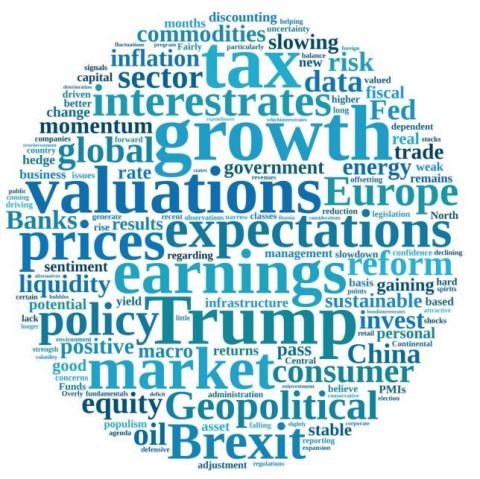

Our survey this quarter finds fewer investors believe U.S. equities are overvalued, a notable shift in sentiment, as participants have consistently maintained markets are frothy for the past four surveys, or a year. To that end, polled investors cite economic momentum, potential tax reform and low interest rate environment as the most significant drivers of the sustained U.S. bull market.

Importantly, 86% expect the Fed to raise interest rates again in 2017, the impact of which will take time to materialize. In addition, potential black swans loom on the horizon. More than half, or 55%, voice concern about U.S. political instability and D.C. dysfunction while the majority expect geopolitical volatility to remain at current levels or worsen over the next six months.

“Our research indicates investors are becoming more comfortable with valuations given evidence of real economic growth in the U.S. and Europe and largely remain committed to equities despite all major U.S. indices at or near all-time highs,” commented Rebecca Corbin, Founder and CEO of Corbin Advisors. Ms. Corbin added, “While most channel checks support cautious optimism, the U.S. political climate and ability to pass legislation lurk in the background and will essentially remain the ‘X factor.’”

Finally, investors continue to bet on Technology as the exponential impact on society continues to amplify, while Biotech bulls more than double from two quarters ago, largely driven by indications of deregulation. Bears remain generally consistent across sectors with Utilities leading the way and Energy seeing the most significant uptick in negative sentiment. Notably, downbeat sentiment on REITs ebbs slightly after four quarters of increasing negative perception.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at www.CorbinAdvisors.com.

About Corbin Advisors

Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting.

Inside the Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit www.CorbinAdvisors.com.