WAYZATA, Minn.--(BUSINESS WIRE)--TCF Financial Corporation (NYSE:TCB):

2013 HIGHLIGHTS

- Net interest margin of 4.68 percent, up 3 basis points from 2012

- Core revenue(1) of $1.2 billion, up 3.2 percent from 2012

- Provision for credit losses of $118.4 million, down 52.2 percent from 2012

- Non-accrual loans and leases of $277 million, down 27 percent from 2012

- Loan and lease originations increased $1.3 billion, or 12.4 percent, from 2012

- Average deposits increased $1 billion, or 8 percent, from 2012

FOURTH QUARTER HIGHLIGHTS

- Earnings per share of 22 cents, up 7 cents from the fourth quarter of 2012

- Core revenue(1) of $306.2 million, up 1.5 percent from the fourth quarter of 2012

- Provision for credit losses of $22.8 million, down 53 percent from the fourth quarter of 2012

- Loan and lease originations increased $213.4 million, or 7.4 percent, from the fourth quarter of 2012

- Average deposits increased $603.5 million, or 4.4 percent, from the fourth quarter of 2012

- Announced that the OCC has lifted the regulatory order related to TCF’s BSA compliance program

- Branch realignment after-tax charge of $5.6 million, or 3 cents per share, related to 46 branches to be consolidated in the first quarter of 2014

| Summary of Financial Results | Table 1 | ||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per-share data) | Percent Change | ||||||||||||||||||||||||||||||||||||||||

| 4Q | 3Q | 4Q |

|

4Q13 vs |

4Q13 vs | YTD | YTD | Percent | |||||||||||||||||||||||||||||||||

| 2013 | 2013 | 2012 |

3Q13 |

4Q12 | 2013 |

2012 (2) |

Change | ||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 35,148 | $ | 37,948 | $ | 23,551 | (7.4 | ) | % | 49.2 | % | $ | 132,603 | $ | (218,490 | ) | N.M. | % | |||||||||||||||||||||||

| Net interest income | 201,862 | 199,627 | 201,063 | 1.1 | .4 | 802,624 | 780,019 | 2.9 | |||||||||||||||||||||||||||||||||

|

Diluted earnings (loss) per common share |

.22 | .23 | .15 | (4.3 | ) | 46.7 | .82 | (1.37 | ) | N.M. | |||||||||||||||||||||||||||||||

|

Financial Ratios (3) |

|||||||||||||||||||||||||||||||||||||||||

|

Pre-tax pre-provision return on average assets (4) |

1.90 | % | 2.04 | % | 1.94 | % | 1.98 | % | (.51 | ) | % | ||||||||||||||||||||||||||||||

| Return on average assets | .90 | .97 | .63 | .87 | (1.14 | ) | |||||||||||||||||||||||||||||||||||

| Return on average common equity | 8.39 | 9.28 | 5.93 | 8.12 | (13.33 | ) | |||||||||||||||||||||||||||||||||||

| Net interest margin | 4.67 | 4.62 | 4.79 | 4.68 | 4.65 | ||||||||||||||||||||||||||||||||||||

|

Net charge-offs as a percentage of average loans and leases |

.76 | .71 | 1.18 | .81 | 1.54 | ||||||||||||||||||||||||||||||||||||

| N.M. Not Meaningful | |||||||||||||||||||||||||||||||||||||||||

| (1) | Core revenue is calculated as total revenue less gains (losses) on sales of securities of $1 million and $(528) thousand for the three months ended December 31, 2013 and 2012, respectively, and $964 thousand and $102.2 million for the year ended December 31, 2013 and 2012, respectively. | |

| (2) | Includes a net, after-tax charge of $295.8 million, or $1.87 per common share, related to the balance sheet repositioning. | |

| (3) | Annualized. | |

| (4) | Pre-tax pre-provision profit (''PTPP'') is calculated as total revenues less non-interest expense. | |

TCF Financial Corporation (“TCF” or the “Company”) (NYSE: TCB) today reported net income of $35.1 million for the fourth quarter of 2013, compared with net income of $23.6 million for the fourth quarter of 2012, and net income of $37.9 million for the third quarter of 2013. Diluted earnings per common share was 22 cents for the fourth quarter of 2013 (inclusive of a net after-tax charge of $5.6 million, or 3 cents per common share, related to the realignment of 46 branches), compared with 15 cents for the fourth quarter of 2012, and 23 cents for the third quarter of 2013.

TCF reported net income of $132.6 million for the year ended December 31, 2013, compared with a net loss of $218.5 million for the same period in 2012 (inclusive of a net after-tax charge of $295.8 million, or $1.87 per common share, related to a balance sheet repositioning involving certain investments and borrowings in the first quarter of 2012). Diluted earnings per common share was 82 cents for the year ended December 31, 2013, compared with a diluted loss per common share of $1.37 for the same period in 2012 (or earnings per common share of 49 cents when excluding the balance sheet repositioning charge).

Chairman’s Statement

“TCF’s focus in 2013 was to execute on the numerous investments we made in 2012,” said William A. Cooper, Chairman and Chief Executive Officer. “Earnings per share increased 67 percent to 82 cents in 2013 from 49 cents in 2012, excluding the balance sheet repositioning charge, reflecting the positive impact that the balance sheet repositioning had on the organization. Throughout the year, we have been successful on several initiatives as we maintained our strong pre-tax pre-provision return on average assets and significantly improved our overall credit quality. At 4.68 percent, TCF has one of the highest net interest margins in the industry. Loan and lease growth and strong origination volume and diversity continue to be a positive part of the TCF story while significant changes made to the branch system will pave the way for future customer experience enhancements in 2014.

“TCF is a much different looking bank than it was two years ago and we believe its strength and diversity will serve our customers and shareholders well in today’s banking environment. The investments in 2012 and the execution in 2013 have positioned TCF to capitalize on opportunities in 2014 and beyond. I am very excited about what lies ahead.”

| Revenue | |||||||||||||||||||||||||||||||||||||

| Total Revenue | Table 2 | ||||||||||||||||||||||||||||||||||||

| Percent Change | |||||||||||||||||||||||||||||||||||||

| 4Q | 3Q | 4Q | 4Q13 vs | 4Q13 vs | YTD | YTD | Percent | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2013 | 2013 | 2012 | 3Q13 | 4Q12 | 2013 | 2012 | Change | |||||||||||||||||||||||||||||

| Net interest income | $ | 201,862 | $ | 199,627 | $ | 201,063 | 1.1 | % | .4 | % | $ | 802,624 | $ | 780,019 | 2.9 | % | |||||||||||||||||||||

| Fees and other revenue: | |||||||||||||||||||||||||||||||||||||

| Fees and service charges | 43,254 | 42,457 | 44,262 | 1.9 | (2.3 | ) | 166,606 | 177,953 | (6.4 | ) | |||||||||||||||||||||||||||

| Card revenue | 13,066 | 13,167 | 12,974 | (.8 | ) | .7 | 51,920 | 52,638 | (1.4 | ) | |||||||||||||||||||||||||||

| ATM revenue | 5,382 | 5,941 | 5,584 | (9.4 | ) | (3.6 | ) | 22,656 | 24,181 | (6.3 | ) | ||||||||||||||||||||||||||

| Total banking fees | 61,702 | 61,565 | 62,820 | .2 | (1.8 | ) | 241,182 | 254,772 | (5.3 | ) | |||||||||||||||||||||||||||

| Leasing and equipment finance | 23,624 | 29,079 | 26,149 | (18.8 | ) | (9.7 | ) | 92,037 | 92,721 | (.7 | ) | ||||||||||||||||||||||||||

| Gains on sales of auto loans | 7,278 | 7,140 | 6,869 | 1.9 | 6.0 | 29,699 | 22,101 | 34.4 | |||||||||||||||||||||||||||||

| Gains on sales of consumer real estate loans | 5,345 | 4,152 | 854 | 28.7 | N.M. | 21,692 | 5,413 | N.M. | |||||||||||||||||||||||||||||

| Other | 6,419 | 4,304 | 3,973 | 49.1 | 61.6 | 18,484 | 13,184 | 40.2 | |||||||||||||||||||||||||||||

| Total fees and other revenue | 104,368 | 106,240 | 100,665 | (1.8 | ) | 3.7 | 403,094 | 388,191 | 3.8 | ||||||||||||||||||||||||||||

| Subtotal - core revenue | 306,230 | 305,867 | 301,728 | .1 | 1.5 | 1,205,718 | 1,168,210 | 3.2 | |||||||||||||||||||||||||||||

| Gains (losses) on securities, net | 1,044 | (80 | ) | (528 | ) | N.M. | N.M. | 964 | 102,232 | (99.1 | ) | ||||||||||||||||||||||||||

| Total revenue | $ | 307,274 | $ | 305,787 | $ | 301,200 | .5 | 2.0 | $ | 1,206,682 | $ | 1,270,442 | (5.0 | ) | |||||||||||||||||||||||

| Net interest margin (1) | 4.67 | % | 4.62 | % | 4.79 | % | 4.68 | % | 4.65 | % | |||||||||||||||||||||||||||

|

Fees and other revenue as a % of total revenue |

33.97 | 34.74 | 33.42 | 33.41 | 30.56 | ||||||||||||||||||||||||||||||||

| N.M. Not meaningful. | |||||||||||||||||||||||||||||||||||||

| (1) Annualized. | |||||||||||||||||||||||||||||||||||||

Net Interest Income

- Net interest income for the fourth quarter of 2013 increased $799 thousand, or .4 percent, compared with the fourth quarter of 2012. The increase was driven by higher average loan and lease balances in the auto finance and inventory finance businesses as well as decreased rates on various deposit products. This increase was partially offset by downward pressure on yields across the lending businesses in this low interest rate environment as well as lower average balances of consumer real estate and commercial fixed-rate loans due to run-off exceeding originations.

- Net interest income for the fourth quarter of 2013 increased $2.2 million, or 1.1 percent, compared with the third quarter of 2013. The increase was attributable to higher average loan and lease balances in the auto finance and inventory finance businesses as well as decreased rates on various deposit products, partially offset by lower average balances of fixed-rate commercial loans primarily resulting from run-off and the impact of a portfolio loan sale.

- Net interest margin in the fourth quarter of 2013 was 4.67 percent, compared with 4.79 percent in the fourth quarter of 2012 and 4.62 percent in the third quarter of 2013. The decrease from the fourth quarter of 2012 was primarily due to downward pressure on origination yields in the lending businesses due to the low interest rate environment as well as a shift in commercial real estate from higher yielding fixed-rate loans to lower yielding variable-rate loans due to marketplace demand. The increase from the third quarter of 2013 was primarily due to cash balances held at the Federal Reserve in the previous quarter being utilized to fund asset growth and a decline in overall funding costs.

