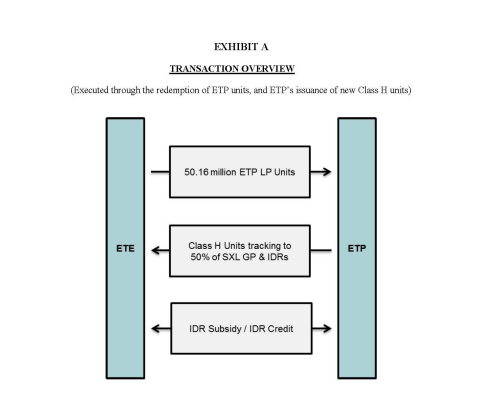

DALLAS--(BUSINESS WIRE)--Energy Transfer Partners, L.P. (NYSE:ETP) and Energy Transfer Equity, L.P. (NYSE:ETE) announced today the exchange of 50.16 million ETP common units, currently owned by ETE, for newly issued Class H units by ETP that track 50% of the underlying economics of the general partner (GP) interest and the incentive distribution rights (IDRs) of Sunoco Logistics Partners L.P. (NYSE: SXL). A subsidiary of ETP will remain the general partner of SXL, and ETP will continue to benefit from 50% of the economics related to SXL’s GP interest and IDRs. The transaction will be effectuated through the redemption of ETP common units and ETP’s issuance of new Class H units (see Exhibit A).

As a result of the significant cash flow accretion expected to be realized by ETP from this transaction ($0.25-$0.35 per common unit per annum), ETP anticipates an increase of $0.01 per common unit per quarter for each of the quarters ending September 30 and December 31, 2013. For 2014 and beyond, ETP is targeting continued distribution increases and a distribution coverage ratio of 1.05x, thereby promoting a prudent balance between distribution increases and enhanced financial flexibility and strength.

For ETE, this transaction continues its transition back to a pure play general partner for the overall Energy Transfer family. ETE expects to increase its distribution by $0.01 per common unit per quarter through 2013 and thereafter to maintain its distribution growth rate while resuming its 1.0x distribution coverage ratio.

Description of the new Class H units includes the following:

- Class H units will entitle ETE to receive a quarterly cash distribution from ETP equal to approximately 50% of the economics related to SXL’s GP interest and IDRs;

- Class H units will entitle ETE to receive additional cash distributions of $329 million. These incremental distributions will be received over 15 quarters commencing with the quarter ending September 30, 2013 and are intended to partially offset the IDR subsidies agreed to by ETE in prior transactions;

- The Class H units will not be convertible or exchangeable for any security of either ETP or SXL and will not be traded on any public securities market; and

- ETE will not receive any IDR distributions with respect to the Class H units.

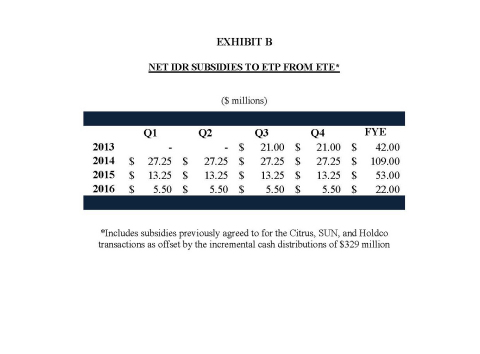

The impact of the incremental cash distributions of $329 million, over 15 quarters, is an offset to the prior IDR subsidies granted by ETE to ETP. The adjustments to the IDR subsidy calculation result in net fixed subsidy amounts as reflected in the table in Exhibit B. Setting these net subsidies as fixed amounts should make the impact of the IDR subsidies easier and simpler for analysts and investors alike.

Kelcy Warren, CEO and Chairman of ETP, said, “The transaction reinforces ETE’s role as the general partner of the broader family. ETE is excited about more directly benefiting from the expected growth at SXL, which has been one of the best performers in the MLP peer group over the last 12 months. In addition, the fact that this exchange can be achieved by ETE using most of its legacy ETP units also provides significant value for all ETE unitholders.”

Mackie McCrea, President and COO of ETP, added, “I am very pleased with the progress we have made to transform ETP into the premier midstream service provider. Resuming ETP’s distribution growth is an important achievement for us. ETP’s retention of a 50% economic interest in SXL’s GP interest/IDRs gives ETP ongoing upside as we look to continue growing our distribution.”

