COLUMBIA, S.C.--(BUSINESS WIRE)--Though America’s attention has been sharply focused on medical insurance and the Affordable Care Act, employers need to keep a broader perspective on the benefits they offer employees if they want to stay competitive. That’s the message of a white paper released today by Colonial Life & Accident Insurance Company.

The new research document, called “Beyond Health Insurance: Creating a competitive benefits program in the health care reform world,” recommends a comprehensive approach to employee benefits. Using proprietary and industry research, the white paper outlines what employers should know about health care reform, employee benefits and the subsequent need for increased benefits education.

“Although medical insurance is the cornerstone of a good benefits package, we encourage employers to think about their benefits as a whole right now,” says Steve Bygott, assistant vice president of core market services at Colonial Life. “Small and large employers face ongoing cost concerns, in addition to new legal requirements, that challenge their ability to remain competitive. Taking their eye off the big picture of employee benefits could be a costly mistake.”

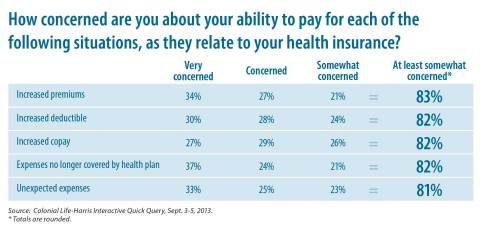

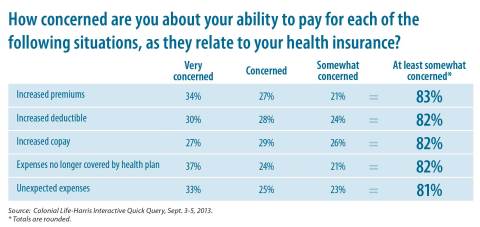

Regardless of health care reform, employees remain concerned about the cost of health insurance. Research conducted on behalf of Colonial Life shows that 83 percent of U.S. employees (full-time and/or part-time, with or without coverage) are at least somewhat concerned about their ability to pay for health premiums. Eighty-two percent are concerned with expenses no longer covered by their health insurance plan and the addition of or an increase in co-payments and deductible amounts. And 81 percent express concern about unexpected medical expenses (emergency room visits, major surgery, etc.).1

Employers with 50 or more full-time employees that must begin offering health insurance to their employees in 2015 may find it challenging to communicate these new benefits if they haven’t done so before. And even small employers with fewer than 50 employees will need benefits that differentiate them from the competition in the future.

“Both large and small employers will need to pay more attention to benefits communication in the years ahead to help them attract and retain a strong workforce,” says Bygott. “Workers will look to their employers to provide them with good, reliable information so they can make the best benefits decisions for themselves and their families.”

Employers don’t have to increase costs to offer competitive benefits packages and improved communication. Many choose to offer employee-paid, voluntary benefits to give their workers more choice and flexibility, without impacting the company’s bottom line. Employers can also work with vendors that provide complimentary personal counseling sessions as part of their enrollment services to enhance their communication efforts.

“Voluntary benefits and personalized benefits education can be a tremendous asset to employers looking for a cost-effective way to offer a competitive benefits package,” says Bygott. “Though health care reform has everyone asking lots of questions now, staying focused on the big picture will help employers stay competitive in the long run.”

About Colonial Life

Colonial Life & Accident Insurance Company is a market leader in providing financial protection benefits through the workplace, including disability, life, accident, cancer, critical illness and supplemental health insurance. The company’s benefit services and education, innovative enrollment technology and personal service support more than 79,000 businesses and organizations, representing more than 3 million working Americans and their families. For more information visit www.coloniallife.com or connect with the company at www.facebook.com/coloniallifebenefits, www.twitter.com/coloniallife and www.linkedin.com/company/colonial-life.

1 Online survey conducted within the United States for Colonial Life & Accident Insurance Company by Harris Interactive, Sept. 3-5, 2013, among 2,046 U.S. adults age 18 and older, among whom 1,023 are employed full-time or part-time.