Non-interest Income

- Fees and service charges in the fourth quarter of 2013 were $43.3 million, down $1 million, or 2.3 percent, from the fourth quarter of 2012. The decrease from the fourth quarter of 2012 was due to lower transaction activity and higher average checking account balances per customer, partially offset by a larger account base.

- Leasing and equipment finance revenue was $23.6 million during the fourth quarter of 2013, down $2.5 million, or 9.7 percent, from the fourth quarter of 2012 and down $5.5 million, or 18.8 percent, from the third quarter of 2013. These decreases were primarily due to lower sales-type lease revenue in the leasing and equipment finance portfolio as a result of customer-driven events.

- TCF sold $236 million, $159.6 million and $182.5 million of auto loans during the fourth quarters of 2013 and 2012, and the third quarter of 2013, respectively, resulting in gains in the same respective periods.

- TCF sold $202.3 million, $25.7 million and $142.4 million of consumer real estate loans during the fourth quarters of 2013 and 2012, and the third quarter of 2013, respectively, resulting in gains in the same respective periods.

| Loans and Leases | |||||||||||||||||||||||||||||||||||

| Period-End and Average Loans and Leases | Table 3 | ||||||||||||||||||||||||||||||||||

| Percent Change | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 4Q | 3Q | 4Q | 4Q13 vs | 4Q13 vs | YTD | YTD | Percent | |||||||||||||||||||||||||||

| 2013 | 2013 | 2012 | 3Q13 | 4Q12 | 2013 | 2012 | Change | ||||||||||||||||||||||||||||

| Period-End: | |||||||||||||||||||||||||||||||||||

| Consumer real estate | $ | 6,339,326 | $ | 6,415,632 | $ | 6,674,501 | (1.2 | ) | % | (5.0 | ) | % | |||||||||||||||||||||||

| Commercial | 3,148,352 | 3,137,088 | 3,405,235 | .4 | (7.5 | ) | |||||||||||||||||||||||||||||

| Leasing and equipment finance | 3,428,755 | 3,286,506 | 3,198,017 | 4.3 | 7.2 | ||||||||||||||||||||||||||||||

| Inventory finance | 1,664,377 | 1,716,542 | 1,567,214 | (3.0 | ) | 6.2 | |||||||||||||||||||||||||||||

| Auto finance | 1,239,386 | 1,069,053 | 552,833 | 15.9 | 124.2 | ||||||||||||||||||||||||||||||

| Other | 26,743 | 26,827 | 27,924 | (.3 | ) | (4.2 | ) | ||||||||||||||||||||||||||||

| Total | $ | 15,846,939 | $ | 15,651,648 | $ | 15,425,724 | 1.2 | 2.7 | |||||||||||||||||||||||||||

| Average: | |||||||||||||||||||||||||||||||||||

| Consumer real estate | $ | 6,412,182 | $ | 6,402,612 | $ | 6,663,660 | .1 | % | (3.8 | ) | % | $ | 6,449,950 | $ | 6,757,512 | (4.6 | ) | % | |||||||||||||||||

| Commercial | 3,088,524 | 3,282,880 | 3,452,768 | (5.9 | ) | (10.5 | ) | 3,262,746 | 3,485,218 | (6.4 | ) | ||||||||||||||||||||||||

| Leasing and equipment finance | 3,342,182 | 3,261,638 | 3,184,540 | 2.5 | 5.0 | 3,260,425 | 3,155,946 | 3.3 | |||||||||||||||||||||||||||

| Inventory finance | 1,734,286 | 1,637,538 | 1,570,829 | 5.9 | 10.4 | 1,723,253 | 1,434,643 | 20.1 | |||||||||||||||||||||||||||

| Auto finance | 1,157,586 | 973,418 | 504,565 | 18.9 | 129.4 | 907,571 | 296,083 | N.M. | |||||||||||||||||||||||||||

| Other | 13,369 | 12,299 | 14,704 | 8.7 | (9.1 | ) | 13,088 | 16,549 | (20.9 | ) | |||||||||||||||||||||||||

| Total | $ | 15,748,129 | $ | 15,570,385 | $ | 15,391,066 | 1.1 | 2.3 | $ | 15,617,033 | $ | 15,145,951 | 3.1 | ||||||||||||||||||||||

| N.M. Not meaningful. | |||||||||||||||||||||||||||||||||||

- Loans and leases were $15.8 billion at December 31, 2013, an increase of $421.2 million, or 2.7 percent, compared with December 31, 2012. Average loans and leases were $15.7 billion for the fourth quarter of 2013, an increase of $357.1 million, or 2.3 percent, compared with the fourth quarter of 2012. The increases in period-end and average loans and leases were primarily due to the continued growth of the auto finance portfolio as TCF expands the number of active dealers and sales force in its network and further penetrates existing territories, as well as an increase in both the leasing and equipment finance and inventory finance portfolios. These increases were partially offset by decreases in commercial loans, primarily due to run-off exceeding new originations, as well as decreases in consumer real estate loans driven by run-off in the first mortgage real estate business and ongoing loan sales.

- Loan and lease originations were $3.1 billion for the fourth quarter of 2013, an increase of $213.4 million, or 7.4 percent, compared with the fourth quarter of 2012. This increase was due to the continued growth within auto finance, as well as an increase in leasing and equipment finance originations as a result of an improving economic environment and customer-driven events.

Credit Quality

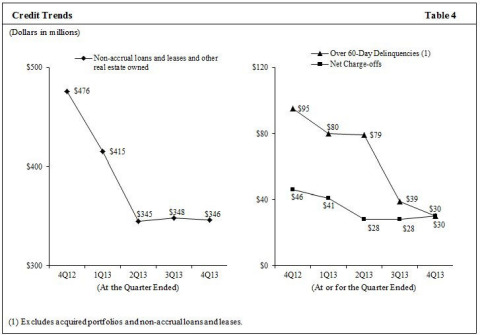

(Table 4 - Credit Trends: http://www.businesswire.com/cgi-bin/mmg.cgi?eid=50791368&lang=en)

- Non-accrual loans and leases were $277 million at December 31, 2013, a decrease of $102.4 million, or 27 percent, from December 31, 2012. The decrease from December 31, 2012 was primarily due to continued efforts to actively work out problem loans in the commercial portfolio. The decrease was further driven by fewer non-accrual consumer real estate loans as a result of improved credit quality, and the sale of $40.5 million of non-accrual loans during the second quarter of 2013. The reduction was partially offset by $48.6 million of delinquent loans entering non-accrual status due to a change in the non-accrual policy for consumer real estate loans during the third quarter of 2013.

- Other real estate owned was $68.9 million at December 31, 2013, a decrease of $28.1 million from December 31, 2012. The decrease was primarily due to a portfolio sale of 184 consumer properties during the first quarter of 2013 and continued efforts to actively work out problem assets.

- The over 60-day delinquency rate, excluding acquired portfolios and non-accrual loans and leases, at December 31, 2013 was .19 percent, down from .25 percent at September 30, 2013 and .64 percent at December 31, 2012. The decrease from September 30, 2013 was primarily driven by loans in the commercial portfolio which were previously delinquent becoming current during the quarter. The decrease from December 31, 2012 was primarily a result of reduced over 60-day delinquencies in the consumer real estate portfolio due to a change in the non-accrual policy for consumer real estate loans during the third quarter of 2013.

- Net charge-offs were $30.1 million for the fourth quarter of 2013, an increase of $2.5 million from the third quarter of 2013 and a decrease of $15.4 million from the fourth quarter of 2012. The increase from September 30, 2013 was primarily driven by a charge-off on one large commercial loan reserved for in a previous quarter. The decrease from December 31, 2012 was primarily due to improved credit quality in the consumer real estate portfolio as home values improve and incident rates of default decline. Consumer real estate net charge-offs were down for the fifth consecutive quarter.

- Provision for credit losses was $22.8 million for the fourth quarter of 2013, a decrease of $1.8 million from the third quarter of 2013 and a decrease of $25.7 million from the fourth quarter of 2012. The decrease from the third quarter of 2013 was due to reduced reserve requirements in the commercial and consumer real estate portfolios as credit quality in those portfolios improved. The decrease from the fourth quarter of 2012 was primarily due to decreased net charge-offs in the consumer real estate portfolio resulting from improved home values and a reduction in incidents of default.

| Deposits | ||||||||||||||||||||||||||||||||||||||

| Average Deposits | Table 5 | |||||||||||||||||||||||||||||||||||||

| Percent Change | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 4Q | 3Q | 4Q | 4Q13 vs | 4Q13 vs | YTD | YTD | Percent | ||||||||||||||||||||||||||||||

| 2013 | 2013 | 2012 | 3Q13 | 4Q12 | 2013 | 2012 | Change | |||||||||||||||||||||||||||||||

| Checking | $ | 4,904,125 | $ | 4,833,196 | $ | 4,627,627 | 1.5 | % | 6.0 | % | $ | 4,851,952 | $ | 4,602,881 | 5.4 | % | ||||||||||||||||||||||

| Savings | 6,217,662 | 6,258,866 | 6,103,302 | (.7 | ) | 1.9 | 6,168,768 | 6,059,237 | 1.8 | |||||||||||||||||||||||||||||

| Money market | 845,562 | 822,094 | 819,596 | 2.9 | 3.2 | 818,814 | 770,104 | 6.3 | ||||||||||||||||||||||||||||||

| Subtotal | 11,967,349 | 11,914,156 | 11,550,525 | .4 | 3.6 | 11,839,534 | 11,432,222 | 3.6 | ||||||||||||||||||||||||||||||

| Certificates of deposit | 2,392,896 | 2,401,811 | 2,206,173 | (.4 | ) | 8.5 | 2,369,992 | 1,727,859 | 37.2 | |||||||||||||||||||||||||||||

| Total average deposits | $ | 14,360,245 | $ | 14,315,967 | $ | 13,756,698 | .3 | 4.4 | $ | 14,209,526 | $ | 13,160,081 | 8.0 | |||||||||||||||||||||||||

| Average interest rate on deposits (1) | .23 | % | .27 | % | .32 | % | .26 | % | .31 | % | ||||||||||||||||||||||||||||

| (1) Annualized. | ||||||||||||||||||||||||||||||||||||||

- Total average deposits for the fourth quarter of 2013 increased $603.5 million, or 4.4 percent, from the fourth quarter of 2012 and increased $44.3 million, or .3 percent, from the third quarter of 2013. The increase from the fourth quarter of 2012 was primarily due to checking account growth, as well as special campaigns for certificates of deposit. The increase from the third quarter of 2013 was primarily due to higher average checking account balances per customer as well as higher average money market balances, partially offset by lower average savings balances.