Transaction Rationale:

For ETP:

- Reduces ETP’s common unit count by almost 13.5% and has a commensurate reduction to the amount of distributions to be paid to ETE with respect to the ETP IDRs;

- Accelerates distribution increases while enabling ETP to achieve a stronger cash distribution coverage ratio of 1.05x;

- Partial unwinding of IDR subsidies, effectuated through the incremental cash distributions related to the Class H units, allows for smoother IDR subsidy roll-offs in future years;

- Retaining a 50% interest in the cash flow of SXL GP interest/IDRs allows ETP to benefit from future growth at SXL; and

- Together with ETP’s focus on continued cost savings initiatives and internal growth projects, this transaction should be a positive catalyst for ETP’s unit price and as a result, lower its current cost of capital which will allow ETP to be more competitive commercially.

For ETE:

- Reinforces ETE’s strategy to become more of a traditional GP within the Energy Transfer family;

- Any increase in value of the underlying SXL GP creates incremental upside to ETE;

- Direct benefit from expected dynamic growth at SXL; and

- Upside from its remaining ETP common units and ETP IDRs as ETP accelerates its future distribution growth.

We also expect there will be no ratings impact from this transaction for either ETP or ETE.

Kelcy Warren, CEO and Chairman of ETP, concluded with: “As everyone knows, ETP has withstood the collapse of basis differentials in natural gas prices for the last five years, which has meant its distribution level has remained flat. We are now more confident than ever that we can and will deliver unitholder value, and growing ETP’s distribution rate is a significant step in doing so. This transaction, together with the strategic acquisitions we have consummated and completion of organic growth projects, should not only accelerate distribution increases but also enhance our ability to build ETP’s distributable cash flow coverage ratio to an appropriate level. We truly believe this transaction creates compelling value for both ETP and ETE.”

Energy Transfer Partners, L.P. (NYSE: ETP) is a master limited partnership owning and operating one of the largest and most diversified portfolios of energy assets in the United States. ETP currently has natural gas operations that include approximately 47,000 miles of gathering and transportation pipelines, treating and processing assets, and storage facilities. ETP owns 100% of ETP Holdco Corporation, which owns Southern Union Company and Sunoco, Inc., and a 70% interest in Lone Star NGL LLC, a joint venture that owns and operates natural gas liquids storage, fractionation and transportation assets. ETP also owns the general partner, 100% of the incentive distribution rights, and approximately 33.5 million common units in Sunoco Logistics Partners L.P. (NYSE: SXL), which operates a geographically diverse portfolio of crude oil and refined products pipelines, terminalling and crude oil acquisition and marketing assets. ETP’s general partner is owned by ETE. For more information, visit the Energy Transfer Partners, L.P. website at www.energytransfer.com.

Energy Transfer Equity, L.P. (NYSE: ETE) is a master limited partnership which owns the general partner and 100% of the incentive distribution rights (IDRs) of Energy Transfer Partners, L.P. (NYSE: ETP) and approximately 99.7 million ETP common units; and owns the general partner and 100% of the IDRs of Regency Energy Partners LP (NYSE: RGP) and approximately 26.3 million RGP common units. The Energy Transfer family of companies owns more than 71,000 miles of natural gas, natural gas liquids, refined products, and crude pipelines. For more information, visit the Energy Transfer Equity, L.P. website at www.energytransfer.com.

Sunoco Logistics Partners L.P. (NYSE: SXL), headquartered in Philadelphia, is a master limited partnership that owns and operates a logistics business consisting of a geographically diverse portfolio of complementary crude oil and refined product pipeline, terminalling, and acquisition and marketing assets. SXL’s general partner is owned by Energy Transfer Partners, L.P. (NYSE: ETP). For more information, visit the Sunoco Logistics Partners, L.P. web site at www.sunocologistics.com.

Forward-Looking Statements

This press release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. Among those is the risk that the anticipated benefits from the proposed transaction cannot be fully realized. An extensive list of factors that can affect future results are discussed in the Partnerships’ Annual Reports on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnerships undertake no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.energytransfer.com.