DENVER--(BUSINESS WIRE)--Whiting Petroleum Corporation (NYSE:WLL) announced today that it has signed a purchase and sale agreement with a private party to acquire certain producing oil and gas wells and development acreage in the Williston Basin in Williams and McKenzie counties of North Dakota and Roosevelt and Richland counties of Montana. The purchase price is $260 million, subject to customary adjustments, and the acquisition has an effective date of August 1, 2013.

Whiting expects the acquisition to close by September 30, 2013, subject to customary conditions to closing. Whiting plans to finance the acquisition with borrowings under its existing bank credit facility.

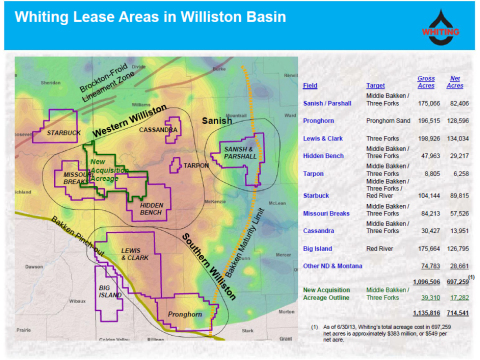

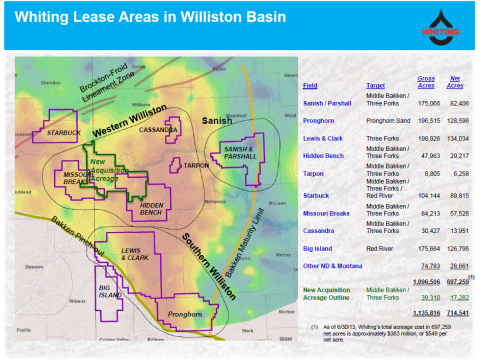

As detailed in the map attached to this press release, the properties primarily target the Middle Bakken and Three Forks zones and include 17,282 net (39,310 gross) acres located in and around Whiting’s acreage in the Missouri Breaks and Hidden Bench prospects in its Western Williston Basin area. The properties include 13 operated 1,280-acre Bakken/Three Forks drilling spacing units with an average working interest of 58% and net revenue interest of 48%. 92% of the acreage is held by production.

Net oil and gas production from the properties is estimated to average 2,420 barrels of oil equivalent (BOE) per day in August 2013. Whiting estimates proved reserves at 17.1 million BOE with 85% of reserves being oil. Whiting also estimates 24% of the reserves are proved developed producing and 76% are proved undeveloped.

James J. Volker, Whiting’s Chairman and CEO, commented, “This acreage expands our presence in our Western Williston Basin area where we have seen recent strong production growth primarily as a result of positive drilling results at our Hidden Bench, Tarpon and Missouri Breaks prospects.”

About Whiting Petroleum Corporation

Whiting Petroleum Corporation, a Delaware corporation, is an independent oil and gas company that explores for, develops, acquires and produces crude oil, natural gas and natural gas liquids primarily in the Rocky Mountain, Permian Basin, Mid-Continent, Michigan and Gulf Coast regions of the United States. The Company’s largest projects are in the Bakken and Three Forks plays in North Dakota and its Enhanced Oil Recovery field in Texas. The Company trades publicly under the symbol WLL on the New York Stock Exchange. For further information, please visit http://www.whiting.com.

Forward-Looking Statements

This news release contains statements that we believe to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than historical facts, including, without limitation, statements regarding our future financial position, business strategy, projected revenues, earnings, costs, capital expenditures and debt levels, and plans and objectives of management for future operations, are forward-looking statements. When used in this news release, words such as we "expect," "intend," "plan," "estimate," "anticipate," "believe" or "should" or the negative thereof or variations thereon or similar terminology are generally intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such statements.

These risks and uncertainties include, but are not limited to: declines in oil, NGL or natural gas prices; our level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of our exploration and development expenditures; our ability to obtain sufficient quantities of CO2 necessary to carry out our enhanced oil recovery projects; inaccuracies of our reserve estimates or our assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; risks related to our level of indebtedness and periodic redeterminations of the borrowing base under our credit agreement; our ability to generate sufficient cash flows from operations to meet the internally funded portion of our capital expenditures budget; our ability to obtain external capital to finance exploration and development operations and acquisitions; federal and state initiatives relating to the regulation of hydraulic fracturing; the potential impact of federal debt reduction initiatives and tax reform legislation being considered by the U.S. Federal government that could have a negative effect on the oil and gas industry; our ability to identify and complete acquisitions and to successfully integrate acquired businesses, including the Williston Basin properties; unforeseen underperformance of or liabilities associated with acquired properties, including the Williston Basin properties; our ability to successfully complete potential asset dispositions and the risks related thereto; the impacts of hedging on our results of operations; failure of our properties to yield oil or gas in commercially viable quantities; uninsured or underinsured losses resulting from our oil and gas operations; our inability to access oil and gas markets due to market conditions or operational impediments; the impact and costs of compliance with laws and regulations governing our oil and gas operations; our ability to replace our oil and natural gas reserves; any loss of our senior management or technical personnel; competition in the oil and gas industry in the regions in which we operate; risks arising out of our hedging transactions; and other risks described under the caption “Risk Factors” in our Annual Report on Form 10-K for the period ended December 31, 2012. We assume no obligation, and disclaim any duty, to update the forward-looking statements in this news release.