- The average interest rate on deposits in the fourth quarter of 2013 was .23 percent, down nine basis points from the fourth quarter of 2012 and down four basis points from the third quarter of 2013. The decreases from both periods were primarily due to reduced average interest rates on various savings accounts and certificates of deposit.

| Non-interest Expense | ||||||||||||||||||||||||||||||||||||||

| Non-interest Expense | Table 6 | |||||||||||||||||||||||||||||||||||||

| Percent Change | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 4Q | 3Q | 4Q | 4Q13 vs | 4Q13 vs | YTD | YTD | Percent | ||||||||||||||||||||||||||||||

| 2013 | 2013 | 2012 | 3Q13 | 4Q12 | 2013 | 2012 | Change | |||||||||||||||||||||||||||||||

|

Compensation and employee benefits |

$ | 108,589 | $ | 110,833 | $ | 101,678 | (2.0 | ) | % | 6.8 | % | $ | 429,188 | $ | 393,841 | 9.0 | % | |||||||||||||||||||||

| Occupancy and equipment | 35,504 | 33,253 | 32,809 | 6.8 | 8.2 | 134,694 | 130,792 | 3.0 | ||||||||||||||||||||||||||||||

| FDIC insurance | 7,892 | 8,102 | 8,671 | (2.6 | ) | (9.0 | ) | 32,066 | 30,425 | 5.4 | ||||||||||||||||||||||||||||

| Operating lease depreciation | 6,009 | 6,706 | 5,905 | (10.4 | ) | 1.8 | 24,500 | 25,378 | (3.5 | ) | ||||||||||||||||||||||||||||

| Advertising and marketing | 3,275 | 4,593 | 4,303 | (28.7 | ) | (23.9 | ) | 19,132 | 16,572 | 15.4 | ||||||||||||||||||||||||||||

| Deposit account premiums | 479 | 664 | 523 | (27.9 | ) | (8.4 | ) | 2,345 | 8,669 | (72.9 | ) | |||||||||||||||||||||||||||

| Other | 44,162 | 43,730 | 53,472 | 1.0 | (17.4 | ) | 167,777 | 163,897 | 2.4 | |||||||||||||||||||||||||||||

| Core operating expenses | 205,910 | 207,881 | 207,361 | (.9 | ) | (.7 | ) | 809,702 | 769,574 | 5.2 | ||||||||||||||||||||||||||||

| Loss on termination of debt | - | - | - | - | - | - | 550,735 | (100.0 | ) | |||||||||||||||||||||||||||||

| Branch realignment | 8,869 | - | - | N.M. | N.M. | 8,869 | - | N.M. | ||||||||||||||||||||||||||||||

|

Foreclosed real estate and repossessed assets, net |

6,066 | 4,162 | 7,582 | 45.7 | (20.0 | ) | 27,950 | 41,358 | (32.4 | ) | ||||||||||||||||||||||||||||

| Other credit costs, net | (376 | ) | 189 | (894 | ) | N.M. | 57.9 | (1,252 | ) | 887 | N.M. | |||||||||||||||||||||||||||

| Total non-interest expense | $ | 220,469 | $ | 212,232 | $ | 214,049 | 3.9 | 3.0 | $ | 845,269 | $ | 1,362,554 | (38.0 | ) | ||||||||||||||||||||||||

| N.M. Not meaningful. | ||||||||||||||||||||||||||||||||||||||

- Compensation and employee benefits expense for the fourth quarter of 2013 increased $6.9 million, or 6.8 percent, from the fourth quarter of 2012. The increase from the fourth quarter of 2012 was primarily due to increased staff levels to support the growth of auto finance and expenses related to higher commissions based on production results and performance incentives.

- Foreclosed real estate and repossessed assets expense decreased $1.5 million, or 20 percent, from the fourth quarter of 2012 and increased $1.9 million, or 45.7 percent, from the third quarter of 2013. The decrease from the fourth quarter of 2012 was driven by reduced expenses related to fewer foreclosed consumer properties and a reduction in write-downs in balances of existing foreclosed real estate properties as a result of improved real estate property values. The increase from the third quarter of 2013 was primarily due to continued efforts to actively work out problem commercial loans.

- TCF executed a realignment of its retail banking system to support its strategic initiatives, which resulted in a pre-tax charge of $8.9 million in the fourth quarter of 2013. The consolidation of 46 branches in Illinois and Minnesota (45 in-store branches and 1 traditional branch) will occur near the end of the first quarter of 2014. The ongoing benefit of this branch realignment is expected to exceed the pre-tax charges, together with the estimated financial impact of related ongoing account attrition, over a period of approximately one year.

| Capital | ||||||||||||||

| Capital Information | Table 7 | |||||||||||||

| At period end | ||||||||||||||

| (Dollars in thousands, except per-share data) | 4Q | 4Q | ||||||||||||

| 2013 | 2012 | |||||||||||||

| Total equity | $ | 1,964,759 | $ | 1,876,643 | ||||||||||

| Book value per common share | $ | 10.23 | $ | 9.79 | ||||||||||

| Tangible realized common equity to tangible assets (1) | 8.18 | % | 7.52 | % | ||||||||||

| Risk-based capital (2) | ||||||||||||||

| Tier 1 | $ | 1,763,682 | 11.41 | % | $ | 1,633,336 | 11.09 | % | ||||||

| Total | 2,107,981 | 13.64 | 2,007,835 | 13.63 | ||||||||||

| Tier 1 leverage capital | $ | 1,763,682 | 9.71 | % | $ | 1,633,336 | 9.21 | % | ||||||

| Tier 1 common capital (3) | $ | 1,488,651 | 9.63 | % | $ | 1,356,826 | 9.21 | % | ||||||

|

(1) |

Excludes the impact of preferred shares, goodwill, other intangibles and accumulated other comprehensive (loss) income (see “Reconciliation of GAAP to Non-GAAP Financial Measures” table). |

|

|

(2) |

The Company's capital ratios continue to be in excess of "well-capitalized" regulatory benchmarks. |

|

|

(3) |

Excludes the effect of preferred shares and qualifying non-controlling interest in subsidiaries (see “Reconciliation of GAAP to Non-GAAP Financial Measures” table). |

- On January 25, 2014, the Board of Directors of TCF declared a regular quarterly cash dividend of 5 cents per common share, payable on March 3, 2014, to stockholders of record at the close of business on February 14, 2014. TCF also declared dividends on the 7.50% Series A and 6.45% Series B Non-Cumulative Perpetual Preferred Stock, both payable on March 3, 2014, to stockholders of record at the close of business on February 14, 2014.

- All capital ratios improved during the period, with retained earnings less dividends supporting the asset growth of the organization.

Webcast Information

A live webcast of TCF’s conference call to discuss the 2013 year-end and fourth quarter earnings will be hosted at TCF’s website, http://ir.tcfbank.com, on January 29, 2014 at 8:00 a.m. CT. A slide presentation for the call will be available on the website prior to the call. Additionally, the webcast will be available for replay at TCF’s website after the conference call. The website also includes free access to company news releases, TCF’s annual report, investor presentations and SEC filings.

__________________________________________________________________________________________

TCF is a Wayzata, Minnesota-based national bank holding company. As of December 31, 2013, TCF had $18.4 billion in total assets and nearly 430 branches in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana, Arizona and South Dakota, providing retail and commercial banking services. TCF, through its subsidiaries, also conducts commercial leasing and equipment finance business in all 50 states, commercial inventory finance business in the U.S. and Canada, and indirect auto finance business in 45 states. For more information about TCF, please visit http://ir.tcfbank.com.

__________________________________________________________________________________________

Cautionary Statements for Purposes of the Safe Harbor Provisions of the Securities Litigation Reform Act

Any statements contained in this earnings release regarding the outlook for the Company’s businesses and their respective markets, such as projections of future performance, guidance, statements of the Company’s plans and objectives, forecasts of market trends and other matters, are forward-looking statements based on the Company’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,” “will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, TCF claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events.

Certain factors could cause the Company’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this earnings release. These factors include the factors discussed in Part I, Item 1A of the Company’s Annual Report on Form 10-K under the heading “Risk Factors,” the factors discussed below and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive.

Adverse Economic or Business Conditions; Competitive Conditions; Credit and Other Risks. Deterioration in general economic and banking industry conditions, including those arising from government shutdowns, defaults, anticipated defaults or rating agency downgrades of sovereign debt (including debt of the U.S.), or continued high rates of or increases in unemployment in TCF’s primary banking markets; adverse economic, business and competitive developments such as shrinking interest margins, reduced demand for financial services and loan and lease products, deposit outflows, deposit account attrition or an inability to increase the number of deposit accounts; customers completing financial transactions without using a bank; adverse changes in credit quality and other risks posed by TCF’s loan, lease, investment and securities available for sale portfolios, including declines in commercial or residential real estate values, changes in the allowance for loan and lease losses dictated by new market conditions or regulatory requirements, or the inability of home equity line borrowers to make increased payments caused by increased interest rates or amortization of principal; deviations from estimates of prepayment rates and fluctuations in interest rates that result in decreases in value of assets such as interest-only strips that arise in connection with TCF’s loan sales activity; interest rate risks resulting from fluctuations in prevailing interest rates or other factors that result in a mismatch between yields earned on TCF’s interest-earning assets and the rates paid on its deposits and borrowings; foreign currency exchange risks; counterparty risk, including the risk of defaults by our counterparties or diminished availability of counterparties who satisfy our credit quality requirements; decreases in demand for the types of equipment that TCF leases or finances; the effect of any negative publicity.

Legislative and Regulatory Requirements. New consumer protection and supervisory requirements and regulations, including those resulting from action by the Consumer Financial Protection Bureau and changes in the scope of Federal preemption of state laws that could be applied to national banks and their subsidiaries; the imposition of requirements that adversely impact TCF’s lending, loan collection and other business activities as a result of the Dodd-Frank Act, or other legislative or regulatory developments such as mortgage foreclosure moratorium laws, use by municipalities of eminent domain on underwater mortgages, or imposition of underwriting or other limitations that impact the ability to use certain variable-rate products; impact of legislative, regulatory or other changes affecting customer account charges and fee income; application of bankruptcy laws which result in the loss of all or part of TCF’s security interest due to collateral value declines; deficiencies in TCF’s regulatory compliance programs, which may result in regulatory enforcement actions, including monetary penalties; increased health care costs resulting from Federal health care reform legislation; adverse regulatory examinations and resulting adverse consequences such as increased capital requirements or higher deposit insurance assessments; heightened regulatory practices, requirements or expectations, including, but not limited to, requirements related to the Bank Secrecy Act and anti-money laundering compliance activity.

Earnings/Capital Risks and Constraints, Liquidity Risks. Limitations on TCF’s ability to pay dividends or to increase dividends because of financial performance deterioration, regulatory restrictions or limitations; increased deposit insurance premiums, special assessments or other costs related to adverse conditions in the banking industry, the economic impact on banks of the Dodd-Frank Act and other regulatory reform legislation; the impact of financial regulatory reform, including additional capital, leverage, liquidity and risk management requirements or changes in the composition of qualifying regulatory capital (including those resulting from U.S. implementation of Basel III requirements); adverse changes in securities markets directly or indirectly affecting TCF’s ability to sell assets or to fund its operations; diminished unsecured borrowing capacity resulting from TCF credit rating downgrades and unfavorable conditions in the credit markets that restrict or limit various funding sources; costs associated with new regulatory requirements or interpretive guidance relating to liquidity; uncertainties relating to regulatory requirements or customer opt-in preferences with respect to overdraft, which may have an adverse impact on TCF’s fee revenue; uncertainties relating to future retail deposit account changes, including limitations on TCF’s ability to predict customer behavior and the impact on TCF’s fee revenues.

Supermarket Branching Risk; Growth Risks. Adverse developments affecting TCF’s supermarket banking relationships or any of the supermarket chains in which TCF maintains supermarket branches; costs related to closing underperforming branches; slower than anticipated growth in existing or acquired businesses; inability to successfully execute on TCF’s growth strategy through acquisitions or cross-selling opportunities; failure to expand or diversify TCF’s balance sheet through programs or new opportunities; failure to successfully attract and retain new customers, including the failure to attract and retain manufacturers and dealers to expand the inventory finance business; failure to effectuate, and risks of claims related to, sales and securitizations of loans; risks related to new product additions and addition of distribution channels (or entry into new markets) for existing products.

Technological and Operational Matters. Technological or operational difficulties, loss or theft of information (including the loss of account information by, or theft from, third parties such as merchants), cyber-attacks and other security breaches, counterparty failures and the possibility that deposit account losses (fraudulent checks, etc.) may increase; failure to keep pace with technological change.

Litigation Risks. Results of litigation, including class action litigation concerning TCF’s lending or deposit activities including account servicing processes or fees or charges, or employment practices, the effect of interchange rate litigation against the Federal Reserve on debit card interchange fees and possible increases in indemnification obligations for certain litigation against Visa U.S.A. and potential reductions in card revenues resulting from such litigation or other litigation against Visa.

Accounting, Audit, Tax and Insurance Matters. Changes in accounting standards or interpretations of existing standards; federal or state monetary, fiscal or tax policies, including adoption of state legislation that would increase state taxes; ineffective internal controls; adverse federal, state or foreign tax assessments or findings in tax audits; lack of or inadequate insurance coverage for claims against TCF; potential for claims and legal action related to TCF’s fiduciary responsibilities.

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||||||||

| (Dollars in thousands, except per-share data) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Three Months Ended December 31, | Change | |||||||||||||||||||

| 2013 | 2012 | $ | % | |||||||||||||||||

| Interest income: | ||||||||||||||||||||

| Loans and leases | $ | 204,042 | $ | 210,490 | $ | (6,448 | ) | (3.1 | ) | % | ||||||||||

| Securities available for sale | 4,194 | 4,615 | (421 | ) | (9.1 | ) | ||||||||||||||

| Investments and other | 7,693 | 3,922 | 3,771 | 96.1 | ||||||||||||||||

| Total interest income | 215,929 | 219,027 | (3,098 | ) | (1.4 | ) | ||||||||||||||

| Interest expense: | ||||||||||||||||||||

| Deposits | 8,428 | 10,972 | (2,544 | ) | (23.2 | ) | ||||||||||||||

| Borrowings | 5,639 | 6,992 | (1,353 | ) | (19.4 | ) | ||||||||||||||

| Total interest expense | 14,067 | 17,964 | (3,897 | ) | (21.7 | ) | ||||||||||||||

| Net interest income | 201,862 | 201,063 | 799 | .4 | ||||||||||||||||

| Provision for credit losses | 22,792 | 48,520 | (25,728 | ) | (53.0 | ) | ||||||||||||||

| Net interest income after provision for credit losses | 179,070 | 152,543 | 26,527 | 17.4 | ||||||||||||||||

| Non-interest income: | ||||||||||||||||||||

| Fees and service charges | 43,254 | 44,262 | (1,008 | ) | (2.3 | ) | ||||||||||||||

| Card revenue | 13,066 | 12,974 | 92 | .7 | ||||||||||||||||

| ATM revenue | 5,382 | 5,584 | (202 | ) | (3.6 | ) | ||||||||||||||

| Subtotal | 61,702 | 62,820 | (1,118 | ) | (1.8 | ) | ||||||||||||||

| Leasing and equipment finance | 23,624 | 26,149 | (2,525 | ) | (9.7 | ) | ||||||||||||||

| Gains on sales of auto loans | 7,278 | 6,869 | 409 | 6.0 | ||||||||||||||||

| Gains on sales of consumer real estate loans | 5,345 | 854 | 4,491 | N.M. | ||||||||||||||||

| Other | 6,419 | 3,973 | 2,446 | 61.6 | ||||||||||||||||

| Fees and other revenue | 104,368 | 100,665 | 3,703 | 3.7 | ||||||||||||||||

| Gains (losses) on securities, net | 1,044 | (528 | ) | 1,572 | N.M. | |||||||||||||||

| Total non-interest income | 105,412 | 100,137 | 5,275 | 5.3 | ||||||||||||||||

| Non-interest expense: | ||||||||||||||||||||

| Compensation and employee benefits | 108,589 | 101,678 | 6,911 | 6.8 | ||||||||||||||||

| Occupancy and equipment | 35,504 | 32,809 | 2,695 | 8.2 | ||||||||||||||||

| FDIC insurance | 7,892 | 8,671 | (779 | ) | (9.0 | ) | ||||||||||||||

| Operating lease depreciation | 6,009 | 5,905 | 104 | 1.8 | ||||||||||||||||

| Advertising and marketing | 3,275 | 4,303 | (1,028 | ) | (23.9 | ) | ||||||||||||||

| Deposit account premiums | 479 | 523 | (44 | ) | (8.4 | ) | ||||||||||||||

| Other | 44,162 | 53,472 | (9,310 | ) | (17.4 | ) | ||||||||||||||

| Subtotal | 205,910 | 207,361 | (1,451 | ) | (.7 | ) | ||||||||||||||

| Branch realignment | 8,869 | - | 8,869 | N.M. | ||||||||||||||||

| Foreclosed real estate and repossessed assets, net | 6,066 | 7,582 | (1,516 | ) | (20.0 | ) | ||||||||||||||

| Other credit costs, net | (376 | ) | (894 | ) | 518 | 57.9 | ||||||||||||||

| Total non-interest expense | 220,469 | 214,049 | 6,420 | 3.0 | ||||||||||||||||

| Income before income tax expense | 64,013 | 38,631 | 25,382 | 65.7 | ||||||||||||||||

| Income tax expense | 22,791 | 10,540 | 12,251 | 116.2 | ||||||||||||||||

| Income after income tax expense | 41,222 | 28,091 | 13,131 | 46.7 | ||||||||||||||||

| Income attributable to non-controlling interest | 1,227 | 1,306 | (79 | ) | (6.0 | ) | ||||||||||||||

| Net income attributable to TCF Financial Corporation | 39,995 | 26,785 | 13,210 | 49.3 | ||||||||||||||||

| Preferred stock dividends | 4,847 | 3,234 | 1,613 | 49.9 | ||||||||||||||||

| Net income available to common stockholders | $ | 35,148 | $ | 23,551 | $ | 11,597 | 49.2 | |||||||||||||

| Net income per common share: | ||||||||||||||||||||

| Basic | $ | .22 | $ | .15 | $ | .07 | 46.7 |

% |

||||||||||||

| Diluted | .22 | .15 | .07 | 46.7 |

|

|||||||||||||||

| Dividends declared per common share | $ | .05 | $ | .05 | $ | - | - |

% |

||||||||||||

|

Average common and common equivalent shares outstanding (in thousands): |

||||||||||||||||||||

| Basic | 161,544 | 159,914 | 1,630 | 1.0 |

% |

|||||||||||||||

| Diluted | 162,625 | 160,500 | 2,125 | 1.3 | ||||||||||||||||

| N.M. Not meaningful. | ||||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||||||||

| (Dollars in thousands, except per-share data) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Year Ended December 31, | Change | |||||||||||||||||||

| 2013 | 2012 | $ | % | |||||||||||||||||

| Interest income: | ||||||||||||||||||||

| Loans and leases | $ | 819,501 | $ | 835,380 | $ | (15,879 | ) | (1.9 | ) | % | ||||||||||

| Securities available for sale | 18,074 | 35,150 | (17,076 | ) | (48.6 | ) | ||||||||||||||

| Investments and other | 26,965 | 14,093 | 12,872 | 91.3 | ||||||||||||||||

| Total interest income | 864,540 | 884,623 | (20,083 | ) | (2.3 | ) | ||||||||||||||

| Interest expense: | ||||||||||||||||||||

| Deposits | 36,604 | 40,987 | (4,383 | ) | (10.7 | ) | ||||||||||||||

| Borrowings | 25,312 | 63,617 | (38,305 | ) | (60.2 | ) | ||||||||||||||

| Total interest expense | 61,916 | 104,604 | (42,688 | ) | (40.8 | ) | ||||||||||||||

| Net interest income | 802,624 | 780,019 | 22,605 | 2.9 | ||||||||||||||||

| Provision for credit losses | 118,368 | 247,443 | (129,075 | ) | (52.2 | ) | ||||||||||||||

| Net interest income after provision for credit losses | 684,256 | 532,576 | 151,680 | 28.5 | ||||||||||||||||

| Non-interest income: | ||||||||||||||||||||

| Fees and service charges | 166,606 | 177,953 | (11,347 | ) | (6.4 | ) | ||||||||||||||

| Card revenue | 51,920 | 52,638 | (718 | ) | (1.4 | ) | ||||||||||||||

| ATM revenue | 22,656 | 24,181 | (1,525 | ) | (6.3 | ) | ||||||||||||||

| Subtotal | 241,182 | 254,772 | (13,590 | ) | (5.3 | ) | ||||||||||||||

| Leasing and equipment finance | 92,037 | 92,721 | (684 | ) | (.7 | ) | ||||||||||||||

| Gains on sales of auto loans | 29,699 | 22,101 | 7,598 | 34.4 | ||||||||||||||||

| Gains on sales of consumer real estate loans | 21,692 | 5,413 | 16,279 | N.M. | ||||||||||||||||

| Other | 18,484 | 13,184 | 5,300 | 40.2 | ||||||||||||||||

| Fees and other revenue | 403,094 | 388,191 | 14,903 | 3.8 | ||||||||||||||||

| Gains on securities, net | 964 | 102,232 | (101,268 | ) | (99.1 | ) | ||||||||||||||

| Total non-interest income | 404,058 | 490,423 | (86,365 | ) | (17.6 | ) | ||||||||||||||

| Non-interest expense: | ||||||||||||||||||||

| Compensation and employee benefits | 429,188 | 393,841 | 35,347 | 9.0 | ||||||||||||||||

| Occupancy and equipment | 134,694 | 130,792 | 3,902 | 3.0 | ||||||||||||||||

| FDIC insurance | 32,066 | 30,425 | 1,641 | 5.4 | ||||||||||||||||

| Operating lease depreciation | 24,500 | 25,378 | (878 | ) | (3.5 | ) | ||||||||||||||

| Advertising and marketing | 19,132 | 16,572 | 2,560 | 15.4 | ||||||||||||||||

| Deposit account premiums | 2,345 | 8,669 | (6,324 | ) | (72.9 | ) | ||||||||||||||

| Other | 167,777 | 163,897 | 3,880 | 2.4 | ||||||||||||||||

| Subtotal | 809,702 | 769,574 | 40,128 | 5.2 | ||||||||||||||||

| Loss on termination of debt | - | 550,735 | (550,735 | ) | (100.0 | ) | ||||||||||||||

| Branch realignment | 8,869 | - | 8,869 | N.M. | ||||||||||||||||

| Foreclosed real estate and repossessed assets, net | 27,950 | 41,358 | (13,408 | ) | (32.4 | ) | ||||||||||||||

| Other credit costs, net | (1,252 | ) | 887 | (2,139 | ) | N.M. | ||||||||||||||

| Total non-interest expense | 845,269 | 1,362,554 | (517,285 | ) | (38.0 | ) | ||||||||||||||

| Income (loss) before income tax expense (benefit) | 243,045 | (339,555 | ) | 582,600 | N.M. | |||||||||||||||

| Income tax expense (benefit) | 84,345 | (132,858 | ) | 217,203 | N.M. | |||||||||||||||

| Income (loss) after income tax expense (benefit) | 158,700 | (206,697 | ) | 365,397 | N.M. | |||||||||||||||

| Income attributable to non-controlling interest | 7,032 | 6,187 | 845 | 13.7 | ||||||||||||||||

| Net income (loss) attributable to TCF Financial Corporation | 151,668 | (212,884 | ) | 364,552 | N.M. | |||||||||||||||

| Preferred stock dividends | 19,065 | 5,606 | 13,459 | N.M. | ||||||||||||||||

| Net income (loss) available to common stockholders | $ | 132,603 | $ | (218,490 | ) | $ | 351,093 | N.M. | ||||||||||||

| Net income (loss) per common share: | ||||||||||||||||||||

| Basic | $ | .82 | $ | (1.37 | ) | $ | 2.19 | N.M. | ||||||||||||

| Diluted | .82 | (1.37 | ) | 2.19 | N.M. | |||||||||||||||

| Dividends declared per common share | $ | .20 | $ | .20 | $ | - | - |

% |

||||||||||||

|

Average common and common equivalent shares outstanding (in thousands): |

||||||||||||||||||||

| Basic | 161,016 | 159,269 | 1,747 | 1.1 |

% |

|||||||||||||||

| Diluted | 161,927 | 159,269 | 2,658 | 1.7 | ||||||||||||||||

| N.M. Not meaningful. | ||||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | ||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Three Months Ended December 31, | Change | |||||||||||||||||||

| 2013 | 2012 | $ | % | |||||||||||||||||

| Net income attributable to TCF Financial Corporation | $ | 39,995 | $ | 26,785 | $ | 13,210 | 49.3 | % | ||||||||||||

| Other comprehensive loss: | ||||||||||||||||||||

|

Reclassification adjustment for securities gains included in net income |

(860 | ) | - | (860 | ) | N.M. | ||||||||||||||

|

Unrealized holding losses arising during the period on securities available for sale |

(13,778 | ) | (8,589 | ) | (5,189 | ) | (60.4 | ) | ||||||||||||

| Foreign currency hedge | 861 | 136 | 725 | N.M. | ||||||||||||||||

| Foreign currency translation adjustment | (999 | ) | (170 | ) | (829 | ) | N.M. | |||||||||||||

|

Recognized postretirement prior service cost and transition obligation |

(11 | ) | 144 | (155 | ) | N.M. | ||||||||||||||

| Income tax benefit | 5,172 | 2,855 | 2,317 | 81.2 | ||||||||||||||||

| Total other comprehensive loss | (9,615 | ) | (5,624 | ) | (3,991 | ) | (71.0 | ) | ||||||||||||

| Comprehensive income | $ | 30,380 | $ | 21,161 | $ | 9,219 | 43.6 | |||||||||||||

| Year Ended December 31, | Change | |||||||||||||||||||

| 2013 | 2012 | $ | % | |||||||||||||||||

| Net income (loss) attributable to TCF Financial Corporation | $ | 151,668 | $ | (212,884 | ) | $ | 364,552 | N.M. | % | |||||||||||

| Other comprehensive loss: | ||||||||||||||||||||

|

Reclassification adjustment for securities gains included in net income |

(860 | ) | (89,879 | ) | 89,019 | 99.0 | ||||||||||||||

|

Unrealized holding (losses) gains arising during the period on securities available for sale |

(61,177 | ) | 19,794 | (80,971 | ) | N.M. | ||||||||||||||

| Foreign currency hedge | 1,625 | (630 | ) | 2,255 | N.M. | |||||||||||||||

| Foreign currency translation adjustment | (1,979 | ) | 531 | (2,510 | ) | N.M. | ||||||||||||||

|

Recognized postretirement prior service cost and transition obligation |

(46 | ) | 123 | (169 | ) | N.M. | ||||||||||||||

| Income tax benefit | 22,781 | 25,678 | (2,897 | ) | (11.3 | ) | ||||||||||||||

| Total other comprehensive loss | (39,656 | ) | (44,383 | ) | 4,727 | 10.7 | ||||||||||||||

| Comprehensive income (loss) | $ | 112,012 | $ | (257,267 | ) | $ | 369,279 | N.M. | ||||||||||||

| N.M. Not meaningful. | ||||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | ||||||||||||||||||||

| (Dollars in thousands, except per-share data) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| At Dec. 31, | Change | |||||||||||||||||||

| 2013 | 2012 | $ | % | |||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Cash and due from banks | $ | 915,076 | $ | 1,100,347 | $ | (185,271 | ) | (16.8 | ) | % | ||||||||||

| Investments | 114,238 | 120,867 | (6,629 | ) | (5.5 | ) | ||||||||||||||

| Securities available for sale | 551,064 | 712,091 | (161,027 | ) | (22.6 | ) | ||||||||||||||

| Loans and leases held for sale | 79,768 | 10,289 | 69,479 | N.M. | ||||||||||||||||

| Loans and leases: | ||||||||||||||||||||

| Consumer real estate | 6,339,326 | 6,674,501 | (335,175 | ) | (5.0 | ) | ||||||||||||||

| Commercial | 3,148,352 | 3,405,235 | (256,883 | ) | (7.5 | ) | ||||||||||||||

| Leasing and equipment finance | 3,428,755 | 3,198,017 | 230,738 | 7.2 | ||||||||||||||||

| Inventory finance | 1,664,377 | 1,567,214 | 97,163 | 6.2 | ||||||||||||||||

| Auto finance | 1,239,386 | 552,833 | 686,553 | 124.2 | ||||||||||||||||

| Other loans and leases | 26,743 | 27,924 | (1,181 | ) | (4.2 | ) | ||||||||||||||

| Total loans and leases | 15,846,939 | 15,425,724 | 421,215 | 2.7 | ||||||||||||||||

| Allowance for loan and lease losses | (252,230 | ) | (267,128 | ) | 14,898 | 5.6 | ||||||||||||||

| Net loans and leases | 15,594,709 | 15,158,596 | 436,113 | 2.9 | ||||||||||||||||

| Premises and equipment, net | 437,602 | 440,466 | (2,864 | ) | (.7 | ) | ||||||||||||||

| Goodwill | 225,640 | 225,640 | - | - | ||||||||||||||||

| Other assets | 461,743 | 457,621 | 4,122 | .9 | ||||||||||||||||

| Total assets | $ | 18,379,840 | $ | 18,225,917 | $ | 153,923 | .8 | |||||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Checking | $ | 4,980,451 | $ | 4,834,632 | $ | 145,819 | 3.0 | |||||||||||||

| Savings | 6,194,003 | 6,104,104 | 89,899 | 1.5 | ||||||||||||||||

| Money market | 831,910 | 820,553 | 11,357 | 1.4 | ||||||||||||||||

| Subtotal | 12,006,364 | 11,759,289 | 247,075 | 2.1 | ||||||||||||||||

| Certificates of deposit | 2,426,412 | 2,291,497 | 134,915 | 5.9 | ||||||||||||||||

| Total deposits | 14,432,776 | 14,050,786 | 381,990 | 2.7 | ||||||||||||||||

| Short-term borrowings | 4,918 | 2,619 | 2,299 | 87.8 | ||||||||||||||||

| Long-term borrowings | 1,483,325 | 1,931,196 | (447,871 | ) | (23.2 | ) | ||||||||||||||

| Total borrowings | 1,488,243 | 1,933,815 | (445,572 | ) | (23.0 | ) | ||||||||||||||

| Accrued expenses and other liabilities | 494,062 | 364,673 | 129,389 | 35.5 | ||||||||||||||||

| Total liabilities | 16,415,081 | 16,349,274 | 65,807 | .4 | ||||||||||||||||

| Equity: | ||||||||||||||||||||

|

Preferred stock, par value $.01 per share, 30,000,000 authorized; and 4,006,900 shares issued |

263,240 | 263,240 | - | - | ||||||||||||||||

|

Common stock, par value $.01 per share, 280,000,000 shares authorized; 165,164,861 and 163,428,763 shares issued, respectively |

1,652 | 1,634 | 18 | 1.1 | ||||||||||||||||

| Additional paid-in capital | 779,641 | 750,040 | 29,601 | 3.9 | ||||||||||||||||

| Retained earnings, subject to certain restrictions | 977,846 | 877,445 | 100,401 | 11.4 | ||||||||||||||||

| Accumulated other comprehensive (loss) income | (27,213 | ) | 12,443 | (39,656 | ) | N.M. | ||||||||||||||

| Treasury stock at cost, 42,566 shares, and other | (42,198 | ) | (41,429 | ) | (769 | ) | (1.9 | ) | ||||||||||||

| Total TCF Financial Corporation stockholders' equity | 1,952,968 | 1,863,373 | 89,595 | 4.8 | ||||||||||||||||

| Non-controlling interest in subsidiaries | 11,791 | 13,270 | (1,479 | ) | (11.1 | ) | ||||||||||||||

| Total equity | 1,964,759 | 1,876,643 | 88,116 | 4.7 | ||||||||||||||||

| Total liabilities and equity | $ | 18,379,840 | $ | 18,225,917 | $ | 153,923 | .8 | |||||||||||||

| N.M. Not Meaningful. | ||||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||||||||||||||

| SUMMARY OF CREDIT QUALITY DATA | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||

| At | At | At | At | At | Change from | |||||||||||||||||||||||||

| Dec. 31, | Sep. 30, | Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Dec. 31, | ||||||||||||||||||||||||

| 2013 | 2013 | 2013 | 2013 | 2012 | 2013 | 2012 | ||||||||||||||||||||||||

|

Delinquency Data - Principal Balances (1) |

||||||||||||||||||||||||||||||

| 60 days or more: | ||||||||||||||||||||||||||||||

| Consumer real estate | ||||||||||||||||||||||||||||||

| First mortgage lien | $ | 20,894 | $ | 23,576 | $ | 66,876 | $ | 66,164 | $ | 76,020 | $ | (2,682 | ) | $ | (55,126 | ) | ||||||||||||||

| Junior lien | 3,532 | 3,822 | 8,022 | 9,674 | 13,141 | (290 | ) | (9,609 | ) | |||||||||||||||||||||

| Total consumer real estate | 24,426 | 27,398 | 74,898 | 75,838 | 89,161 | (2,972 | ) | (64,735 | ) | |||||||||||||||||||||

| Commercial | 1,430 | 7,201 | 1,679 | 906 | 2,630 | (5,771 | ) | (1,200 | ) | |||||||||||||||||||||

| Leasing and equipment finance | 2,401 | 2,539 | 1,840 | 2,067 | 2,568 | (138 | ) | (167 | ) | |||||||||||||||||||||

| Inventory finance | 50 | 71 | 33 | 156 | 119 | (21 | ) | (69 | ) | |||||||||||||||||||||

| Auto finance | 1,877 | 1,429 | 868 | 563 | 532 | 448 | 1,345 | |||||||||||||||||||||||

| Other | 10 | - | 26 | - | 31 | 10 | (21 | ) | ||||||||||||||||||||||

| Subtotal | 30,194 | 38,638 | 79,344 | 79,530 | 95,041 | (8,444 | ) | (64,847 | ) | |||||||||||||||||||||

| Acquired portfolios | 458 | 334 | 627 | 578 | 982 | 124 | (524 | ) | ||||||||||||||||||||||

| Total delinquencies | $ | 30,652 | $ | 38,972 | $ | 79,971 | $ | 80,108 | $ | 96,023 | $ | (8,320 | ) | $ | (65,371 | ) | ||||||||||||||

|

Delinquency Data - % of Portfolio (1) |

||||||||||||||||||||||||||||||

| 60 days or more: | ||||||||||||||||||||||||||||||

| Consumer real estate | ||||||||||||||||||||||||||||||

| First mortgage lien | .58 | % | .64 | % | 1.74 | % | 1.67 | % | 1.88 | % | (6 | ) | bps | (130 | ) | bps | ||||||||||||||

| Junior lien | .14 | .15 | .34 | .43 | .55 | (1 | ) | (41 | ) | |||||||||||||||||||||

| Total consumer real estate | .40 | .44 | 1.21 | 1.22 | 1.38 | (4 | ) | (98 | ) | |||||||||||||||||||||

| Commercial | .05 | .23 | .05 | .03 | .08 | (18 | ) | (3 | ) | |||||||||||||||||||||

| Leasing and equipment finance | .07 | .08 | .06 | .07 | .08 | (1 | ) | (1 | ) | |||||||||||||||||||||

| Inventory finance | - | - | - | .01 | .01 | - | (1 | ) | ||||||||||||||||||||||

| Auto finance | .15 | .13 | .10 | .08 | .10 | 2 | 5 | |||||||||||||||||||||||

| Other | .04 | - | .11 | - | .12 | 4 | (8 | ) | ||||||||||||||||||||||

| Subtotal | .19 | .25 | .52 | .53 | .64 | (6 | ) | (45 | ) | |||||||||||||||||||||

| Acquired portfolios | 1.64 | .80 | .99 | .65 | .89 | 84 | 75 | |||||||||||||||||||||||

| Total delinquencies | .20 | .25 | .52 | .52 | .64 | (5 | ) | (44 | ) | |||||||||||||||||||||

| (1) Excludes non-accrual loans and leases. | ||||||||||||||||||||||||||||||

| At | At | At | At | At | Change from | |||||||||||||||||||||||||

| Dec. 31, | Sep. 30, | Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Dec. 31, | ||||||||||||||||||||||||

| 2013 | 2013 | 2013 | 2013 | 2012 | 2013 | 2012 | ||||||||||||||||||||||||

|

Non-Accrual Loans and Leases |

||||||||||||||||||||||||||||||

| Non-accrual loans and leases: | ||||||||||||||||||||||||||||||

| Consumer real estate | ||||||||||||||||||||||||||||||

| First mortgage lien | $ | 180,811 | $ | 170,306 | $ | 132,586 | $ | 186,218 | $ | 199,631 | $ | 10,505 | $ | (18,820 | ) | |||||||||||||||

| Junior lien | 38,222 | 35,732 | 30,744 | 33,907 | 35,269 | 2,490 | 2,953 | |||||||||||||||||||||||

| Total consumer real estate | 219,033 | 206,038 | 163,330 | 220,125 | 234,900 | 12,995 | (15,867 | ) | ||||||||||||||||||||||

| Commercial | 40,539 | 62,273 | 102,103 | 108,505 | 127,746 | (21,734 | ) | (87,207 | ) | |||||||||||||||||||||

| Leasing and equipment finance | 14,041 | 11,820 | 11,103 | 11,695 | 13,652 | 2,221 | 389 | |||||||||||||||||||||||

| Inventory finance | 2,529 | 1,802 | 1,008 | 1,480 | 1,487 | 727 | 1,042 | |||||||||||||||||||||||

| Auto finance | 470 | 212 | 118 | 106 | 101 | 258 | 369 | |||||||||||||||||||||||

| Other | 410 | 728 | 809 | 1,477 | 1,571 | (318 | ) | (1,161 | ) | |||||||||||||||||||||

| Total non-accrual loans and leases | $ | 277,022 | $ | 282,873 | $ | 278,471 | $ | 343,388 | $ | 379,457 | $ | (5,851 | ) | $ | (102,435 | ) | ||||||||||||||

| Non-accrual loans and leases - rollforward | ||||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 282,873 | $ | 278,471 | $ | 343,388 | $ | 379,457 | $ | 421,813 | $ | 4,402 | $ | (138,940 | ) | |||||||||||||||

| Additions | 71,513 | 93,337 | 41,549 | 56,712 | 88,235 | (21,824 | ) | (16,722 | ) | |||||||||||||||||||||

| Charge-offs | (25,195 | ) | (10,225 | ) | (12,780 | ) | (23,773 | ) | (27,657 | ) | (14,970 | ) | 2,462 | |||||||||||||||||

| Transfers to other assets | (23,085 | ) | (23,810 | ) | (16,014 | ) | (20,087 | ) | (17,305 | ) | 725 | (5,780 | ) | |||||||||||||||||

| Return to accrual status | (13,085 | ) | (16,218 | ) | (21,360 | ) | (34,692 | ) | (55,261 | ) | 3,133 | 42,176 | ||||||||||||||||||

| Payments received | (13,331 | ) | (40,319 | ) | (16,977 | ) | (15,399 | ) | (30,832 | ) | 26,988 | 17,501 | ||||||||||||||||||

| Sales | (3,602 | ) | - | (40,461 | ) | (133 | ) | - | (3,602 | ) | (3,602 | ) | ||||||||||||||||||

| Other, net | 934 | 1,637 | 1,126 | 1,303 | 464 | (703 | ) | 470 | ||||||||||||||||||||||

| Balance, end of period | $ | 277,022 | $ | 282,873 | $ | 278,471 | $ | 343,388 | $ | 379,457 | $ | (5,851 | ) | $ | (102,435 | ) | ||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| SUMMARY OF CREDIT QUALITY DATA, CONTINUED | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||

| Change from | |||||||||||||||||||||||||||||

| Dec 31, | Sep 30, | Jun 30, | Mar 31, | Dec 31, | Sep 30, | Dec 31, | |||||||||||||||||||||||

| 2013 | 2013 | 2013 | 2013 | 2012 | 2013 | 2012 | |||||||||||||||||||||||

|

Other Real Estate Owned |

|||||||||||||||||||||||||||||

| Other real estate owned (1) | |||||||||||||||||||||||||||||

| Consumer real estate | $ | 47,637 | $ | 48,910 | $ | 44,759 | $ | 46,404 | $ | 69,599 | $ | (1,273 | ) | $ | (21,962 | ) | |||||||||||||

| Commercial real estate | 21,237 | 16,669 | 21,473 | 25,359 | 27,379 | 4,568 | (6,142 | ) | |||||||||||||||||||||

| Total other real estate owned | $ | 68,874 | $ | 65,579 | $ | 66,232 | $ | 71,763 | $ | 96,978 | $ | 3,295 | $ | (28,104 | ) | ||||||||||||||

| Other real estate owned - rollforward | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 65,579 | $ | 66,232 | $ | 71,763 | $ | 96,978 | $ | 120,426 | $ | (653 | ) | $ | (54,847 | ) | |||||||||||||

| Transferred in | 21,045 | 23,339 | 16,503 | 20,855 | 18,444 | (2,294 | ) | 2,601 | |||||||||||||||||||||

| Sales | (15,939 | ) | (22,683 | ) | (17,895 | ) | (40,456 | ) | (39,528 | ) | 6,744 | 23,589 | |||||||||||||||||

| Writedowns | (3,496 | ) | (2,197 | ) | (4,270 | ) | (5,294 | ) | (4,614 | ) | (1,299 | ) | 1,118 | ||||||||||||||||

| Other, net | 1,685 | 888 | 131 | (320 | ) | 2,250 | 797 | (565 | ) | ||||||||||||||||||||

| Balance, end of period | $ | 68,874 | $ | 65,579 | $ | 66,232 | $ | 71,763 | $ | 96,978 | $ | 3,295 | $ | (28,104 | ) | ||||||||||||||

| Ending number of properties owned | |||||||||||||||||||||||||||||

| Consumer real estate | 336 | 327 | 246 | 224 | 418 | 9 | (82 | ) | |||||||||||||||||||||

| Commercial real estate | 18 | 18 | 20 | 18 | 18 | - | - | ||||||||||||||||||||||

| Total | 354 | 345 | 266 | 242 | 436 | 9 | (82 | ) | |||||||||||||||||||||

| (1) Includes properties owned and foreclosed properties subject to redemption. | |||||||||||||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||||||||||||||

| SUMMARY OF CREDIT QUALITY DATA, CONTINUED | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||

|

Allowance for Loan and Lease Losses |

||||||||||||||||||||||||||||||

| At December 31, 2013 | At September 30, 2013 | At December 31, 2012 | Change from | |||||||||||||||||||||||||||

| % of | % of | % of | Sep. 30, | Dec. 31, | ||||||||||||||||||||||||||

| Balance | Portfolio | Balance | Portfolio | Balance | Portfolio | 2013 | 2012 | |||||||||||||||||||||||

| Consumer real estate | $ | 176,030 | 2.78 | % | $ | 177,970 | 2.77 |

% |

|

$ | 182,013 | 2.73 |

% |

|

1 |

bps |

|

5 | bps | |||||||||||

| Commercial | 37,467 | 1.19 | 46,638 | 1.49 | 51,575 | 1.51 | (30 | ) | (32 | ) | ||||||||||||||||||||

|

Leasing and equipment finance |

18,733 | .55 | 18,216 | .55 | 21,037 | .66 | - | (11 | ) | |||||||||||||||||||||

| Inventory finance | 8,592 | .52 | 8,547 | .50 | 7,569 | .48 | 2 | 4 | ||||||||||||||||||||||

| Auto finance | 10,623 | .86 | 9,112 | .85 | 4,136 | .75 | 1 | 11 | ||||||||||||||||||||||

| Other | 785 | 2.94 | 802 | 2.99 | 798 | 2.86 | (5 | ) | 8 | |||||||||||||||||||||

|

Total |

$ | 252,230 | 1.59 | $ | 261,285 | 1.67 | $ | 267,128 | 1.73 | (8 | ) | (14 | ) | |||||||||||||||||

|

Net Charge-Offs |

||||||||||||||||||||||||||||||

| Change from | ||||||||||||||||||||||||||||||

| Quarter Ended | Quarter Ended | |||||||||||||||||||||||||||||

| Dec. 31, | Sep. 30, | Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Dec. 31, | ||||||||||||||||||||||||

| 2013 | 2013 | 2013 | 2013 | 2012 | 2013 | 2012 | ||||||||||||||||||||||||

| Consumer real estate | ||||||||||||||||||||||||||||||

|

First mortgage lien |

$ | 10,545 | $ | 12,770 | $ | 15,084 | $ | 19,907 | $ | 22,163 | $ | (2,225 | ) | $ | (11,618 | ) | ||||||||||||||

| Junior lien | 5,901 | 5,474 | 8,642 | 10,540 | 11,757 | 427 | (5,856 | ) | ||||||||||||||||||||||

| Total consumer real estate | 16,446 | 18,244 | 23,726 | 30,447 | 33,920 | (1,798 | ) | (17,474 | ) | |||||||||||||||||||||

| Commercial | 9,363 | 6,513 | 2,449 | 7,849 | 8,351 | 2,850 | 1,012 | |||||||||||||||||||||||

| Leasing and equipment finance | 1,197 | 658 | 244 | 1,210 | 1,345 | 539 | (148 | ) | ||||||||||||||||||||||

| Inventory finance | 341 | 86 | (14 | ) | 355 | 193 | 255 | 148 | ||||||||||||||||||||||

| Auto finance | 1,976 | 1,122 | 765 | 836 | 771 | 854 | 1,205 | |||||||||||||||||||||||

| Other | 774 | 993 | 524 | 307 | 940 | (219 | ) | (166 | ) | |||||||||||||||||||||

| Total | $ | 30,097 | $ | 27,616 | $ | 27,694 | $ | 41,004 | $ | 45,520 | $ | 2,481 | $ | (15,423 | ) | |||||||||||||||

|

Net Charge-Offs as a Percentage of Average Loans and Leases |

||||||||||||||||||||||||||||||

| Change from | ||||||||||||||||||||||||||||||

| Quarter Ended (1) | Quarter Ended | |||||||||||||||||||||||||||||

| Dec. 31, | Sep. 30, | Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Dec. 31, | ||||||||||||||||||||||||

| 2013 | 2013 | 2013 | 2013 | 2012 | 2013 | 2012 | ||||||||||||||||||||||||

| Consumer real estate | ||||||||||||||||||||||||||||||

| First mortgage lien | 1.11 | % | 1.30 |

% |

|

1.48 |

% |

|

1.90 |

% |

|

2.06 |

% |

|

(19 | ) |

bps |

|

(95 | ) | bps | |||||||||

| Junior lien | .91 | .88 | 1.46 | 1.78 | 1.99 | 3 | (108 | ) | ||||||||||||||||||||||

| Total consumer real estate | 1.03 | 1.14 | 1.48 | 1.86 | 2.04 | (11 | ) | (101 | ) | |||||||||||||||||||||

| Commercial | 1.21 | .79 | .29 | .94 | .97 | 42 | 24 | |||||||||||||||||||||||

| Leasing and equipment finance | .14 | .08 | .03 | .15 | .17 | 6 | (3 | ) | ||||||||||||||||||||||

| Inventory finance | .08 | .02 | - | .08 | .05 | 6 | 3 | |||||||||||||||||||||||

| Auto finance | .68 | .46 | .37 | .50 | .61 | 22 | 7 | |||||||||||||||||||||||

| Other | N.M. | N.M. | 16.05 | 9.01 | N.M. | N.M. | N.M. | |||||||||||||||||||||||

| Total | .76 | .71 | .70 | 1.06 | 1.18 | 5 | (42 | ) | ||||||||||||||||||||||

| (1) Annualized. | ||||||||||||||||||||||||||||||

| N.M. Not Meaningful. | ||||||||||||||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||

| CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES | ||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||

| (Unaudited) | ||||||||||||||||||

| Three Months Ended December 31, | ||||||||||||||||||

| 2013 | 2012 | |||||||||||||||||

| Average | Yields and | Average | Yields and | |||||||||||||||

| Balance | Interest | Rates (1) (2) | Balance | Interest | Rates (1) (2) | |||||||||||||

| ASSETS: | ||||||||||||||||||

| Investments and other | $ | 673,750 | $ | 4,150 | 2.45 | % | $ | 642,580 | $ | 2,854 | 1.77 | % | ||||||

| U.S. Government sponsored entities: | ||||||||||||||||||

| Mortgage-backed securities, fixed rate | 625,156 | 4,194 | 2.68 | 699,528 | 4,614 | 2.64 | ||||||||||||

| Other securities | 84 | - | 2.50 | 115 | 1 | 2.52 | ||||||||||||

| Total securities available for sale (3) | 625,240 | 4,194 | 2.68 | 699,643 | 4,615 | 2.64 | ||||||||||||

| Loans and leases held for sale | 193,164 | 3,543 | 7.28 | 53,140 | 1,068 | 8.00 | ||||||||||||

| Loans and leases: | ||||||||||||||||||

| Consumer real estate: | ||||||||||||||||||

| Fixed-rate | 3,584,072 | 51,736 | 5.73 | 4,012,702 | 59,968 | 5.95 | ||||||||||||

| Variable-rate | 2,828,110 | 36,578 | 5.13 | 2,650,958 | 33,817 | 5.07 | ||||||||||||

| Total consumer real estate | 6,412,182 | 88,314 | 5.46 | 6,663,660 | 93,785 | 5.60 | ||||||||||||

| Commercial: | ||||||||||||||||||

| Fixed- and adjustable-rate | 2,060,455 | 26,661 | 5.13 | 2,614,824 | 36,776 | 5.60 | ||||||||||||

| Variable-rate | 1,028,069 | 9,572 | 3.69 | 837,944 | 7,475 | 3.55 | ||||||||||||

| Total commercial | 3,088,524 | 36,233 | 4.65 | 3,452,768 | 44,251 | 5.10 | ||||||||||||

| Leasing and equipment finance | 3,342,182 | 40,851 | 4.89 | 3,184,540 | 41,729 | 5.24 | ||||||||||||

| Inventory finance | 1,734,286 | 25,559 | 5.85 | 1,570,829 | 24,124 | 6.11 | ||||||||||||

| Auto finance | 1,157,586 | 13,542 | 4.64 | 504,565 | 7,016 | 5.53 | ||||||||||||

| Other | 13,369 | 263 | 7.78 | 14,704 | 307 | 8.31 | ||||||||||||

| Total loans and leases (4) | 15,748,129 | 204,762 | 5.17 | 15,391,066 | 211,212 | 5.47 | ||||||||||||

| Total interest-earning assets | 17,240,283 | 216,649 | 4.99 | 16,786,429 | 219,749 | 5.21 | ||||||||||||

| Other assets (5) | 1,074,655 | 1,161,959 | ||||||||||||||||

| Total assets | $ | 18,314,938 | $ | 17,948,388 | ||||||||||||||

| LIABILITIES AND EQUITY: | ||||||||||||||||||

| Non-interest bearing deposits: | ||||||||||||||||||

| Retail | $ | 1,430,998 | $ | 1,294,027 | ||||||||||||||

| Small business | 812,394 | 775,334 | ||||||||||||||||

| Commercial and custodial | 377,568 | 329,919 | ||||||||||||||||

| Total non-interest bearing deposits | 2,620,960 | 2,399,280 | ||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||

| Checking | 2,303,416 | 261 | .05 | 2,248,481 | 625 | .11 | ||||||||||||

| Savings | 6,197,411 | 2,704 | .17 | 6,083,168 | 4,511 | .29 | ||||||||||||

| Money market | 845,562 | 626 | .29 | 819,596 | 716 | .35 | ||||||||||||

| Subtotal | 9,346,389 | 3,591 | .15 | 9,151,245 | 5,852 | .25 | ||||||||||||

| Certificates of deposit | 2,392,896 | 4,837 | .80 | 2,206,173 | 5,120 | .92 | ||||||||||||

| Total interest-bearing deposits | 11,739,285 | 8,428 | .28 | 11,357,418 | 10,972 | .38 | ||||||||||||

| Total deposits | 14,360,245 | 8,428 | .23 | 13,756,698 | 10,972 | .32 | ||||||||||||

| Borrowings: | ||||||||||||||||||

| Short-term borrowings | 8,333 | 19 | .96 | 47,715 | 49 | .41 | ||||||||||||

| Long-term borrowings | 1,486,189 | 5,620 | 1.51 | 1,928,507 | 6,943 | 1.44 | ||||||||||||

| Total borrowings | 1,494,522 | 5,639 | 1.50 | 1,976,222 | 6,992 | 1.41 | ||||||||||||

| Total interest-bearing liabilities | 13,233,807 | 14,067 | .42 | 13,333,640 | 17,964 | .54 | ||||||||||||

| Total deposits and borrowings | 15,854,767 | 14,067 | .35 | 15,732,920 | 17,964 | .45 | ||||||||||||

| Other liabilities | 508,253 | 434,471 | ||||||||||||||||

| Total liabilities | 16,363,020 | 16,167,391 | ||||||||||||||||

| Total TCF Financial Corp. stockholders' equity | 1,938,646 | 1,768,002 | ||||||||||||||||

| Non-controlling interest in subsidiaries | 13,272 | 12,995 | ||||||||||||||||

| Total equity | 1,951,918 | 1,780,997 | ||||||||||||||||

| Total liabilities and equity | $ | 18,314,938 | $ | 17,948,388 | ||||||||||||||

| Net interest income and margin | $ | 202,582 | 4.67 | $ | 201,785 | 4.79 | ||||||||||||

| (1) Annualized. | ||||||||||||||||||

| (2) Interest and yields are presented on a fully tax-equivalent basis. | ||||||||||||||||||

| (3) Average balances and yields of securities available for sale are based upon historical amortized cost and exclude equity securities. | ||||||||||||||||||

| (4) Average balances of loans and leases include non-accrual loans and leases, and are presented net of unearned income. | ||||||||||||||||||

| (5) Includes operating leases. | ||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | ||||||||||||||||||

| CONSOLIDATED AVERAGE BALANCE SHEETS, YIELDS AND RATES | ||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||

| (Unaudited) | ||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||

| 2013 | 2012 | |||||||||||||||||

| Average | Yields and | Average | Yields and | |||||||||||||||

| Balance | Interest | Rates (1) (2) | Balance | Interest | Rates (1) (2) | |||||||||||||

| ASSETS: | ||||||||||||||||||

| Investments and other | $ | 774,917 | $ | 15,318 | 1.98 | % | $ | 574,422 | $ | 10,404 | 1.81 | % | ||||||

| U.S. Government sponsored entities: | ||||||||||||||||||

| Mortgage-backed securities, fixed rate | 648,187 | 18,072 | 2.79 | 1,055,868 | 35,143 | 3.33 | ||||||||||||

| U.S. Treasury securities | 345 | - | .07 | - | - | - | ||||||||||||

| Other securities | 98 | 2 | 2.38 | 180 | 7 | 3.70 | ||||||||||||

| Total securities available for sale (3) | 648,630 | 18,074 | 2.79 | 1,056,048 | 35,150 | 3.33 | ||||||||||||

| Loans and leases held for sale | 155,337 | 11,647 | 7.50 | 46,201 | 3,689 | 7.98 | ||||||||||||

| Loans and leases: | ||||||||||||||||||

| Consumer real estate: | ||||||||||||||||||

| Fixed-rate | 3,746,029 | 217,891 | 5.82 | 4,254,039 | 252,233 | 5.93 | ||||||||||||

| Variable-rate | 2,703,921 | 138,192 | 5.11 | 2,503,473 | 126,158 | 5.04 | ||||||||||||

| Total consumer real estate | 6,449,950 | 356,083 | 5.52 | 6,757,512 | 378,391 | 5.60 | ||||||||||||

| Commercial: | ||||||||||||||||||

| Fixed- and adjustable-rate | 2,302,594 | 120,948 | 5.25 | 2,691,004 | 149,793 | 5.57 | ||||||||||||

| Variable-rate | 960,152 | 34,564 | 3.60 | 794,214 | 30,653 | 3.86 | ||||||||||||

| Total commercial | 3,262,746 | 155,512 | 4.77 | 3,485,218 | 180,446 | 5.18 | ||||||||||||

| Leasing and equipment finance | 3,260,425 | 162,035 | 4.97 | 3,155,946 | 170,991 | 5.42 | ||||||||||||

| Inventory finance | 1,723,253 | 103,844 | 6.03 | 1,434,643 | 88,934 | 6.20 | ||||||||||||

| Auto finance | 907,571 | 43,921 | 4.84 | 296,083 | 17,949 | 6.06 | ||||||||||||

| Other | 13,088 | 1,060 | 8.10 | 16,549 | 1,332 | 8.05 | ||||||||||||

| Total loans and leases (4) | 15,617,033 | 822,455 | 5.27 | 15,145,951 | 838,043 | 5.53 | ||||||||||||

| Total interest-earning assets | 17,195,917 | 867,494 | 5.04 | 16,822,622 | 887,286 | 5.27 | ||||||||||||

| Other assets (5) | 1,092,681 | 1,233,042 | ||||||||||||||||

| Total assets | $ | 18,288,598 | $ | 18,055,664 | ||||||||||||||

| LIABILITIES AND EQUITY: | ||||||||||||||||||

| Non-interest bearing deposits: | ||||||||||||||||||

| Retail | $ | 1,442,356 | $ | 1,311,561 | ||||||||||||||

| Small business | 771,827 | 738,949 | ||||||||||||||||

| Commercial and custodial | 345,713 | 317,432 | ||||||||||||||||

| Total non-interest bearing deposits | 2,559,896 | 2,367,942 | ||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||

| Checking | 2,313,794 | 1,485 | .06 | 2,256,237 | 3,105 | .14 | ||||||||||||

| Savings | 6,147,030 | 12,437 | .20 | 6,037,939 | 19,834 | .33 | ||||||||||||

| Money market | 818,814 | 2,391 | .29 | 770,104 | 2,859 | .37 | ||||||||||||

| Subtotal | 9,279,638 | 16,313 | .18 | 9,064,280 | 25,798 | .28 | ||||||||||||

| Certificates of deposit | 2,369,992 | 20,291 | .86 | 1,727,859 | 15,189 | .88 | ||||||||||||

| Total interest-bearing deposits | 11,649,630 | 36,604 | .31 | 10,792,139 | 40,987 | .38 | ||||||||||||

| Total deposits | 14,209,526 | 36,604 | .26 | 13,160,081 | 40,987 | .31 | ||||||||||||

| Borrowings: | ||||||||||||||||||

| Short-term borrowings | 7,685 | 46 | .60 | 312,417 | 937 | .30 | ||||||||||||

| Long-term borrowings | 1,724,002 | 25,266 | 1.46 | 2,426,655 | 62,680 | 2.58 | ||||||||||||

| Total borrowings | 1,731,687 | 25,312 | 1.46 | 2,739,072 | 63,617 | 2.32 | ||||||||||||

| Total interest-bearing liabilities | 13,381,317 | 61,916 | .46 | 13,531,211 | 104,604 | .77 | ||||||||||||

| Total deposits and borrowings | 15,941,213 | 61,916 | .39 | 15,899,153 | 104,604 | .66 | ||||||||||||

| Other liabilities | 434,763 | 412,170 | ||||||||||||||||

| Total liabilities | 16,375,976 | 16,311,323 | ||||||||||||||||

| Total TCF Financial Corp. stockholders' equity | 1,896,131 | 1,729,537 | ||||||||||||||||

| Non-controlling interest in subsidiaries | 16,491 | 14,804 | ||||||||||||||||

| Total equity | 1,912,622 | 1,744,341 | ||||||||||||||||

| Total liabilities and equity | $ | 18,288,598 | $ | 18,055,664 | ||||||||||||||

| Net interest income and margin | $ | 805,578 | 4.68 | $ | 782,682 | 4.65 | ||||||||||||

| (1) Annualized. | ||||||||||||||||||

| (2) Interest and yields are presented on a fully tax-equivalent basis. | ||||||||||||||||||

| (3) Average balances and yields of securities available for sale are based upon historical amortized cost and exclude equity securities. | ||||||||||||||||||

| (4) Average balances of loans and leases include non-accrual loans and leases, and are presented net of unearned income. | ||||||||||||||||||

| (5) Includes operating leases. | ||||||||||||||||||

| TCF FINANCIAL CORPORATION AND SUBSIDIARIES | |||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME AND FINANCIAL HIGHLIGHTS | |||||||||||||||||||||

| (Dollars in thousands, except per-share data) | |||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||

| Dec. 31, | Sep. 30, | Jun. 30, | Mar. 31, | Dec. 31, | |||||||||||||||||

| 2013 | 2013 | 2013 | 2013 | 2012 | |||||||||||||||||

| Interest income: | |||||||||||||||||||||

| Loans and leases | $ | 204,042 | $ | 203,879 | $ | 206,675 | $ | 204,905 | $ | 210,490 | |||||||||||

| Securities available for sale | 4,194 | 4,448 | 4,637 | 4,795 | 4,615 | ||||||||||||||||

| Investments and other | 7,693 | 7,126 | 6,296 | 5,850 | 3,922 | ||||||||||||||||

| Total interest income | 215,929 | 215,453 | 217,608 | 215,550 | 219,027 | ||||||||||||||||

| Interest expense: | |||||||||||||||||||||

| Deposits | 8,428 | 9,644 | 8,851 | 9,681 | 10,972 | ||||||||||||||||

| Borrowings | 5,639 | 6,182 | 6,713 | 6,778 | 6,992 | ||||||||||||||||

| Total interest expense | 14,067 | 15,826 | 15,564 | 16,459 | 17,964 | ||||||||||||||||

| Net interest income | 201,862 | 199,627 | 202,044 | 199,091 | 201,063 | ||||||||||||||||

| Provision for credit losses | 22,792 | 24,602 | 32,591 | 38,383 | 48,520 | ||||||||||||||||

|

Net interest income after provision for credit losses |

179,070 | 175,025 | 169,453 | 160,708 | 152,543 | ||||||||||||||||

| Non-interest income: | |||||||||||||||||||||

| Fees and service charges | 43,254 | 42,457 | 41,572 | 39,323 | 44,262 | ||||||||||||||||

| Card revenue | 13,066 | 13,167 | 13,270 | 12,417 | 12,974 | ||||||||||||||||

| ATM revenue | 5,382 | 5,941 | 5,828 | 5,505 | 5,584 | ||||||||||||||||

| Subtotal | 61,702 | 61,565 | 60,670 | 57,245 | 62,820 | ||||||||||||||||

| Leasing and equipment finance | 23,624 | 29,079 | 22,874 | 16,460 | 26,149 | ||||||||||||||||

| Gains on sales of auto loans | 7,278 | 7,140 | 8,135 | 7,146 | 6,869 | ||||||||||||||||